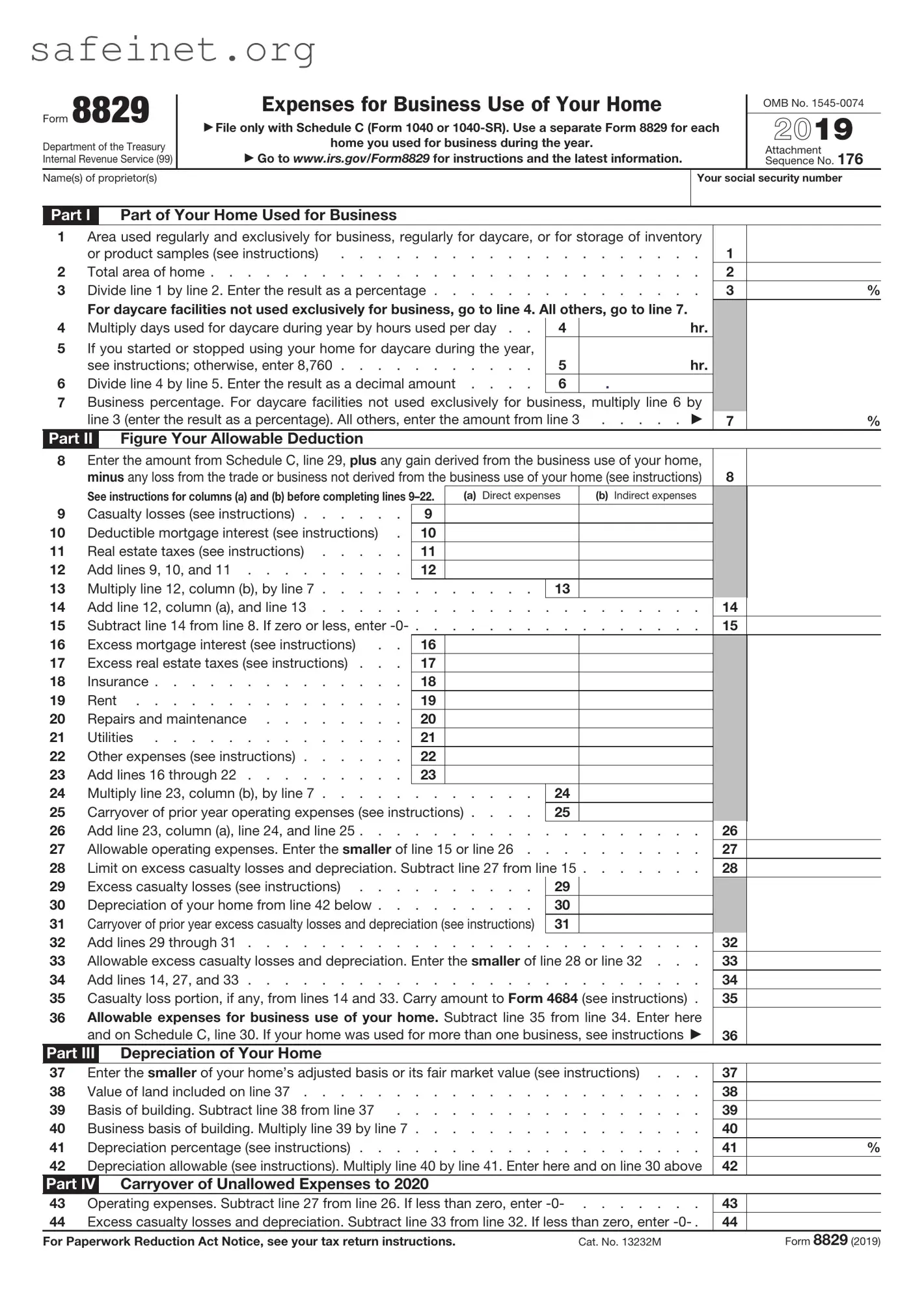

What is the IRS Form 8829?

The IRS Form 8829 is a document that taxpayers use to claim expenses for the business use of their home. If you operate a business from your home, this form helps you calculate the allowable expenses connected to that business. It accounts for direct and indirect costs, including utilities, rent, repairs, and depreciation, related to your home office.

Who can use Form 8829?

Form 8829 is primarily for individuals who are sole proprietors and use a part of their home exclusively and regularly for business. If you itemize business expenses on Schedule C of your tax return, you will likely need to file this form as part of your annual tax submission.

What types of expenses can I claim on Form 8829?

You may claim a variety of expenses on Form 8829. These include direct expenses, which are costs related solely to your home office, such as painting the office space or purchasing office furniture. Indirect expenses, which are costs for maintaining and operating your entire home, also qualify, such as mortgage interest, property taxes, and utility bills. Remember, these indirect expenses must be prorated based on the percentage of your home used for business purposes.

How do I determine the square footage of my home office?

To determine the square footage of your home office, measure the area used exclusively for your business. This might include a separate room or specific sections of a room. Once you have that measurement, divide it by the total square footage of your residence. This calculation will yield the percentage of your home used for business purposes, which is vital for prorating expenses accurately.

Do I need to keep records of my expenses when filing Form 8829?

Yes, it is essential to keep detailed records of all expenses you plan to deduct. This includes receipts, invoices, and any relevant documentation. The IRS may require you to provide evidence of your claims, especially if you are audited. Keeping organized records will make it easier to accurately complete Form 8829 and substantiate your deductions.

Can I use Form 8829 if I have an office outside my home?

If you have a separate office location, you may still use Form 8829, provided that you also use part of your home for business purposes. The home office must be utilized exclusively for business and meet the IRS criteria for a qualified business use. It's important to clarify this, as expenses related only to the outside office cannot be claimed on this form.

What happens if I sell my home?

If you sell your home, there may be tax implications related to the business portion of your residence. Specifically, if you claimed depreciation on your home office, you are required to recapture that depreciation as income when you sell the property. Understanding these implications is crucial, as they can affect your tax liability significantly.

Is there a limit on the amount I can deduct using Form 8829?

Yes, the amount you can deduct through Form 8829 has limits. For example, if your net profit from the business is lower than your total home office expenses, you can only deduct up to the amount of your net profit. Additionally, the IRS has specific guidelines regarding the minimum and maximum home office deductions, which must be adhered to in each tax year.

How do I submit Form 8829?

To submit Form 8829, you will need to fill out the form completely, ensuring all calculations and details are accurate. This form is typically filed with your annual tax return, using either paper or electronic filing methods. Ensure you retain a copy of the completed form and any supporting documentation for your records.