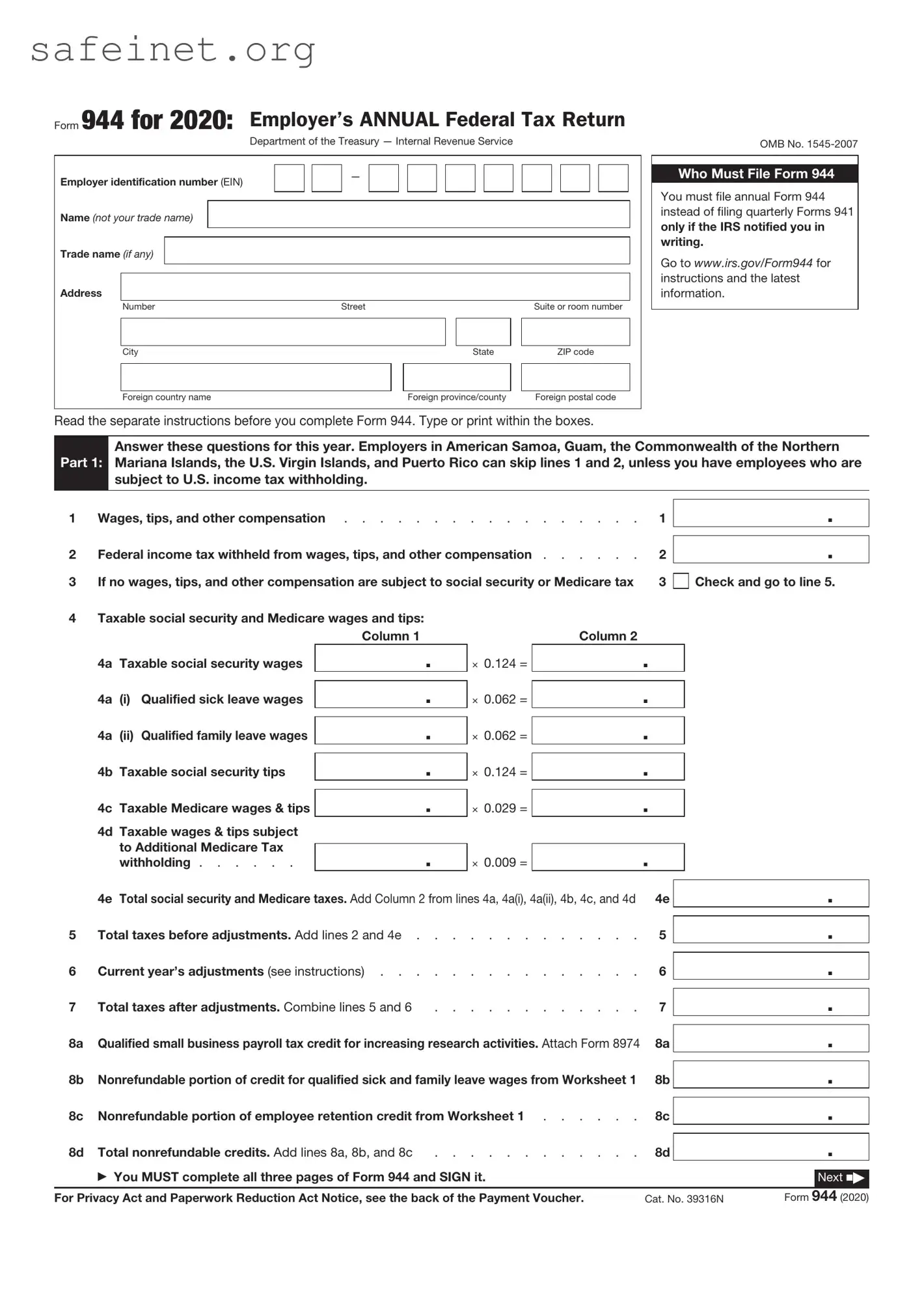

What is the IRS 944 form?

The IRS 944 form is used by eligible small employers to report annual payroll taxes to the Internal Revenue Service. This form allows qualifying businesses to file once a year instead of quarterly, streamlining the reporting process for employers who have a low volume of payroll. The form calculates the amount of taxes owed, including Social Security, Medicare, and federal income tax withheld from employee wages.

Who qualifies to use the IRS 944 form?

Employers qualify to file the IRS 944 form if their annual payroll tax liability has been $1,000 or less for the year. This form is particularly beneficial for small businesses, including certain sole proprietors and small non-profit organizations. The IRS notifies eligible employers who can use this form; however, employers can also request to use it if they believe they qualify.

How do I submit the IRS 944 form?

The IRS 944 form can be filed electronically or via mail. If submitting electronically, employers can use an authorized e-file provider or tax software that supports this option. When mailing the form, you must send it to the appropriate address provided by the IRS based on your location. It is important to ensure that the form is completed accurately to avoid any processing delays.

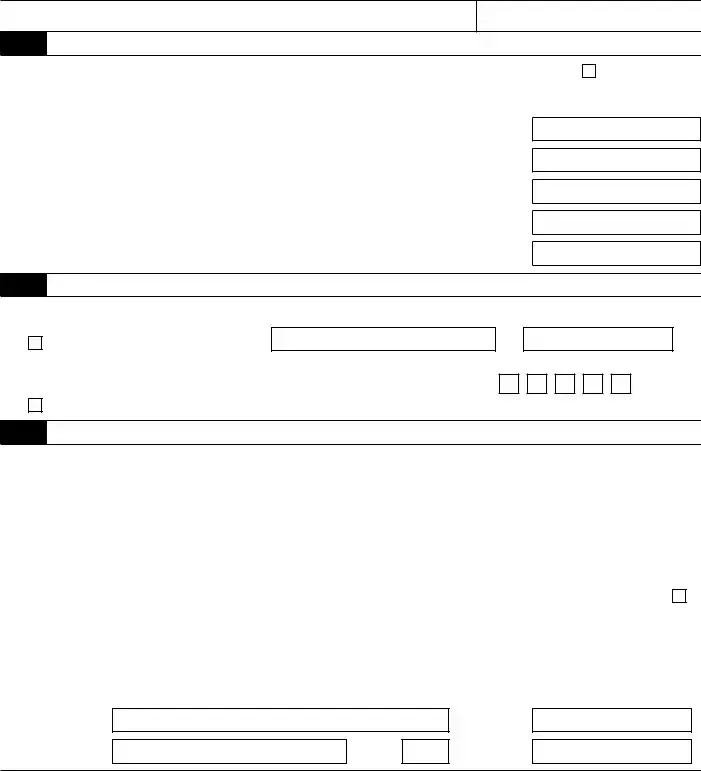

What is the due date for the IRS 944 form?

The due date for the IRS 944 form is typically January 31st of the following year for which you are reporting. If January 31 falls on a weekend or holiday, the due date will be the next business day. Employers are encouraged to submit the form as early as possible to avoid potential penalties for late filing. Reviewing records in advance can also help ensure timely submission.

Are there penalties for late filing or unpaid taxes on the IRS 944 form?

Yes, there are penalties for both late filing and unpaid taxes associated with the IRS 944 form. The penalty for filing late can be 5% of the unpaid tax amount for each month the return is late, up to a maximum of 25%. Additionally, if taxes are not paid by the due date, interest will accrue on the unpaid balance. Employers should aim to remain compliant to avoid these financial repercussions.

Can I amend the IRS 944 form after it has been submitted?

Yes, employers can amend the IRS 944 form if they discover errors after submission. To do this, you should file a corrected form, which includes showing your corrections clearly and providing an explanation for the changes. It's essential to keep records of the original submission along with the amended form. Amending in a timely manner will help ensure compliance and reduce the risk of penalties.