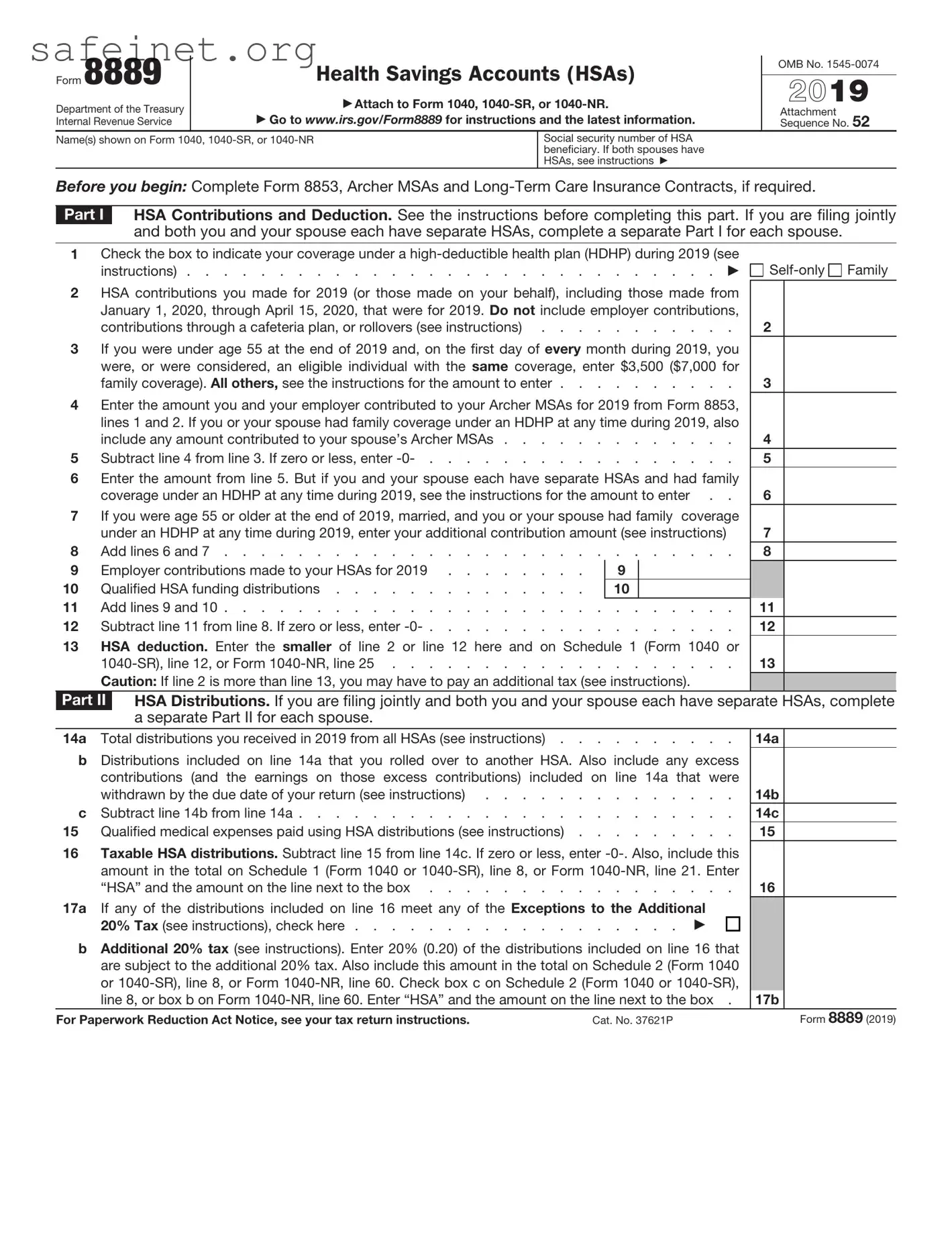

What is IRS Form 8889?

IRS Form 8889 is used to report Health Savings Account (HSA) information. If you have an HSA, you need this form to report contributions made to the account and distributions taken from it. It helps ensure compliance with specific tax provisions related to HSAs.

Who needs to file Form 8889?

You need to file Form 8889 if you received contributions to an HSA during the tax year or if you took distributions from your HSA. Both individuals with their own HSAs and those who received contributions from employers must file this form.

What type of information is required on Form 8889?

Form 8889 requires details about HSA contributions, distributions, and any qualified medical expenses you paid with HSA funds. You'll need to provide information for both self-only and family coverage if applicable.

What are the contribution limits for HSAs?

The IRS sets annual contribution limits for HSAs. For 2023, the limit is $3,850 for individuals and $7,750 for families. If you are 55 or older, you may be eligible for an additional $1,000 catch-up contribution. Always verify the current limits before filing.

What happens if I don't file Form 8889?

Failure to file Form 8889 can lead to penalties and interest. If you are required to file and do not, the IRS may impose taxes on your HSA distributions, treating them as taxable income. Always file on time to avoid complications.

Are there penalties for excess contributions to an HSA?

Yes, if you contribute more to your HSA than the allowed limits, the IRS imposes a 6% excise tax on the excess contributions. To avoid this penalty, you should withdraw the excess amount before filing your tax return.

Can I use Form 8889 for other tax benefits?

Form 8889 is specific to HSAs and does not directly apply to other tax benefits. However, the deductions reported on this form can impact your overall tax liability. Be sure to consider how your HSA contributions fit into your broader tax strategy.

Where can I find Form 8889 and instructions?

You can find Form 8889 and its instructions on the IRS website. It is available for download as a PDF file. The IRS website also provides detailed guidance for completing the form correctly.

What if I have questions while filing Form 8889?

If you have questions while filling out Form 8889, consider reaching out to a tax professional. You can also consult the IRS website for FAQs and additional resources. Utilizing these resources can help clarify any uncertainties you may have.

Family

Family