Form 8857 (Rev. 1-2014) |

Page 6 |

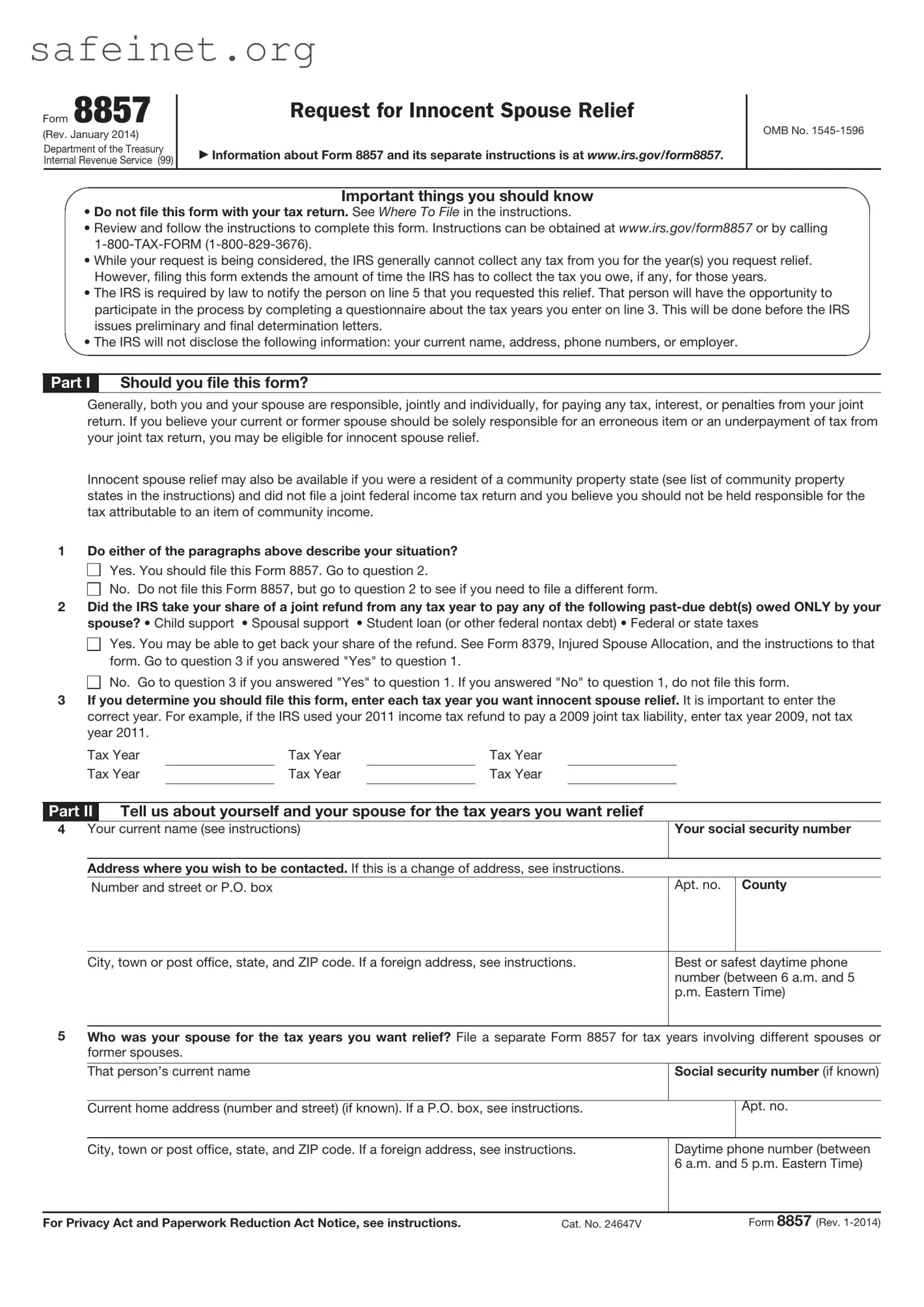

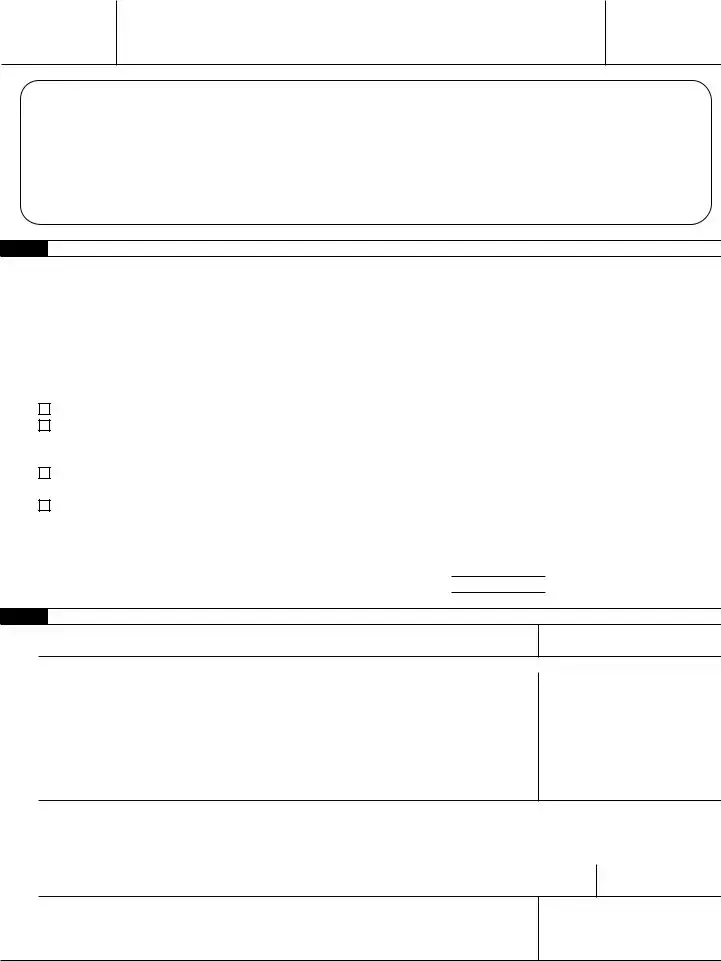

Note. If you need more room to write your answer for any question, attach more pages. Be sure to write your name and social security number on the top of all pages you attach.

Part V Complete this part if you were (or are now) a victim of domestic violence or spousal abuse

As stated in line 8, providing this additional information is not mandatory but may strengthen your request. Additionally, if you prefer to provide this information orally, check the "Yes" box on line 10.

If you were (or are now) a victim of domestic violence or spousal abuse by the person on line 5, the IRS will consider the information you provide in this part to determine whether to grant innocent spouse relief. However, the IRS is required by law to notify the person on line 5 that you requested this relief. There are no exceptions to this rule. That person will have the opportunity to participate in the process by completing a questionnaire about the tax years you entered on line 3. This will be done before the IRS issues preliminary and final determination letters. However, the IRS is also required by law to keep all the personal identifying information (such as current names, addresses, and employment-related information) of both you and the person on line 5 confidential. This means that the IRS cannot disclose one person's information to the other person. If the IRS does not grant you relief and you choose to petition the Tax Court, your personal identifying information is available, unless you ask the Tax Court to withhold it.

The person on line 5 will receive a questionnaire about the tax years you entered on line 3. Except for your current name, address, phone numbers, and employer, this form and any attachments could be disclosed to the person on line 5. If you have any privacy concerns, see instructions.

The IRS understands and is sensitive to the effects of domestic violence and spousal abuse, and encourages victims of domestic violence to call 911 if they are in immediate danger. If you have concerns about your safety, please consider contacting the 24-Hour (Confidential) National Domestic Violence Hotline at 1-800-799-SAFE (7233), or 1-800-787-3224 (TTY), or 1-855-812-1001 (Video Phone Only for Deaf Callers) before you file this form.

A representative from the IRS may call you to gather more information and discuss your request. Be sure you enter your correct contact information on line 4.

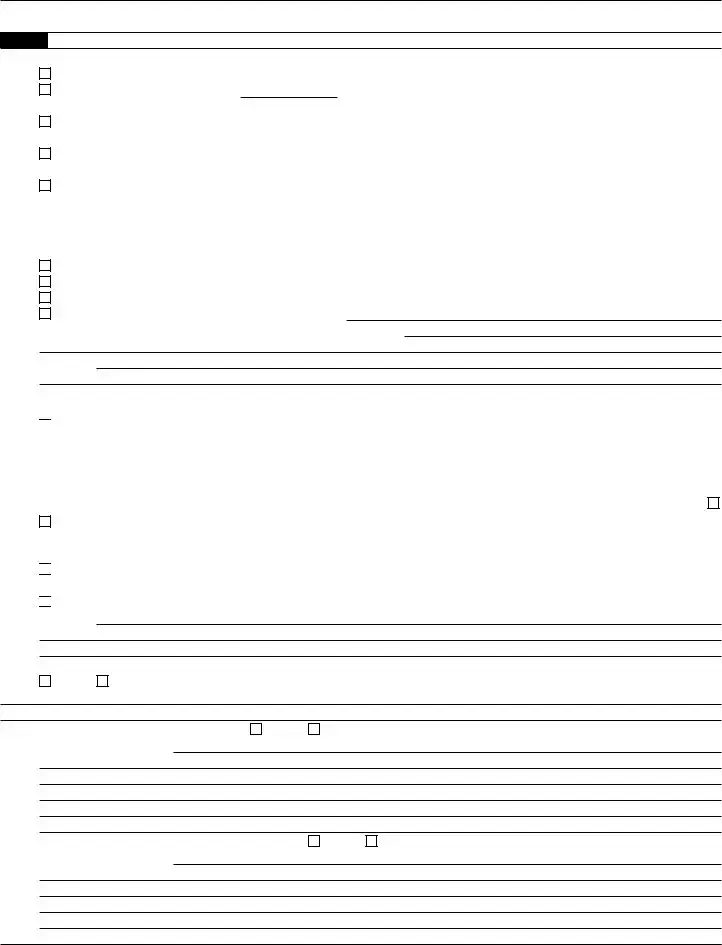

24a During any of the tax years for which you are seeking relief or when any of the returns were filed for those years, did the person on line 5 do any of the following? Check all that apply. (Note. If this does not apply to you, skip lines 24a, b, and c, and complete lines 25 through 29.)

Physically harm or threaten you, your children, or other members of your family.

Sexually abuse you, your children, or other members of your family.

Make you afraid to disagree with him/her.

Criticize or insult you or frequently put you down.

Withhold money for food, clothing, or other basic needs.

Make most or all the decisions for you, including financial decisions.

Restrict or control who you could see or talk to or where you could go.

Isolate you or keep you from contacting your family members and/or friends.

Cause you to fear for your safety in any other way.

Stalk you, your children, or other members of your family.

Abuse alcohol or drugs.

bDescribe the abuse you experienced, including approximately when it began and how it may have affected you, your children, or other members of your family. Explain how this abuse affected your ability to question the reporting of items on your tax return or the payment of the tax due on your return.

cAttach photocopies of any documentation you have, such as:

Yes. If you want the IRS to consider this information in making its determination, complete Part V of this form in addition to other parts of the form. First read the instructions for Part V, to understand how the IRS will proceed with evaluating your claim for relief in these circumstances.

Yes. If you want the IRS to consider this information in making its determination, complete Part V of this form in addition to other parts of the form. First read the instructions for Part V, to understand how the IRS will proceed with evaluating your claim for relief in these circumstances.

Yes.

Yes.

No. Explain

No. Explain

You did not know whether the person on line 5 had income. Explain why you did not know whether the person on line 5 had income

You did not know whether the person on line 5 had income. Explain why you did not know whether the person on line 5 had income

No

No