What is the IRS Form 2210?

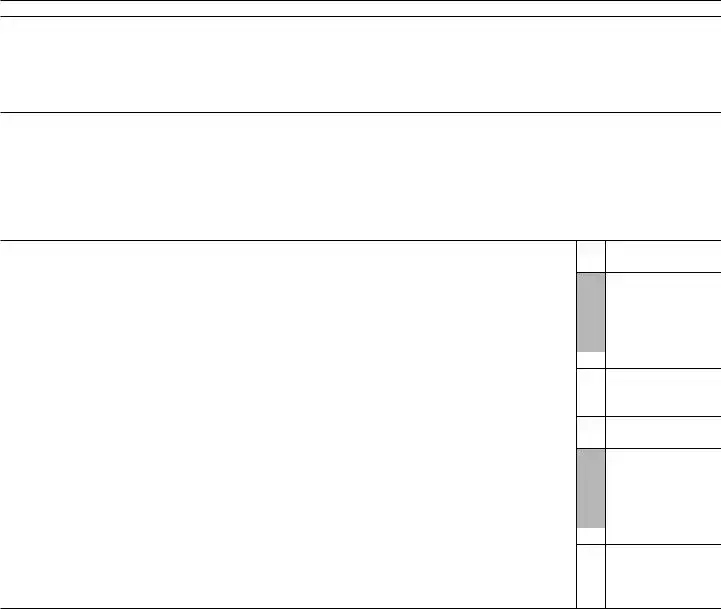

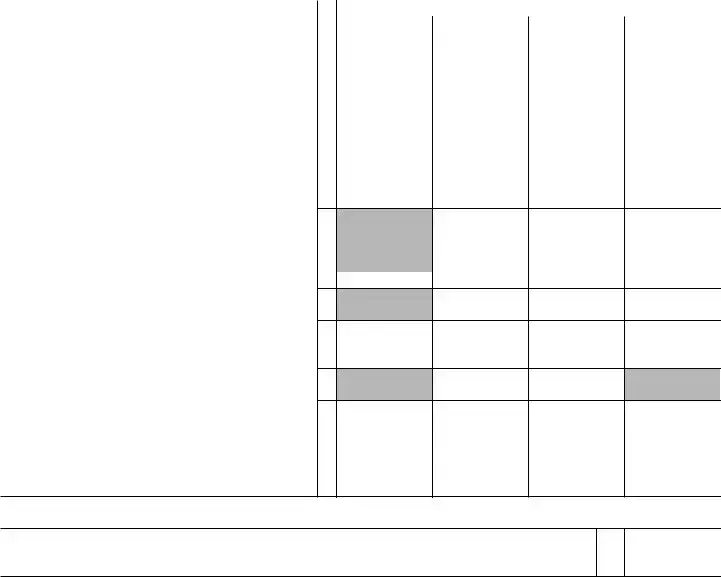

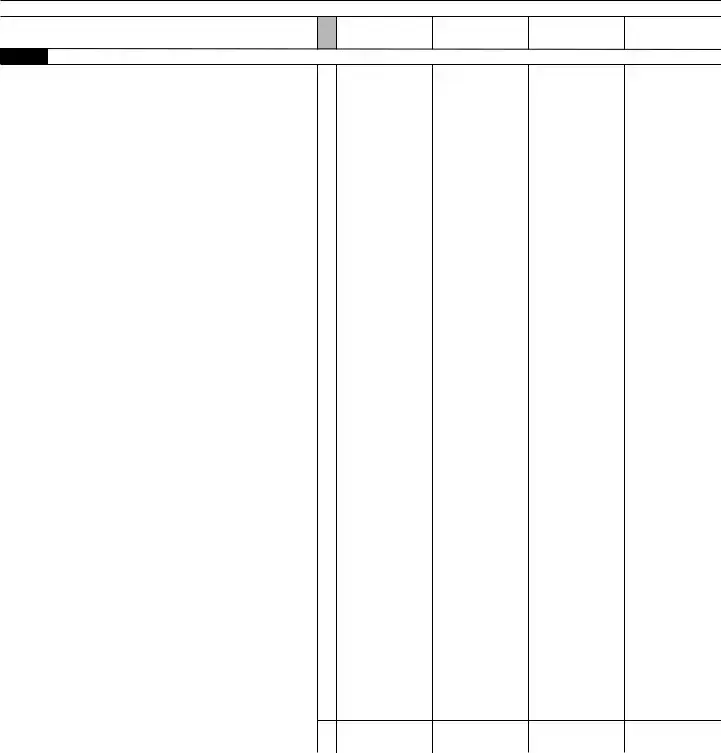

The IRS Form 2210 is used to determine if you owe a penalty for underpaying your estimated tax. This form helps taxpayers calculate whether they have met the required annual payment of tax, which can help avoid unnecessary penalties when tax time arrives.

Who should file Form 2210?

If you find that you owe a penalty when you file your tax return, or if you did not pay enough tax during the year, you should consider filing Form 2210. It's particularly relevant for self-employed individuals, people with income from other sources, or those who had a significant change in income.

What are the common reasons for underpayment of tax?

There are several reasons one might underpay their taxes. This can happen due to a change in income, such as receiving a bonus or starting a new job where taxes are not withheld properly. Additionally, capital gains from investments or other sources of income can contribute to underpayment if not properly estimated and paid during the year.

How do I calculate my tax liability using Form 2210?

To calculate your tax liability, you will need to go through several steps. First, determine your total income for the year and subtract any adjustments to arrive at your taxable income. Then, apply the appropriate tax rates to calculate your overall tax liability. Finally, compare that amount to what you've already paid through withholding and estimated payments to see if you qualify for any penalties.

What are the penalties for underpayment?

The penalty for underpayment is typically calculated based on the amount of tax you owe and the length of time your payment was late. The IRS can charge interest on the unpaid amount and assess a penalty, which varies depending on how long you waited to pay. It’s essential to address these issues as soon as they are identified.

Can I avoid penalties by filing Form 2210?

Filing Form 2210 can help determine if you owe a penalty and, if so, you may qualify for an exception or a waiver. There are safe harbors where you can avoid penalties if you meet certain thresholds of payment, increasing your chances of reducing or eliminating additional costs.

Where do I send Form 2210?

The address to send Form 2210 will depend on whether you are enclosing a payment or not. If you are sending a payment, you can typically send it to the address listed on the form itself. If you are just filing the form without a payment, it may go to a different location based on your state of residence. Always check the latest IRS instructions for the most accurate information.

Can I amend Form 2210 once submitted?

Yes, if you find errors after you've submitted Form 2210, you can amend it. You would typically do this by filling out a new Form 2210 to correct any mistakes. However, be aware that the IRS may take some time to process amendments, so it's advisable to submit any necessary corrections as soon as possible.

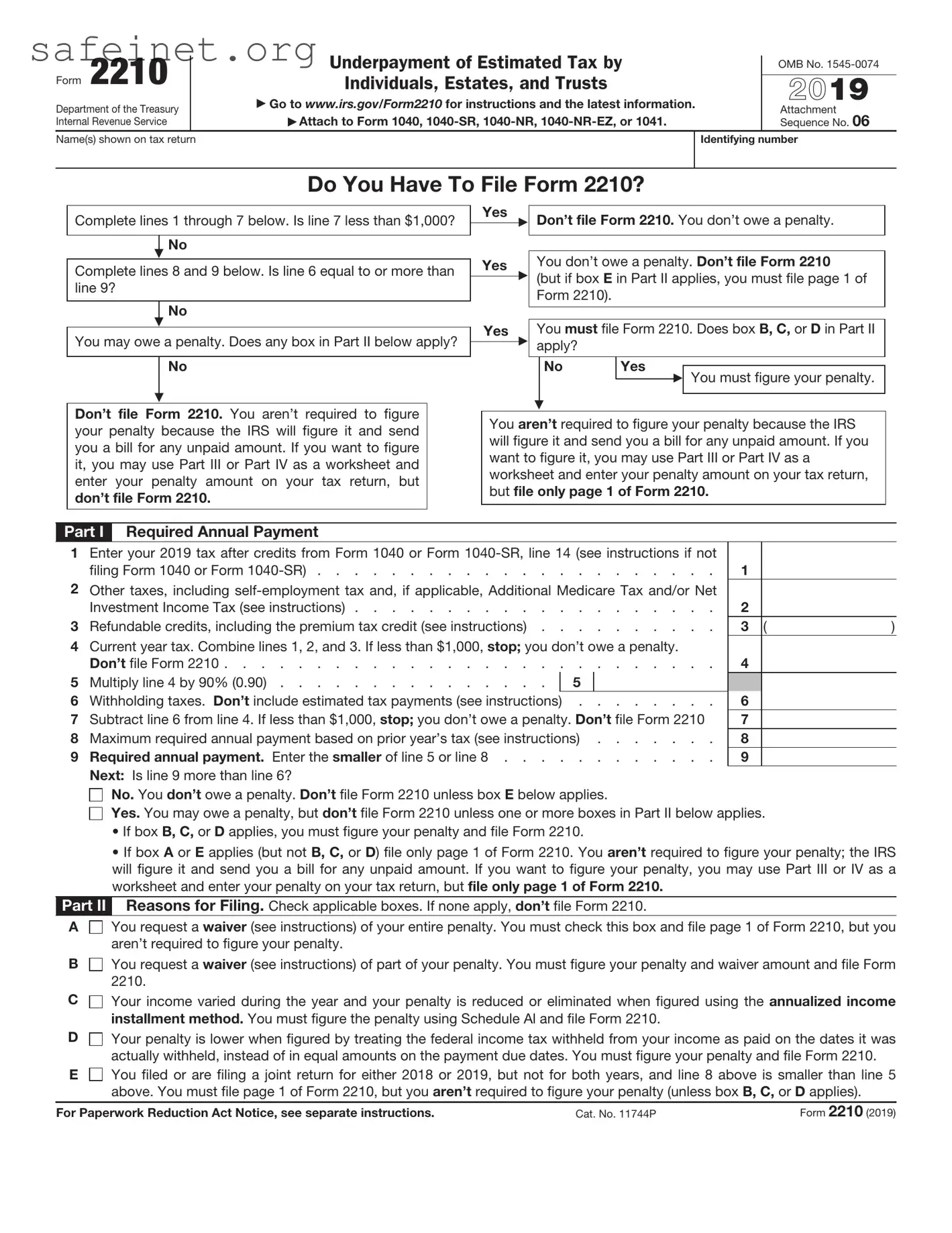

You request a

You request a

You request a

You request a

Your income varied during the year and your penalty is reduced or eliminated when figured using the

Your income varied during the year and your penalty is reduced or eliminated when figured using the

Your penalty is lower when figured by treating the federal income tax withheld from your income as paid on the dates it was actually withheld, instead of in equal amounts on the payment due dates. You must figure your penalty and file Form 2210.

Your penalty is lower when figured by treating the federal income tax withheld from your income as paid on the dates it was actually withheld, instead of in equal amounts on the payment due dates. You must figure your penalty and file Form 2210.

You filed or are filing a joint return for either 2018 or 2019, but not for both years, and line 8 above is smaller than line 5 above. You must file page 1 of Form 2210, but you

You filed or are filing a joint return for either 2018 or 2019, but not for both years, and line 8 above is smaller than line 5 above. You must file page 1 of Form 2210, but you