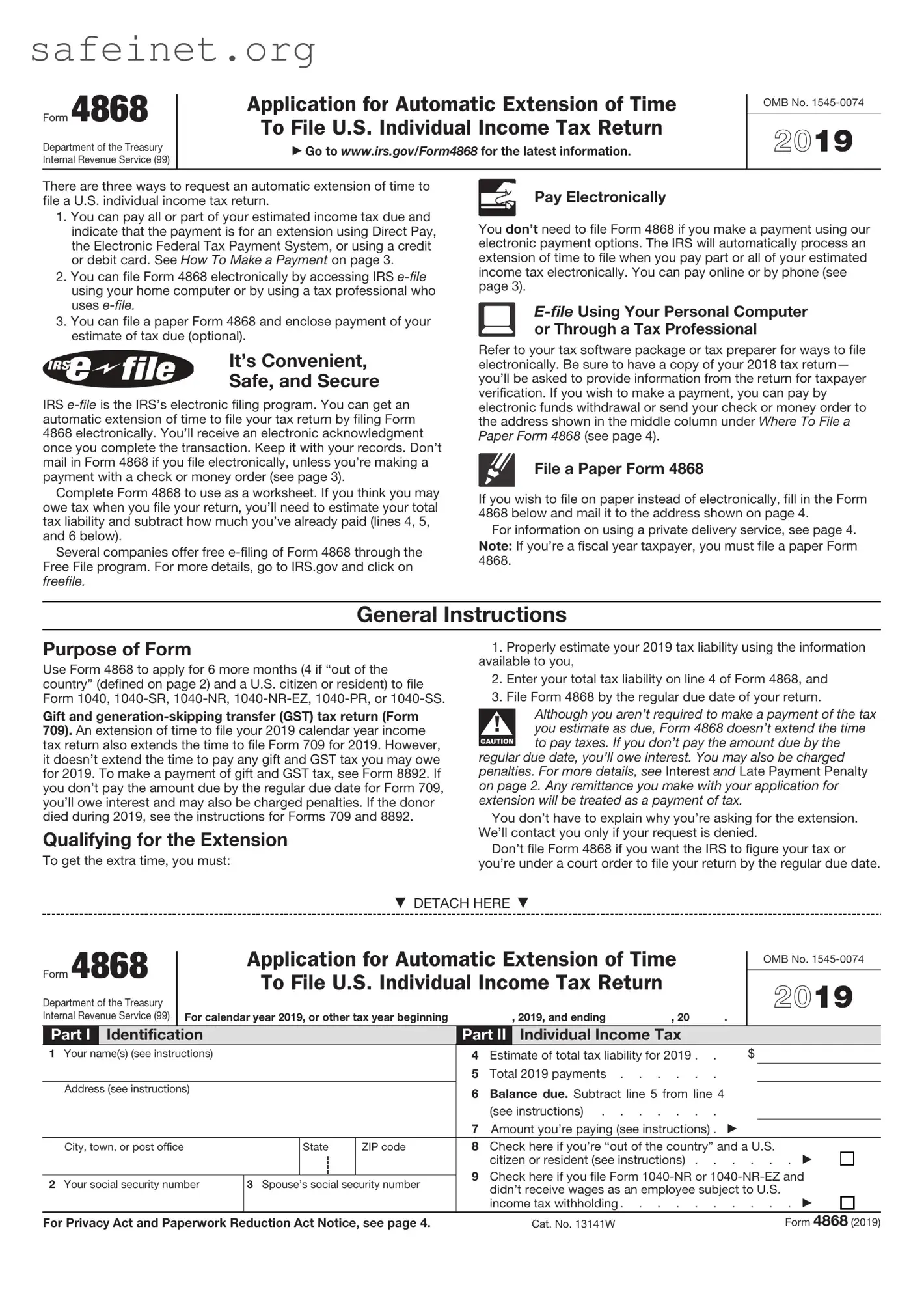

What is the IRS Form 4868?

Form 4868 is an application for automatic extension of time to file individual income tax returns. Taxpayers can use this form to request an additional six months to file their federal income tax returns. While it grants an extension to file, it does not provide an extension to pay any taxes owed.

Who can file Form 4868?

Any individual who is required to file a U.S. individual income tax return can file Form 4868. This includes U.S. citizens, resident aliens, and those who meet the income threshold. Also, it is available for those outside the U.S. and in military service.

When should Form 4868 be filed?

The form should be filed by the regular tax due date, typically April 15, unless that date falls on a weekend or holiday. In such cases, the deadline may be extended to the next business day.

How do I submit Form 4868?

Taxpayers can submit Form 4868 electronically through tax software or by mail. If filing by mail, it must be sent to the appropriate address as listed in the instructions specific to the taxpayer's state of residence.

Is there a fee to file Form 4868?

No, there is no fee for filing Form 4868. However, if you owe taxes, you should pay any estimated tax due to avoid penalties and interest.

What happens if I don’t file Form 4868?

If you do not file for an extension, your tax return will be due on the regular deadline. Failure to file on time could result in penalties and interest on any unpaid taxes. Filing Form 4868 can help avoid these issues.

Do I need to provide a reason for filing Form 4868?

No reason is required when submitting Form 4868. The IRS allows taxpayers to request an extension for any reason, making it a straightforward process.

Will Form 4868 extend the time to pay taxes owed?

No, Form 4868 does not extend the time to pay any taxes that are owed. Taxpayers must still pay their estimated tax liability by the original due date to avoid penalties.

What if I am unable to pay my taxes by the deadline?

If a taxpayer is unable to pay the full tax due, they should still file Form 4868 to request an extension. They can also explore IRS payment plans or alternative options to assist with their tax obligations.

How will I know if my Form 4868 has been processed?

For electronic submissions, taxpayers will typically receive confirmation from their tax software. If Form 4868 is mailed, it does not receive automatic acknowledgment by the IRS. It’s advisable to keep a copy of the submitted form for your records.