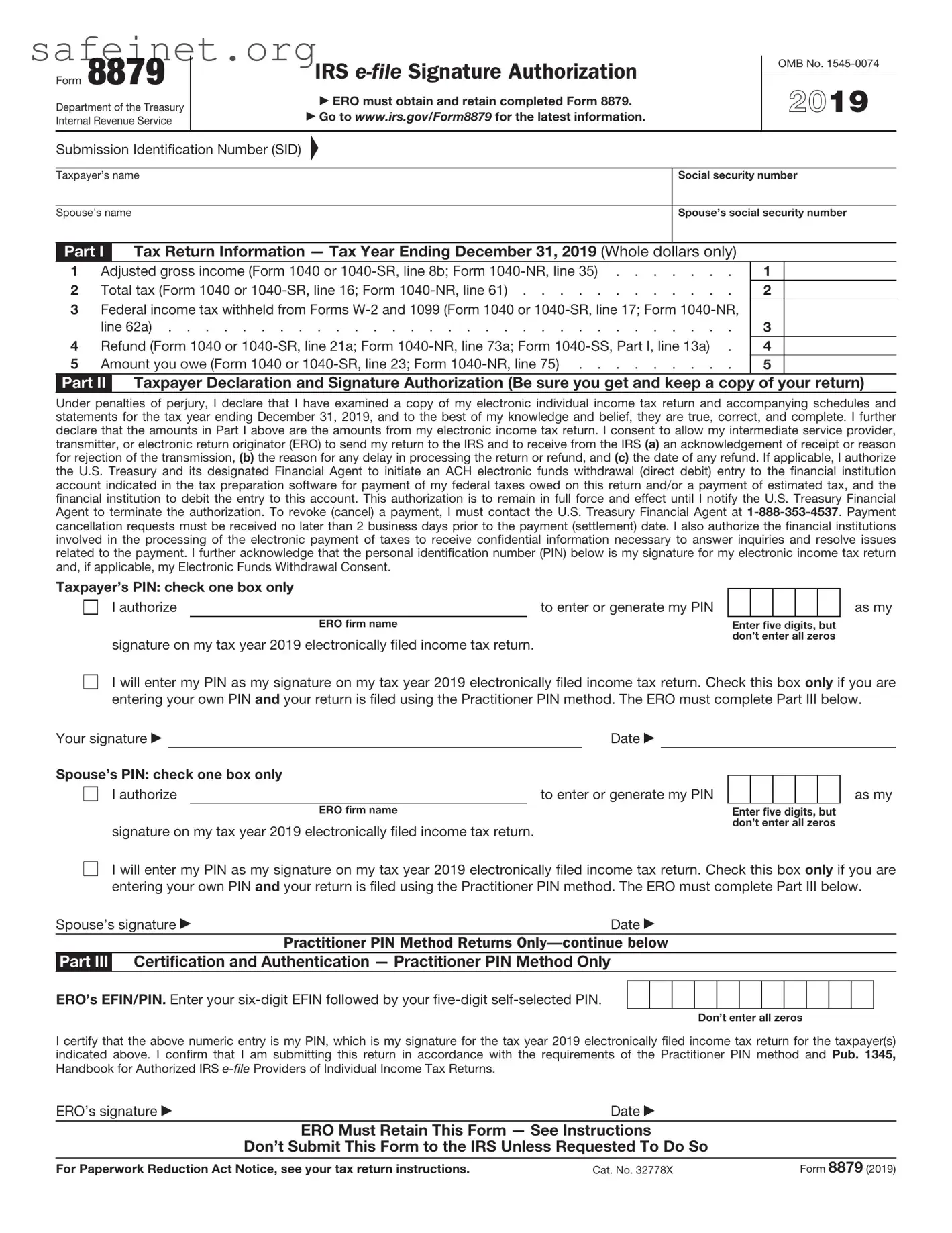

What is IRS Form 8879?

IRS Form 8879, also known as the "IRS e-file Signature Authorization," is a form used by taxpayers to authorize an electronic tax return. This form ensures that the taxpayer gives permission for their tax preparation and filing process to proceed electronically. Essentially, it serves as a signature for situations where a traditional pen-and-paper signature isn’t feasible.

Who needs to use Form 8879?

If you’re filing your taxes electronically through a tax professional or tax software, you will typically need to complete Form 8879. This includes both individuals and businesses. The form is especially important for those who prefer to have a signature authorization without the hassle of mailing in a physical signature.

How do I complete Form 8879?

Completing Form 8879 involves several steps. First, your tax preparer will fill out some sections of the form with your identification details. You will also need to review the information carefully. Finally, you will sign the form electronically or manually, depending on your chosen method. Once signed, it then authorizes your preparer to e-file on your behalf.

Is Form 8879 required for everyone?

Not everyone is required to use Form 8879. If you file your taxes on paper and do not use e-filing, you will not need this form. However, anyone who opts for electronic filing—especially through a preparer—will need to include it to validate the submission properly.

What information do I need to provide on Form 8879?

You will be required to provide personal information such as your name, Social Security Number, and the details of your tax return. Additionally, you’ll find sections that require information about your tax preparer. Make sure to double-check the accuracy of all data before signing the form.

How is Form 8879 submitted?

After completing and signing Form 8879, your tax preparer will typically submit it electronically along with your tax return. It’s essential that this form be retained by the preparer as part of their records, even though you do not have to submit it directly to the IRS.

Can I change my mind after signing Form 8879?

Once you sign Form 8879, you authorize your tax preparer to file your return electronically. However, if you wish to make changes after signing, you should communicate with your preparer immediately. They can guide you on the steps to take, including whether a new form needs to be filled out or if adjustments can be made without issue.

What happens if I don’t sign Form 8879?

If you fail to sign Form 8879 when required, your tax return cannot be filed electronically. This could lead to delays in processing your return and possibly result in penalties if deadlines are missed. It’s essential to address this form promptly to ensure a smooth filing process.

How long do I need to keep Form 8879?

It's recommended that you retain a copy of Form 8879 for at least three years from the date you e-file your tax return. This is important for potential audits or in case the IRS requests verification of your filing. Always err on the side of caution and keep all tax-related documents organized and secure.