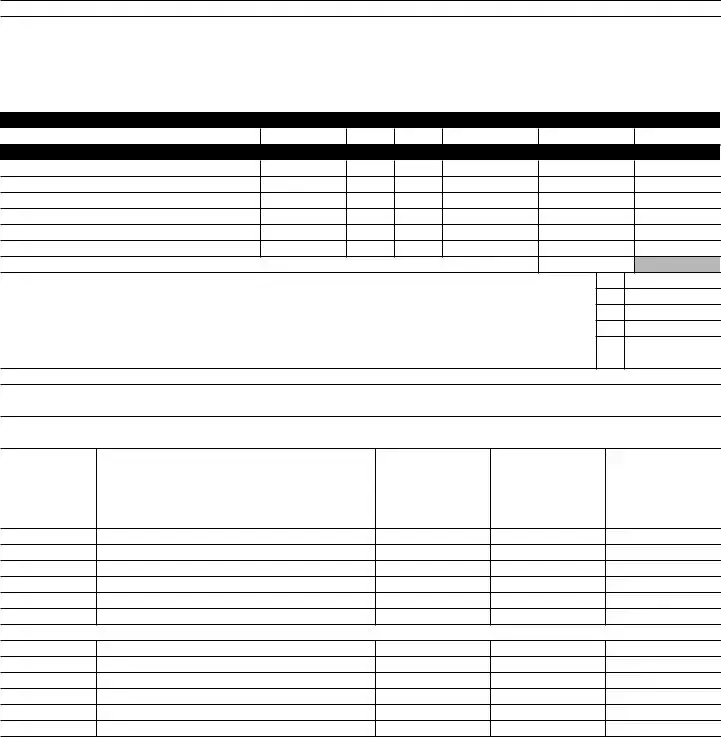

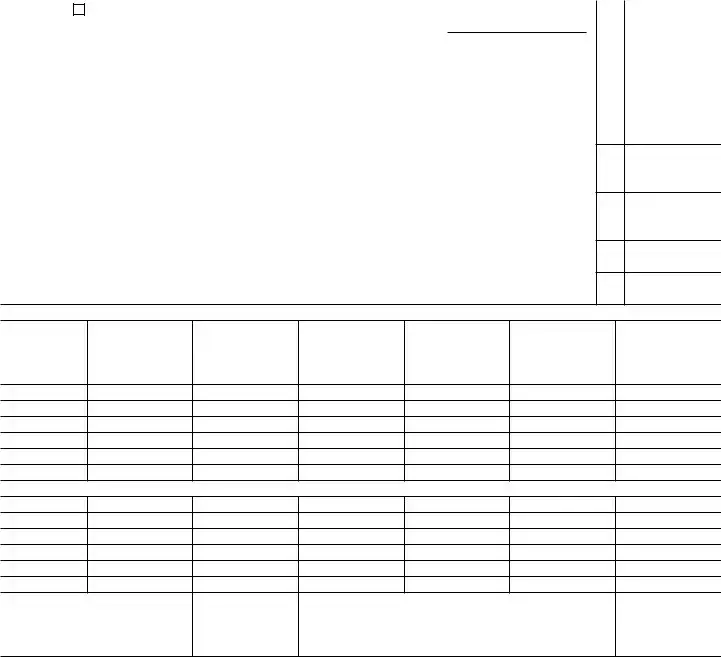

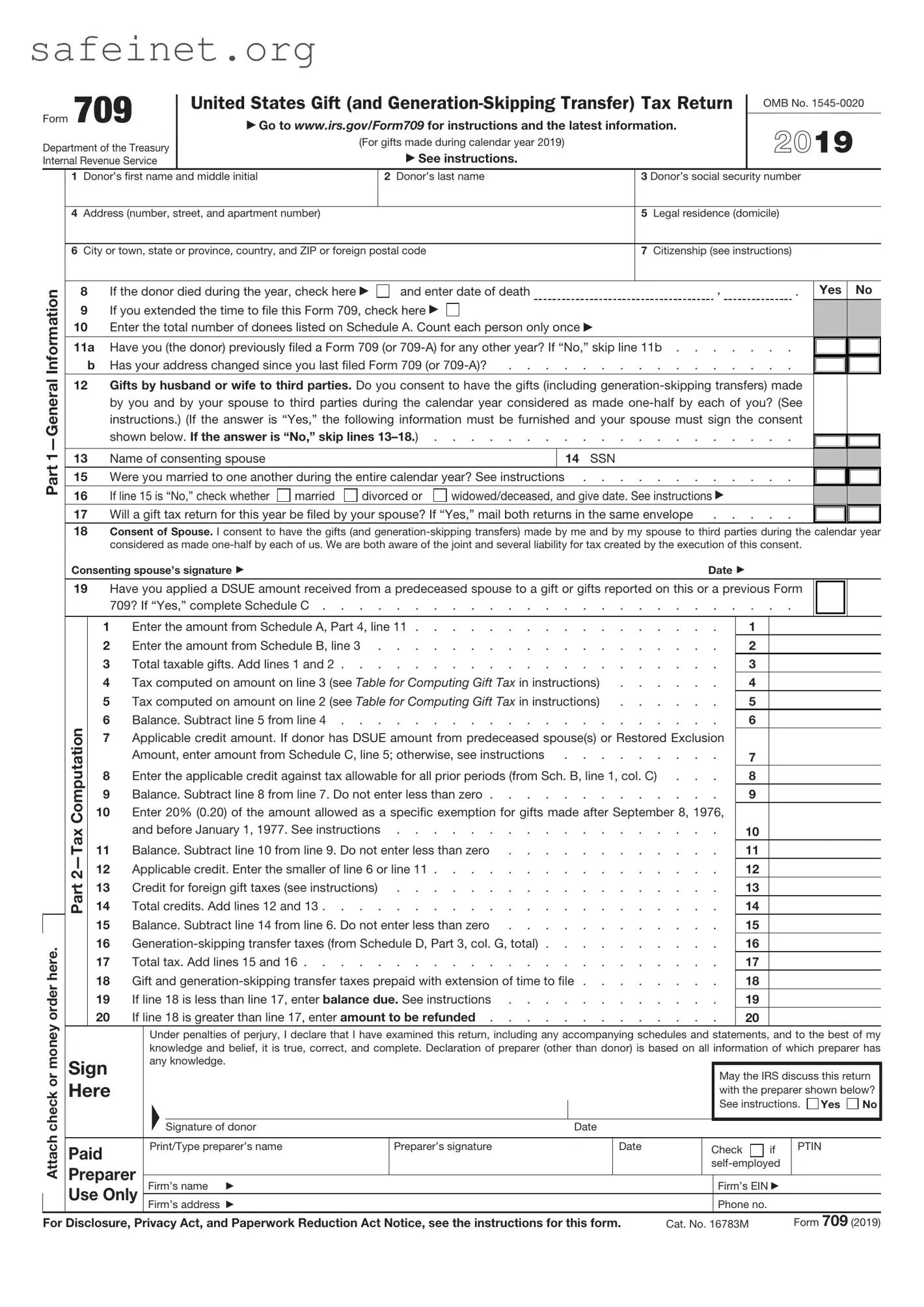

What is IRS Form 709?

IRS Form 709 is the United States Gift (and Generation-Skipping Transfer) Tax Return. It is used to report transfers of money or property made as gifts during a calendar year. If you exceed a certain amount in gifts, you are required to file this form. The current annual exclusion amount for gifts is $17,000 per recipient for 2023, meaning that gifts under this amount typically do not require filing.

Who needs to file Form 709?

Individuals who make gifts exceeding the annual exclusion amount to any single recipient during the tax year must file Form 709. Additionally, if a person splits gifts with their spouse to maximize the gift tax exemption, they must also file this form, regardless of whether the individual gifts were below the threshold.

What is the purpose of Form 709?

Form 709 serves to report gifts that exceed the annual exclusion limit. It helps the IRS monitor and assess any applicable gift taxes. Moreover, it allows individuals to track their lifetime gift tax exemption, which, combined with the estate tax exemption, can be substantial. As of 2023, the lifetime exemption is $12.92 million.

When is Form 709 due?

Form 709 is due on April 15 of the year following the tax year in which the gift was made. If this date falls on a weekend or holiday, the due date is typically the next business day. An extension can be requested through Form 4868, but this does not extend the time to pay any taxes owed.

What happens if I don’t file Form 709 when required?

If you fail to file Form 709 when required, you could face penalties. The IRS generally charges a penalty of 5% per month, up to a maximum of 25% of the unpaid tax. This could significantly increase the amount owed. It is crucial to file the form to avoid potential issues and complications down the line.

Can I file Form 709 electronically?

Currently, Form 709 can only be filed using paper forms. The IRS does not offer an electronic filing option for this specific return. It’s important to ensure that the form is completed accurately and sent to the appropriate address, as listed in the form's instructions, to ensure proper processing.

Can I make gifts without affecting my lifetime exemption?

Yes, as long as each gift is below the annual exclusion amount of $17,000 per recipient in 2023, you can make gifts without impacting your lifetime exemption. Gifts that qualify for the annual exclusion do not need to be reported on Form 709. This allows you to give to multiple recipients without concern.

What types of gifts are subject to Form 709?

Form 709 covers a wide range of gifts, including cash, stock, real estate, and other assets. It also includes gifts of property, transfers to trusts, and generation-skipping gifts. However, certain educational and medical payments made directly to institutions do not count toward the annual exclusion and therefore do not require reporting.

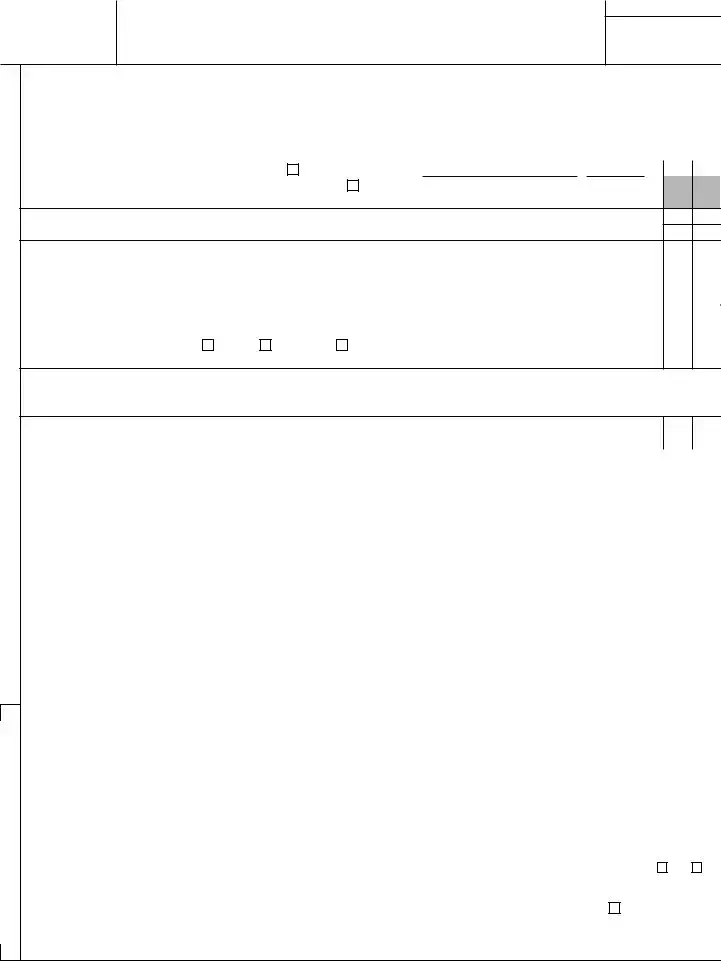

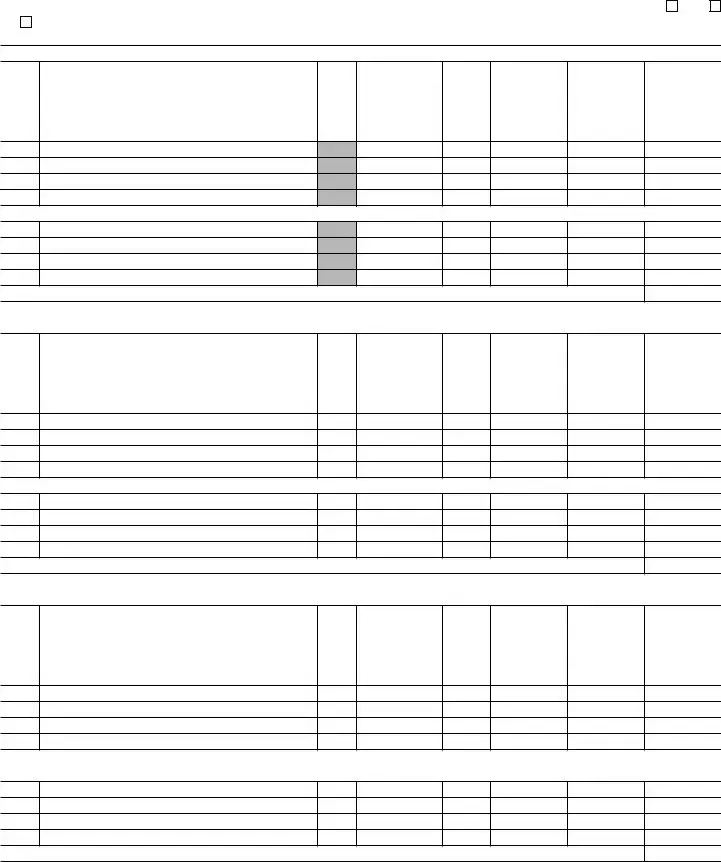

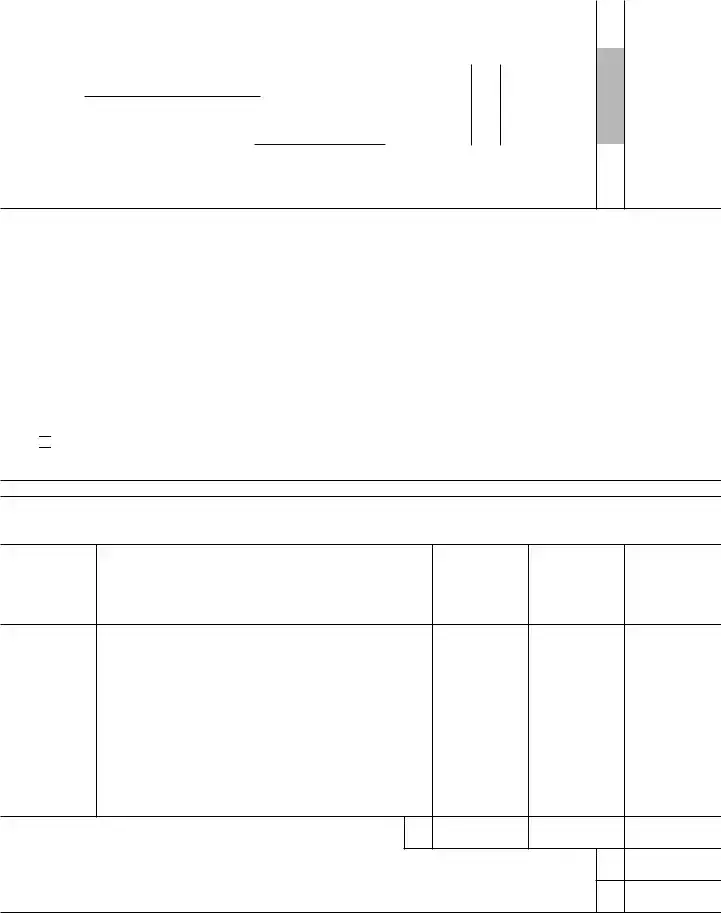

Check here if you elect under section 2523(f)(6)

Check here if you elect under section 2523(f)(6)