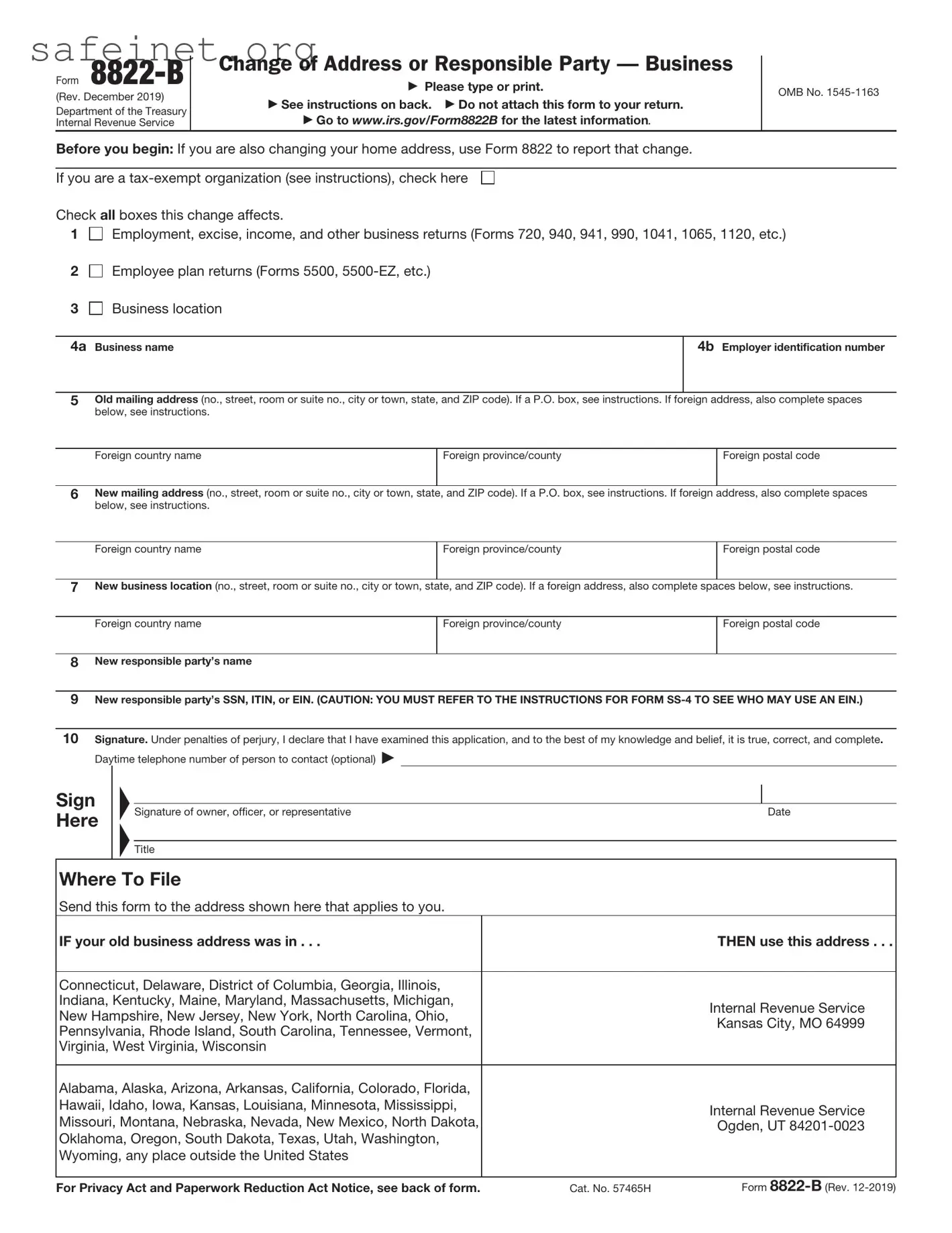

The IRS Form 4506-T allows taxpayers to request a transcript of their tax return. Similar to the IRS 8822-B, it serves administrative purposes, enabling individuals or businesses to obtain important tax information. This document can help with verifying income for loans or financial institutions, making it a valuable tool for financial management.

Form 8822- B is also comparable to Form 1099, which reports income other than wages. Both forms are used for tax reporting purposes. While the IRS 8822-B updates addresses and responsible parties, the 1099 serves to report various types of payments, ensuring that all income is documented and reported correctly to the IRS.

The W-9 form, which requests the Taxpayer Identification Number and certification, holds similarities as well. It is used to provide accuracy in tax reporting. Both forms emphasize the importance of correct and up-to-date information. The W-9 helps businesses identify individuals for tax purposes, just as the IRS 8822-B updates information regarding a business’s responsible parties.

Form 940 is used to file for federal unemployment tax, making it comparable in its role for specific business functions. Just as the IRS 8822-B updates the information of responsible individuals in a business entity, Form 940 helps keep track of unemployment tax liability. Both forms play a role in ensuring compliance with federal tax regulations.

The IRS Form 941 reports payroll taxes. Like the IRS 8822-B, it aims to provide clear information to the IRS, ensuring accurate records. Both forms are necessary for business compliance, but while the 8822-B focuses on changes in information, Form 941 manages ongoing tax responsibilities concerning employee wages.

Form 1065 is used by partnerships to report income and deductions. It shares a purpose with the IRS 8822-B by ensuring that correct information reaches the IRS. While one updates party information, the other focuses on financial data. Accurate reporting is essential in both cases, and they help maintain the integrity of the tax system.

Form 1040 is an individual income tax return document. Like the IRS 8822-B, it is essential for filing and maintaining updated tax records with the IRS. While the 1040 addresses individual tax obligations, the IRS 8822-B helps to ensure relevant information about individuals or entities is complete and accurate for compliance purposes.

The IRS Form 8862 is used to claim the Earned Income Credit after it was previously disallowed. It is similar to the IRS 8822-B in that it helps address specific issues with tax returns. Both forms serve to clarify taxpayer information—Form 8862 by rectifying a disallowance situation, and the IRS 8822-B by updating responsible party information to ensure proper claims going forward.

Form 8832 is the entity classification election form, which allows an eligible entity to choose its federal tax classification. It relates closely to the IRS 8822-B as it involves changes to an entity’s status. Both forms provide crucial updates that help clarify the relationships and responsibilities concerning tax matters in the eyes of the IRS.

Finally, the IRS Form 9465 is used to apply for a payment plan. This form is necessary for taxpayers who need to manage their tax liabilities over time. Like the IRS 8822-B, it helps facilitate communication with the IRS regarding a taxpayer's status and needs, ensuring all parties are informed and can act accordingly on financial matters.

Employment, excise, income, and other business returns (Forms 720, 940, 941, 990, 1041, 1065, 1120, etc.)

Employment, excise, income, and other business returns (Forms 720, 940, 941, 990, 1041, 1065, 1120, etc.)