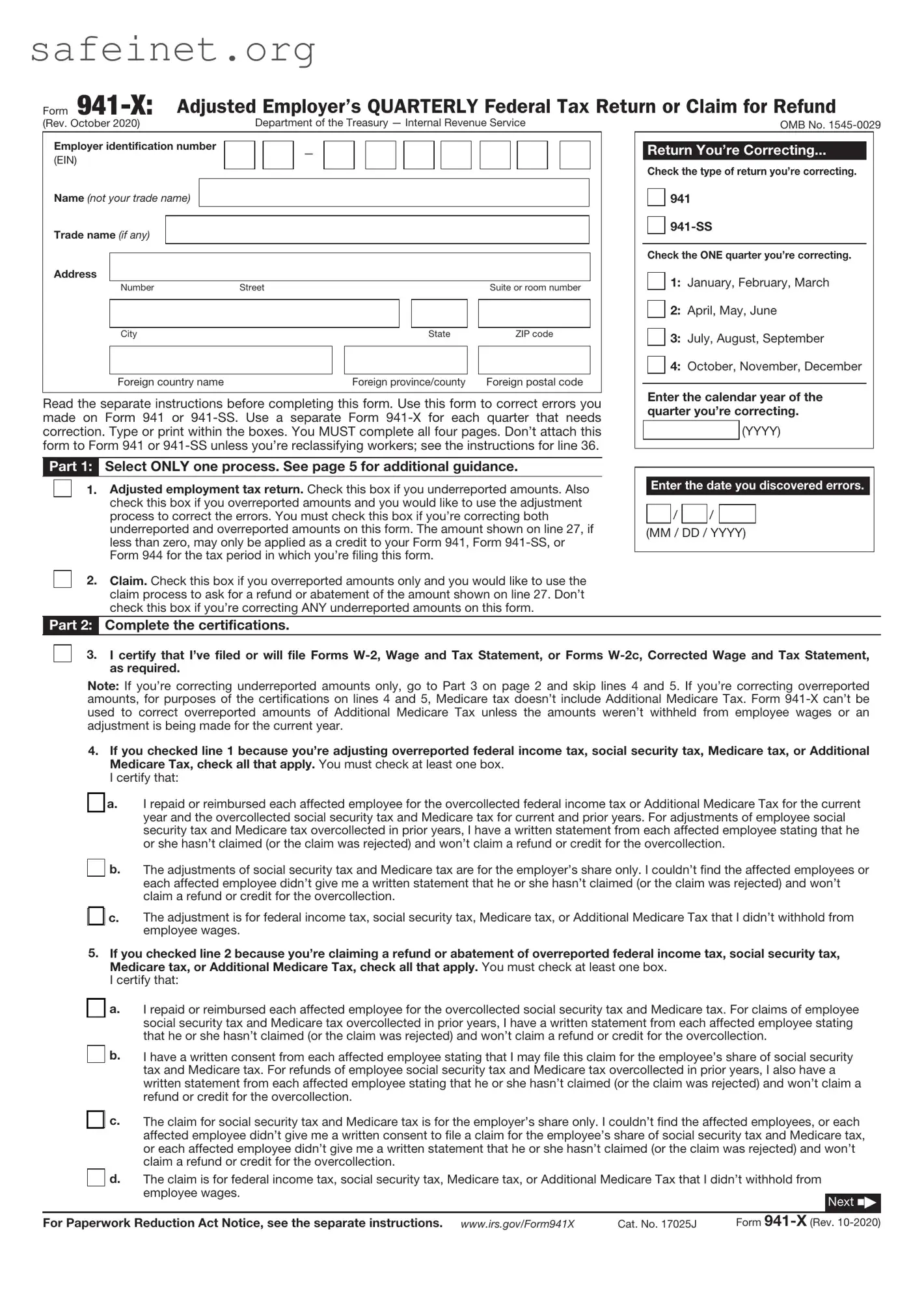

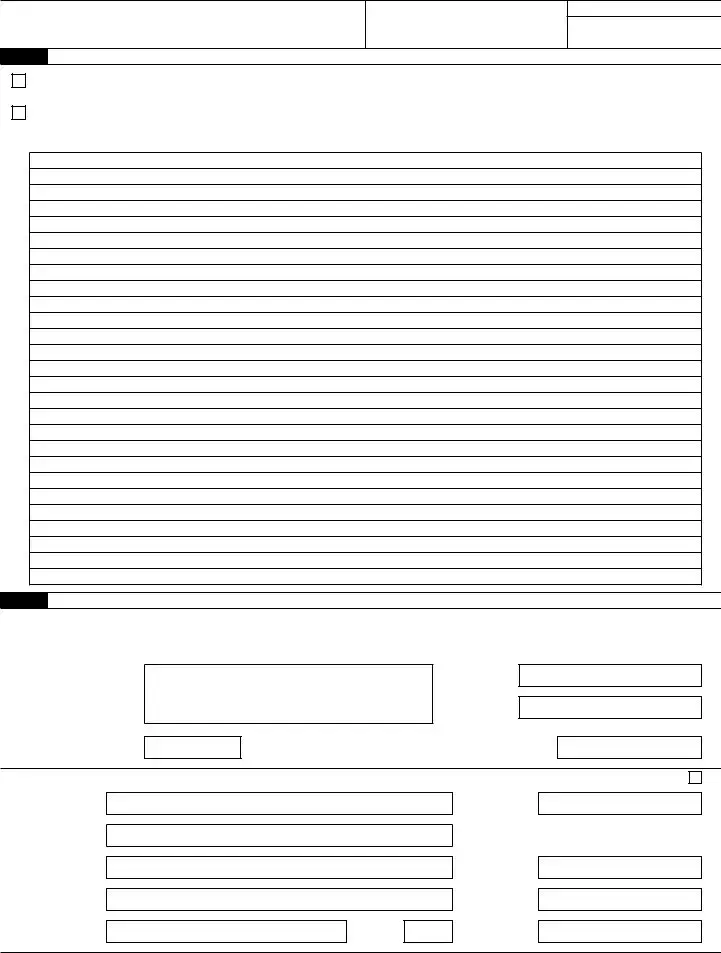

What is the IRS 941-X form?

The IRS 941-X form, officially known as the "Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund," is used by employers to correct errors made on previously filed Form 941. This form allows businesses to amend their original filings, ensuring accurate reporting of employment taxes.

When should I use Form 941-X?

You should use Form 941-X if you discover an error on your previously filed Form 941. Common reasons for filing include corrections to wages, tips, tax withholdings, or any claim for overpayment. It's crucial to file this form to rectify any inaccuracies, as they can affect your tax obligations and potential refunds.

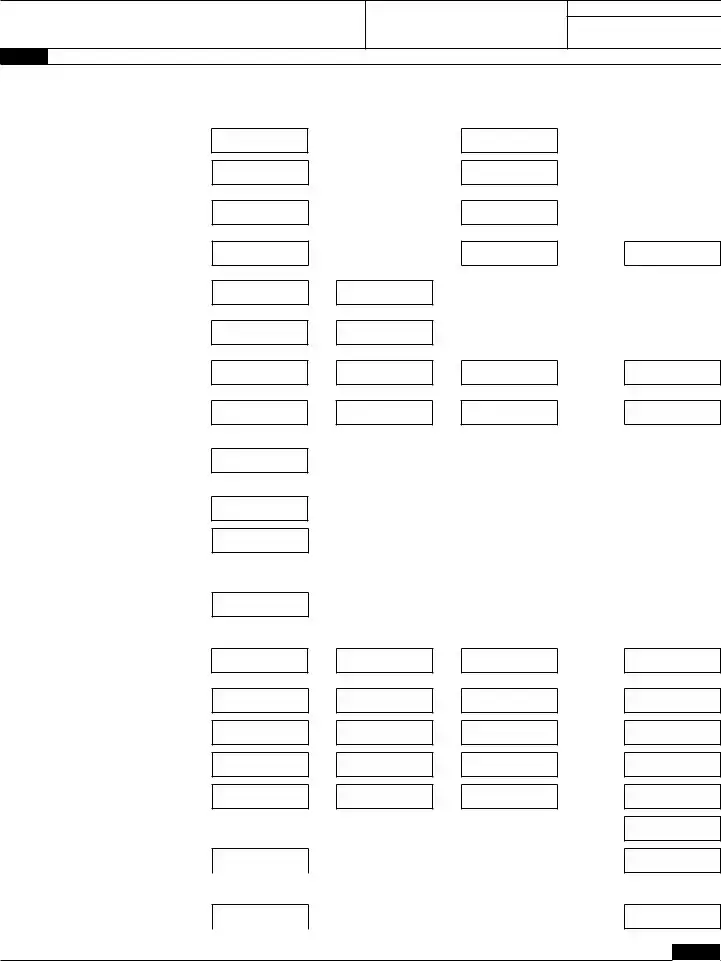

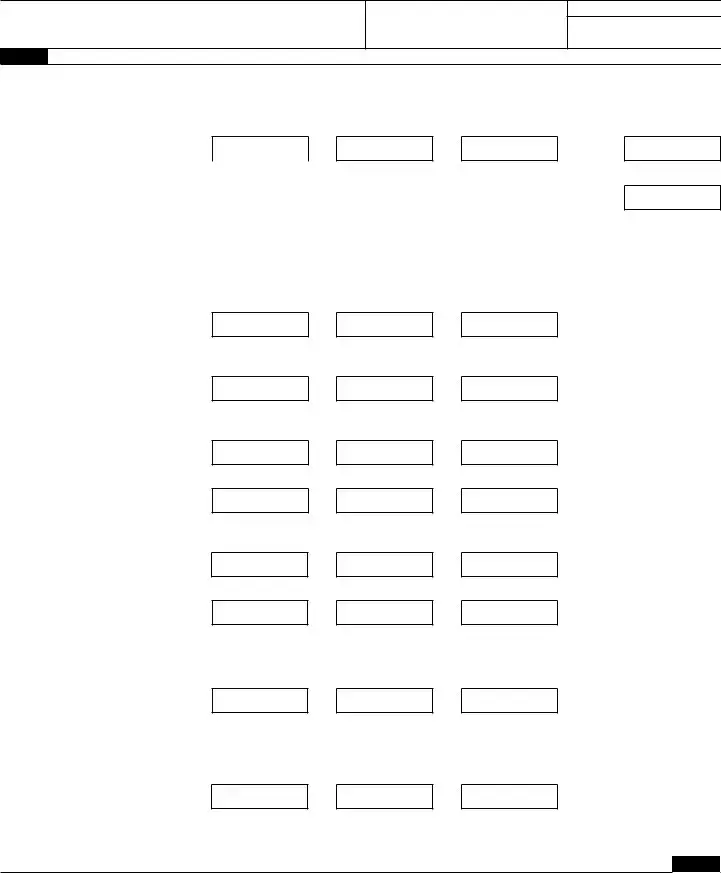

How do I fill out Form 941-X?

Filling out Form 941-X involves a few steps. First, obtain the current version of the form from the IRS website. Next, you'll need specific details about the quarter you are amending. Complete the form by indicating the original amount filed and the corrected amounts. Pay close attention to the instructions provided by the IRS for each section to ensure accuracy.

Are there any deadlines for filing Form 941-X?

Yes, there are deadlines depending on the type of correction you are making. Generally, you have up to three years from the date you filed the original Form 941 or two years from the date you paid the tax to file Form 941-X. It's essential to keep these timelines in mind to avoid any penalties or loss of refund eligibility.

Can I amend multiple quarters with one Form 941-X?

No, you cannot amend multiple quarters on a single Form 941-X. Each quarter needs its own form. This means if you have corrections for multiple quarters, you will have to complete a separate Form 941-X for each one.

What happens after I submit Form 941-X?

After submitting Form 941-X, the IRS will process your amendment. This may take some time, so it’s essential to keep a copy of the submitted form for your records. If a refund is due, it will be issued after the IRS completes its processing, but be prepared for possible delays if additional information is needed.

Will I face a penalty for filing Form 941-X?

Filing Form 941-X itself does not incur penalties; however, if the original error was due to negligence or an intentional disregard of the tax laws, penalties may apply. It is always best to file amendments promptly and accurately to minimize any potential issues.

Where can I get help if I have questions about Form 941-X?

If you have questions about completing Form 941-X or about your specific situation, consider reaching out to a tax professional or the IRS directly. The IRS offers various resources, including publications and assistance lines, to help you navigate the amendment process efficiently.