What is the IRS Form 2106?

The IRS Form 2106, also known as the Employee Business Expenses form, is used by employees to report expenses related to their jobs. The form helps employees claim deductions for costs incurred while performing their work duties, particularly when these expenses are not reimbursed by their employer. Common expenses that can be reported include travel, meals, and equipment costs.

Who should use Form 2106?

Form 2106 is designed for employees who incur unreimbursed expenses while carrying out job responsibilities. If you're an employee and your employer does not reimburse you for costs such as travel or supplies, this form may apply to you. However, some self-employed individuals use a different form to report business expenses.

What types of expenses can be claimed on Form 2106?

Typical expenses include vehicle costs, travel costs that are not reimbursed, business-related meals, and any other costs necessary for your job that your employer does not cover. It’s essential to keep detailed records and receipts for all claimed expenses, as these may be necessary for verification.

Are there any limitations on the expenses reported on Form 2106?

Yes, there are limitations. For instance, the Tax Cuts and Jobs Act of 2017 suspended the deduction for employee business expenses for most employees through 2025. However, specific categories, like certain performing arts professionals or members of the Armed Forces, may still qualify. Always check current IRS guidelines or consult a tax professional for the most accurate information.

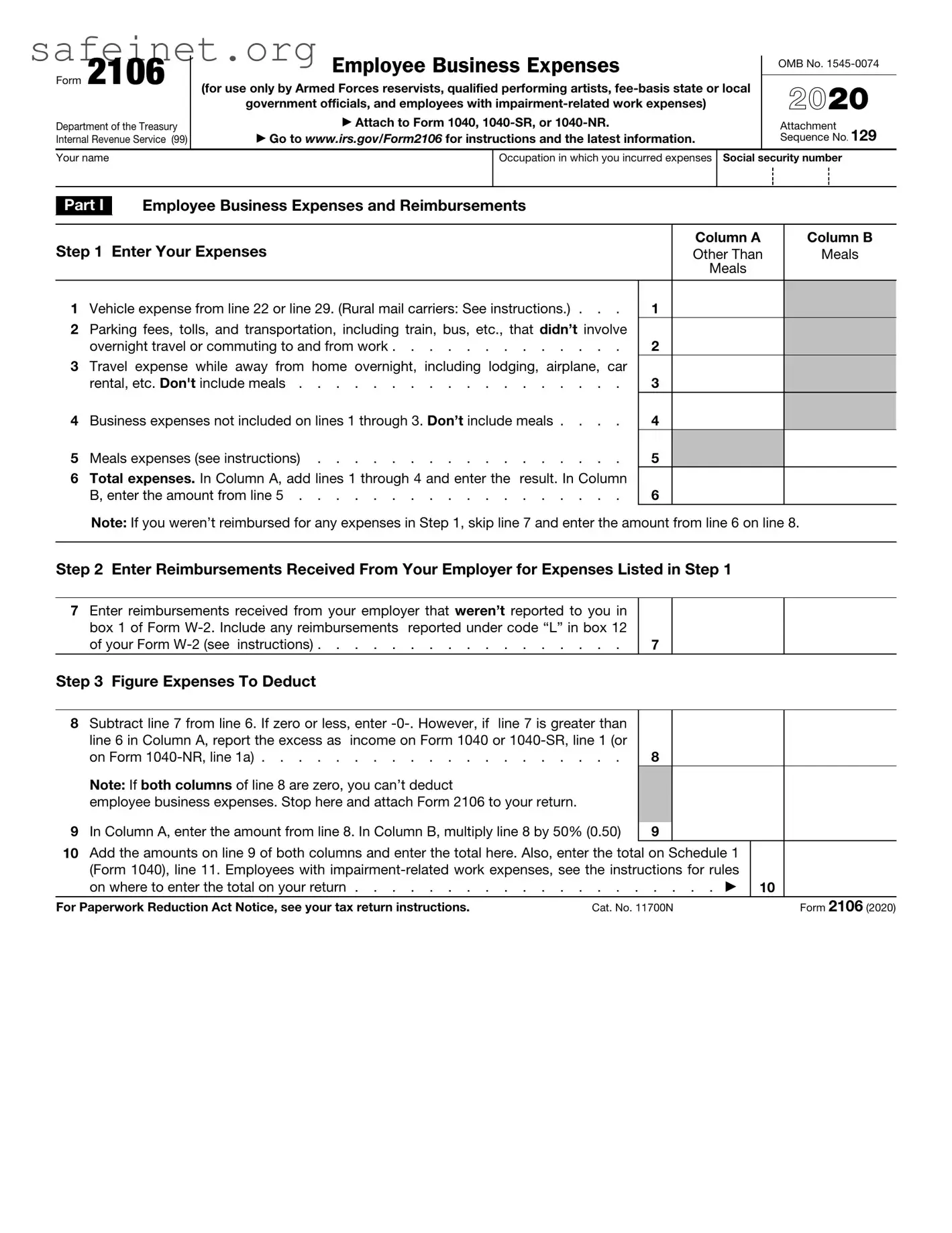

How do I fill out Form 2106?

To fill out Form 2106, start by entering personal information, including your name and social security number. Then, report your eligible business expenses in the designated categories. Accurate calculations are vital, along with adding any necessary schedules or additional paperwork that may support your claims. Review everything for accuracy before submitting.

Is Form 2106 different from Schedule C?

Yes, there is a distinction between these two forms. Form 2106 is for employees to report unreimbursed expenses, while Schedule C is used by self-employed individuals to report income and deductions. Self-employed individuals typically report all expenses on Schedule C rather than using Form 2106.

When is the deadline for submitting Form 2106?

The deadline for submitting Form 2106 generally coincides with the tax filing deadline, which is usually April 15. If you need more time, you can file for an extension, but it’s essential to submit the form by the extended deadline to avoid penalties. Always verify the specific date of the tax deadline each year, as it can occasionally change.