The IRS Form 8858 is similar to Form 5472 as both are used for foreign entities and ownership. Specifically, Form 8858 is filed by U.S. persons who own a foreign disregarded entity or a foreign branch. It captures details regarding the financial activities of these foreign entities, including income, expenses, and transactions. Like Form 5472, it helps ensure transparency and compliance with U.S. tax laws, providing the IRS with comprehensive information about foreign holdings.

Another document that bears resemblance is IRS Form 8865. This form is utilized by U.S. taxpayers who are partners in a foreign partnership. Similar to Form 5472, it reports various financial details, including income, deductions, and the partners’ percentage of ownership. It facilitates the IRS in assessing the tax obligations tied to international partnerships, highlighting the intricate financial relationship between U.S. citizens and foreign entities.

IRS Form 8938, which mandates specified U.S. taxpayers to report foreign financial assets, shares some similarities with Form 5472. Both forms focus on ensuring U.S. taxpayers comply with disclosure requirements concerning foreign holdings. Form 8938 aims to provide the IRS with a broader understanding of an individual's foreign assets, whereas Form 5472 concentrates on transactions with foreign entities, but both ultimately promote transparency in international finance.

The IRS Form 1120 is also worth noting due to its connection with U.S. corporations. Similar to Form 5472's purpose, Form 1120 reports the income, gains, losses, and deductions of a domestic corporation. While Form 5472 specifically addresses transactions involving foreign entities, both highlight the importance of accurate reporting for compliance with U.S. tax regulations.

In the realm of international tax reporting, IRS Form 1042 is significant. This form provides information on amounts paid to foreign persons, along with withholding tax details. Much like Form 5472, it ensures that the IRS is informed about funds flowing across borders, promoting compliance with tax obligations for foreign recipients. Both forms play a crucial role in understanding international financial relationships.

Additionally, IRS Schedule B, which accompanies the Form 1040, focuses on reporting interest and dividend income from foreign assets. While it primarily addresses individual taxpayers, it shares the goal of Form 5472 by enhancing transparency surrounding foreign financial interests of U.S. citizens. Reporting under Schedule B highlights the importance of documenting all sources of income, including foreign earned income.

The IRS Form 1065, which reports income, gains, and losses from partnerships, is similar to Form 5472 regarding its focus on entity reporting. Both forms require detailed information about financial operations, although Form 1065 pertains specifically to domestic partnerships. It seeks to provide the IRS with a clear view of partnership transactions and activities, paralleling how Form 5472 works for foreign transactions.

Lastly, Form 8939, which relates to the transfer of estate assets, resembles Form 5472 in its reporting function. While the focus of Form 8939 is on estate tax matters, it requires disclosure of certain foreign financial assets. Both forms serve to enhance the IRS's understanding of potential tax liabilities tied to cross-border transactions or holdings, reinforcing the necessity of thorough reporting.

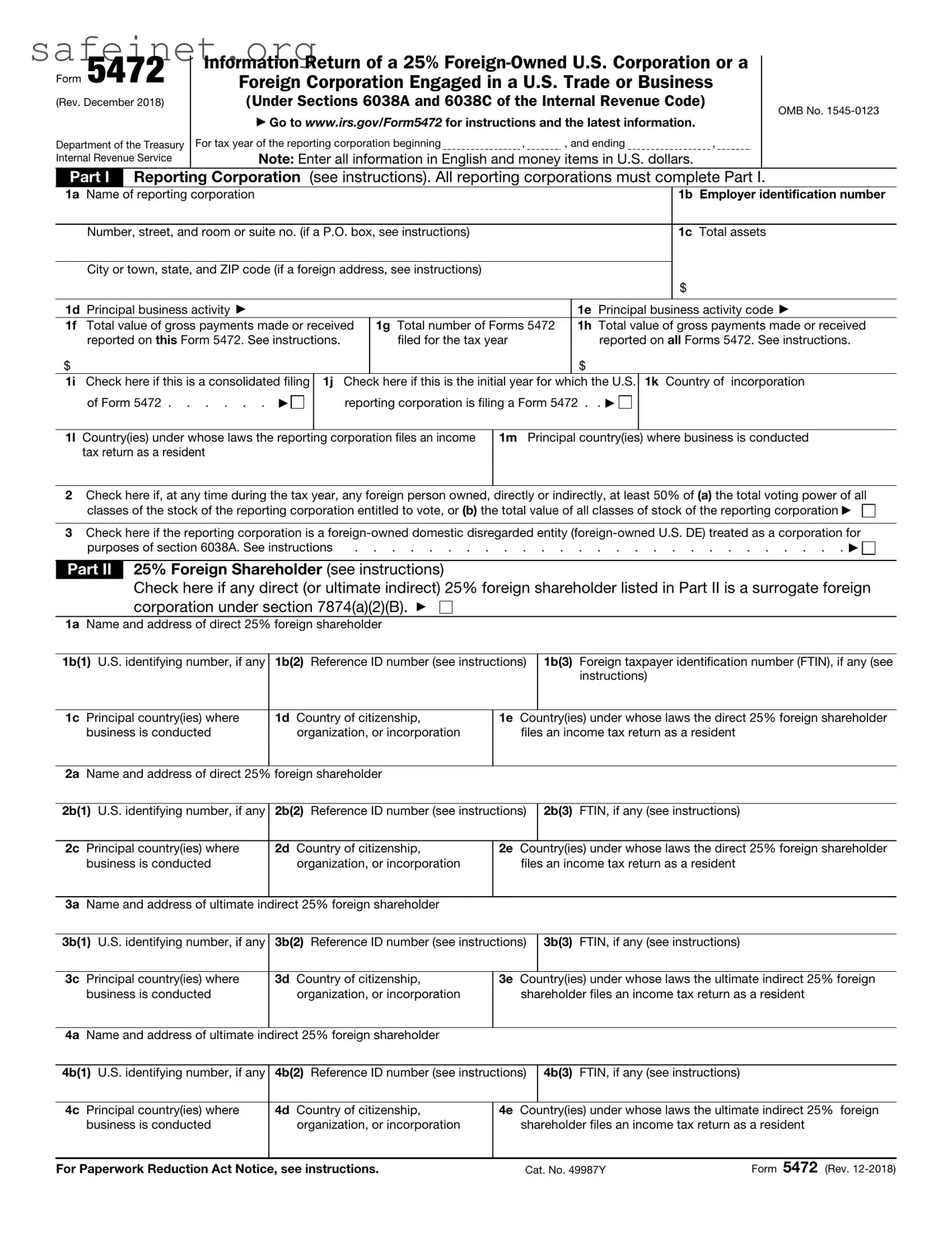

foreign person or

foreign person or  U.S. person?

U.S. person?