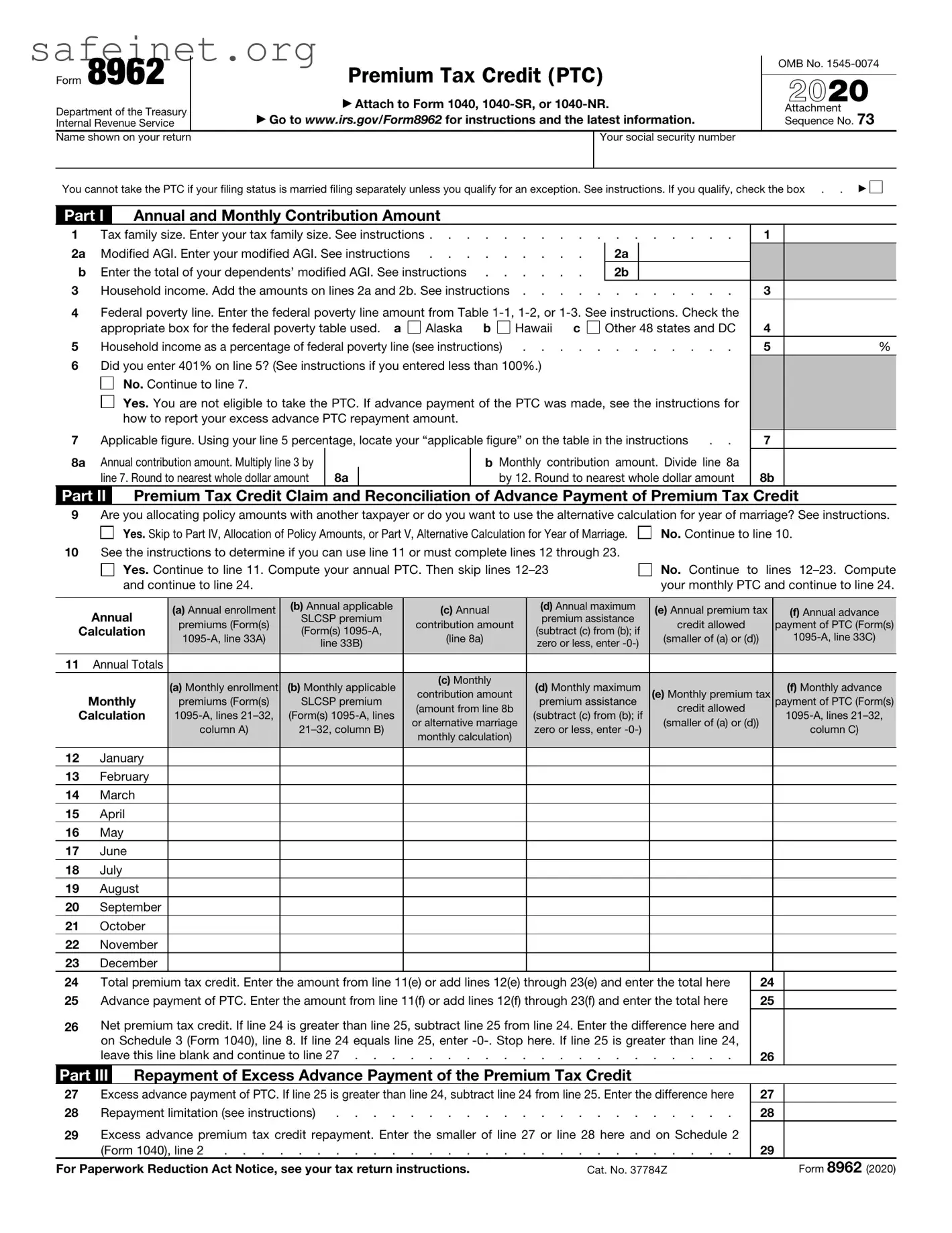

The IRS Form 8962, also known as the Premium Tax Credit (PTC) Form, shares similarities with the IRS Form 1095-A, Health Insurance Marketplace Statement. Both documents are essential in determining eligibility for the premium tax credit. The 1095-A provides information about the health insurance coverage purchased through the marketplace, including the premiums paid and any advance payments of the premium tax credit. The taxpayers use this information when filling out Form 8962 to calculate their actual premium tax credit and reconcile it with any advance payments received. This relationship is crucial for ensuring that individuals receive the correct amount of tax credit based on their actual income and coverage details.

Another document akin to Form 8962 is Form 1040, the individual income tax return. While Form 1040 covers a broad range of income-related matters, Form 8962 specifically addresses the premium tax credit. Taxpayers include Form 8962 as an attachment to their 1040 when they have received advance premium tax credits. This association highlights the interconnectedness of various tax forms, as both forms ultimately contribute to determining the taxpayer's final tax liability or refund.

Form 1095-B, Health Coverage, also bears resemblance to Form 8962. The 1095-B conveys information regarding health coverage offered by insurance providers. Like Form 1095-A, it provides essential information that can help establish compliance with the Affordable Care Act’s requirement for individuals to have health coverage. While Form 1095-B does not directly affect the premium tax credit, it helps individuals understand their health coverage status, which can indirectly influence taxable income and the determination of credits.

IRS Form 8965, Health Coverage Exemptions, is another document that aligns with Form 8962. Form 8965 was used by taxpayers who qualified for a health coverage exemption, allowing them to avoid any penalties for not having health insurance. Though the two forms serve different purposes, they are both connected to the health coverage requirements established by the Affordable Care Act. Taxpayers may find themselves needing to use both forms in a single filing year, particularly if they qualify for a premium tax credit while also seeking an exemption.

Form 8862, Information to Claim Earned Income Credit After Disallowance, is somewhat similar in that both documents require specific information about tax credits. The 8862 form is necessary for taxpayers whose earned income tax credit (EITC) was previously denied and want to claim it again. Much like Form 8962, Form 8862 aims to ensure that individuals receive the appropriate credits based on qualifications. Both forms also emphasize the importance of accurate reporting to avoid errors that could result in disallowance of claimed credits.

Form 8888, Allocation of Refund, can also be viewed as similar in that it is filed during the tax return process. While it specifically deals with how a taxpayer wants to receive their refund, it is still closely associated with the overall tax credit process. For taxpayers who have reconciled their premium tax credit via Form 8962, using Form 8888 can streamline the receipt of their refund, showing the connection between tax credits and how individuals ultimately manage their returns.

Form 8863, Education Credits, is another relevant form when discussing tax credits. Taxpayers use Form 8863 to claim education credits related to higher education expenses, while Form 8962 is used for premium tax credits tied to health coverage. Both forms serve as mechanisms for taxpayers to reduce their tax liability, allowing them to take advantage of available credits based on their circumstances. This highlights the importance of understanding various credits available and ensures individuals are maximizing their benefits in different areas.

Finally, Form W-2, Wage and Tax Statement, is indirectly similar to Form 8962. Though it primarily reports wages and taxes withheld, the information on a W-2 can influence eligibility for premium tax credits. Taxpayers use their W-2s to report income when filling out Form 8962 and determining their eligibility for the premium tax credit. The interplay between these documents illustrates the intricacies of the tax system and highlights how income reporting affects eligibility for various credits.