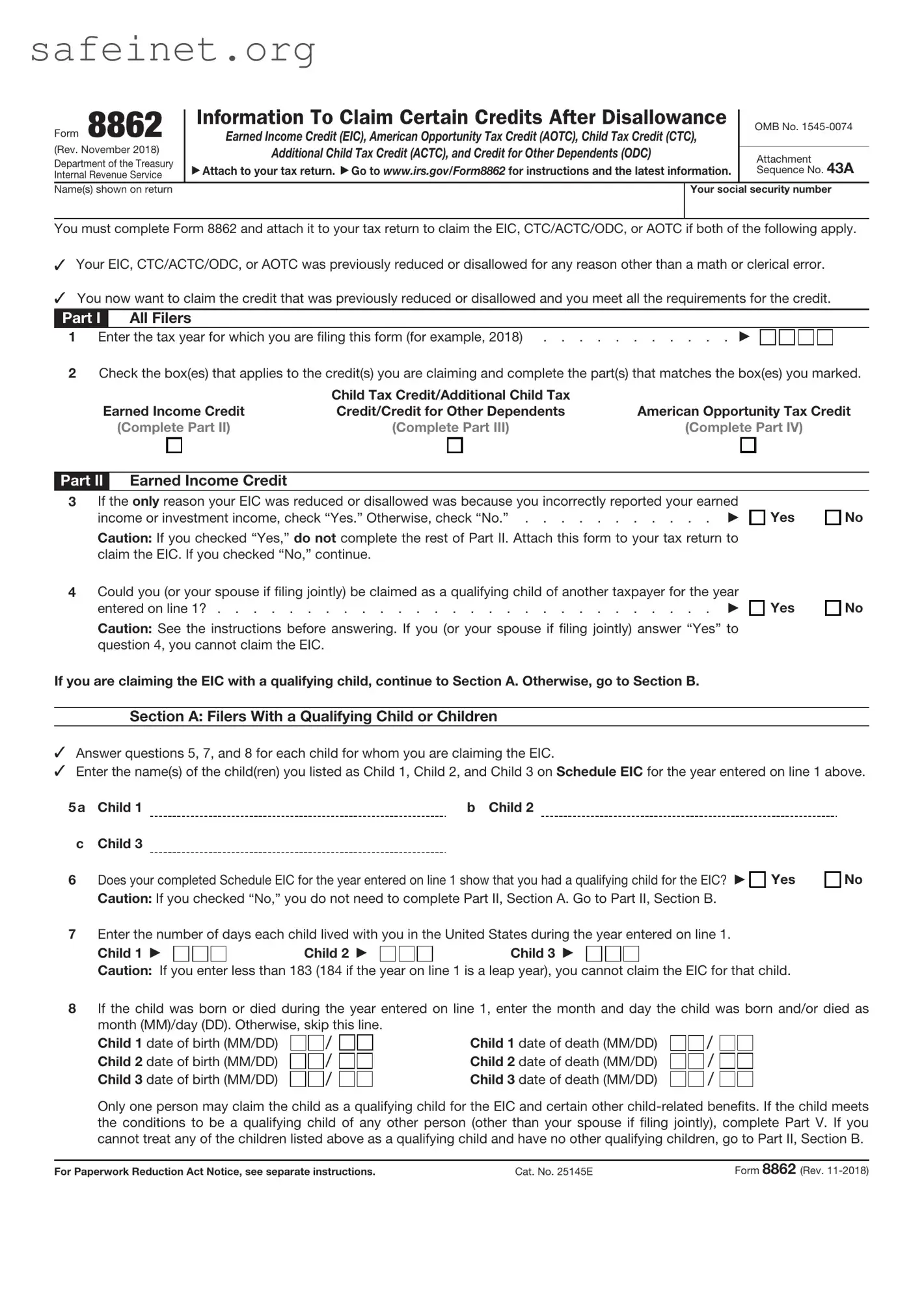

What is IRS Form 8862?

IRS Form 8862 is a document used by individuals who have previously had their claims for the Earned Income Tax Credit (EITC) denied or revoked. It allows these individuals to reapply for the credit by demonstrating that they meet the eligibility requirements in the current tax year.

Who needs to file Form 8862?

If your claim for the Earned Income Tax Credit was disallowed in the past or you received a notice from the IRS regarding the revocation of the credit, you must file Form 8862 when you want to claim the credit again. Additionally, anyone who received a letter from the IRS stating that they must file this form to qualify for the EITC in future years must do so.

What are the eligibility requirements for claiming the EITC?

To qualify for the EITC, you must meet several criteria. You need to have earned income, a valid Social Security number, and a filing status that is not "married filing separately." The amount of your credit can vary based on your income level, number of qualifying children, and filing status. Form 8862 requires you to provide detailed information to prove your current eligibility for the credit.

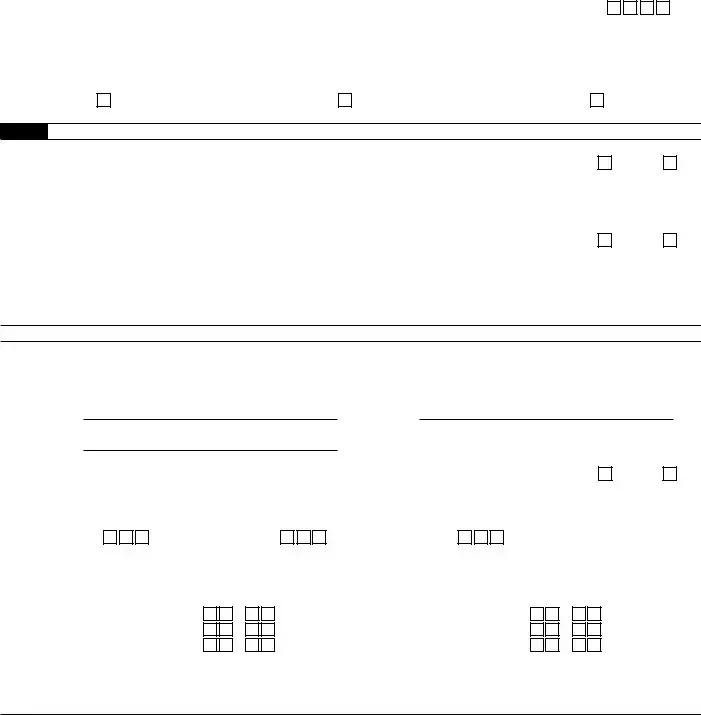

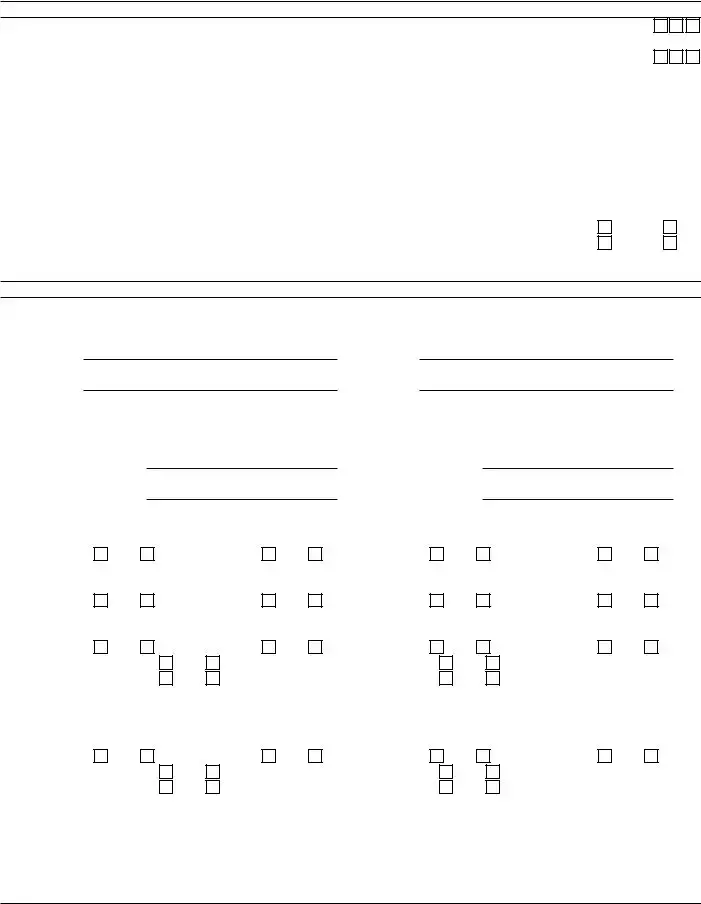

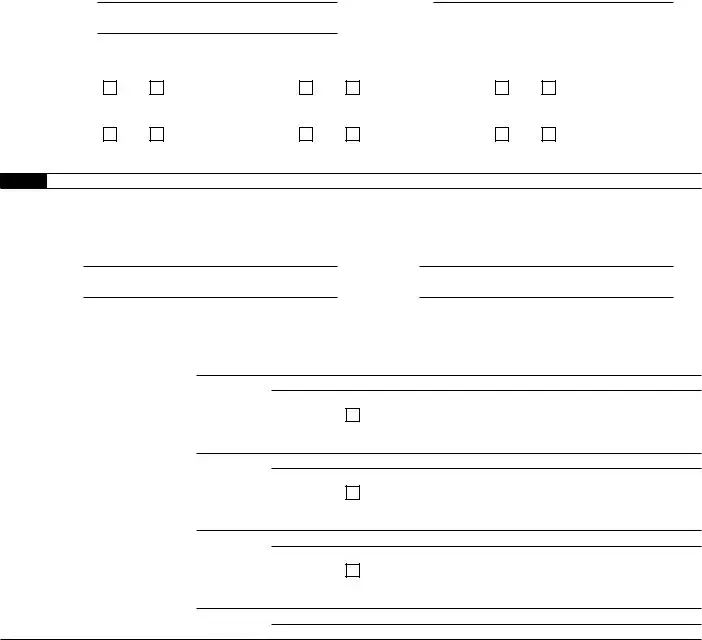

How do I fill out IRS Form 8862?

Form 8862 requires basic information about your identity and your tax situation. You will provide your name, Social Security number, and any qualifying children. Additionally, you will need to answer specific questions about whether you meet the conditions to claim the EITC. Take your time when completing the form to ensure accurate information is provided. If you need assistance, consider reaching out to a tax professional.

Where do I submit IRS Form 8862?

You should submit Form 8862 along with your tax return. If you are filing your return electronically, you can include the form in the submission. If you are submitting a paper return, include Form 8862 with your completed tax documents and mail it to the appropriate address as indicated in the instruction booklet for your tax return.

What happens after I submit Form 8862?

Once the IRS receives your Form 8862, they will review the information provided. If they confirm your eligibility, your claim for the EITC will be reprocessed, and you may receive the credit. The IRS may also reach out if they require additional information or documentation to complete the review.

Can Form 8862 be rejected?

Yes, Form 8862 can be rejected if the IRS determines that you do not meet the qualifications for the EITC, or if there are inconsistencies in the information provided. In such cases, you will receive a notice explaining the reason for the denial. To resolve the issues, you may need to clarify any misunderstandings or provide further information.

Are there any consequences of incorrectly filing Form 8862?

If you incorrectly file Form 8862, it can lead to financial implications. If the IRS finds inaccuracies, your claim for the EITC may be denied, and you could face penalties for submitting incorrect information. Always ensure you provide accurate and truthful information on your tax forms to avoid complications.

Where can I find help if I have more questions about Form 8862?

If you have additional questions or need assistance with Form 8862, consider visiting the IRS website, where you can find detailed instructions and resources. Additionally, reaching out to a tax professional may provide clarity on your specific situation and help ensure that your tax return is completed accurately.