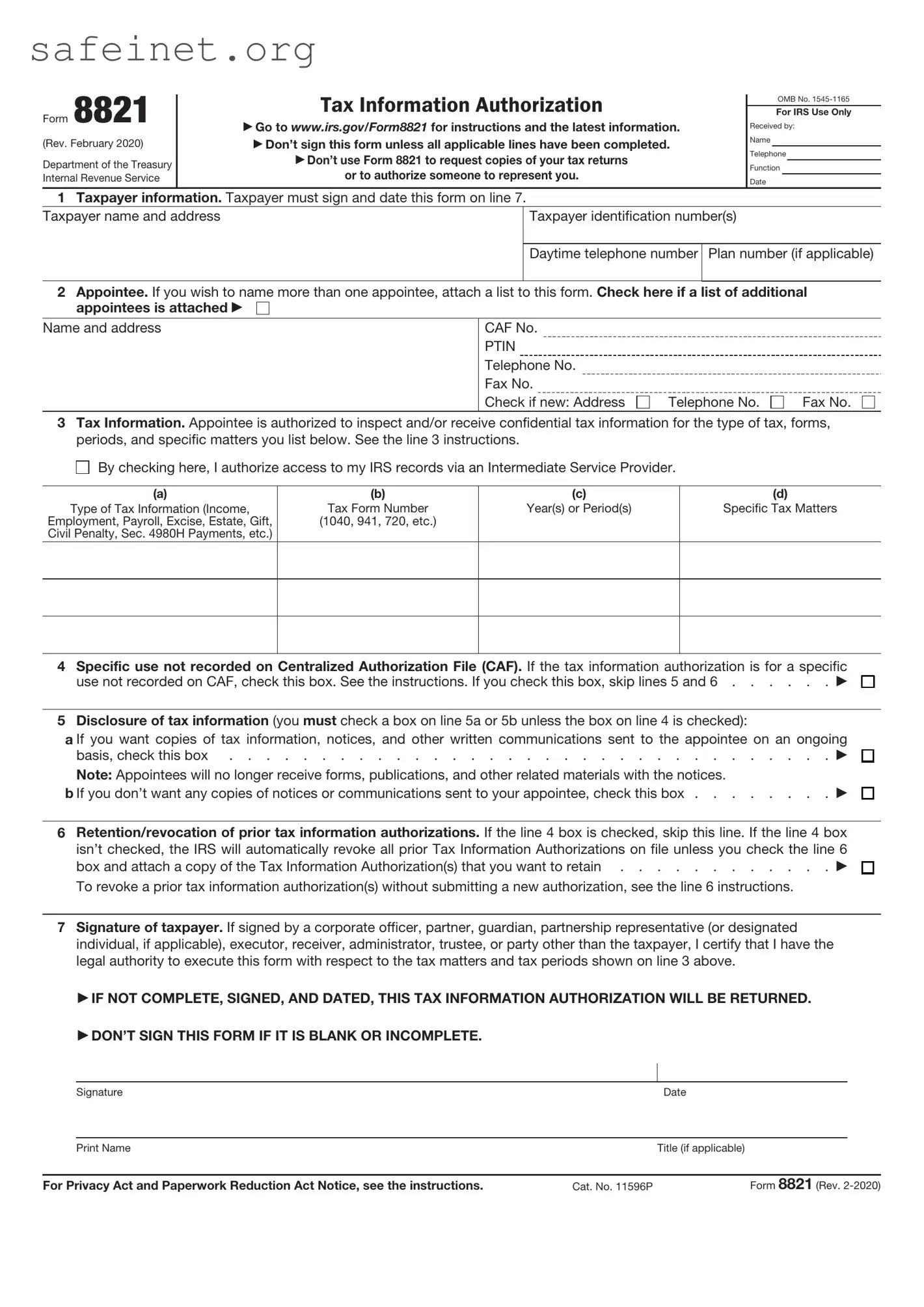

What is IRS Form 8821?

IRS Form 8821, also known as the "Tax Information Authorization," is a document that allows individuals or entities to authorize another person to receive and inspect their confidential tax information. The authorized person can be a tax professional or someone trusted in dealings with the IRS.

Who can file Form 8821?

Any taxpayer can file Form 8821, whether an individual or a business entity. The form is meant for anyone who wishes to permit another person to have access to their tax information without granting the authority to represent them before the IRS.

What type of information can be accessed using Form 8821?

Form 8821 allows the designated individual to access various tax information, including tax returns, account information, and other tax-related documents for the years specified on the form. However, it does not allow the representative to act on behalf of the taxpayer.

How do I complete Form 8821?

To complete Form 8821, provide your personal information at the top, including your name, address, and Social Security number or Employer Identification Number (EIN). Next, enter the name and information of the designated representative. Specify the types of tax information you are authorizing access to, and list the years for which this authorization applies. Finally, sign and date the form.

Can I revoke Form 8821 after it is filed?

Yes, you can revoke Form 8821 at any time. To do this, you should submit a written statement to the IRS clearly stating your intent to revoke authorization and identify the specific Form 8821 that you wish to revoke.

How long does Form 8821 remain in effect?

Form 8821 remains in effect until the specified expiration date, which can be set for up to one year from the date of signing, or until it is revoked. If no expiration date is set, it will last indefinitely until either of the two scenarios occurs.

Do I need to submit Form 8821 for each tax year?

If you want your representative to have access to information for more than one tax year, you can specify multiple years on the same Form 8821. If you need a new authorization in a subsequent year, you should file a new form with the updated information.

Is Form 8821 the same as Form 2848?

No, Form 8821 is different from Form 2848, the "Power of Attorney and Declaration of Representative." While Form 8821 allows the designated individual to obtain tax information, Form 2848 provides the representative with the authority to act on your behalf before the IRS, including making decisions and filing documents.

Where do I send Form 8821?

Form 8821 should be sent to the appropriate IRS office based on the type of tax information needed and your location. The specific mailing address and details can be found in the instructions included with the form. It’s advisable to send the form via certified mail for tracking purposes.

Is there a fee associated with filing Form 8821?

There is no fee for filing IRS Form 8821. Taxpayers can fill out and submit the form freely, depending solely on their need for a designated representative to access their tax information.

By checking here, I authorize access to my IRS records via an Intermediate Service Provider.

By checking here, I authorize access to my IRS records via an Intermediate Service Provider.