Page 2

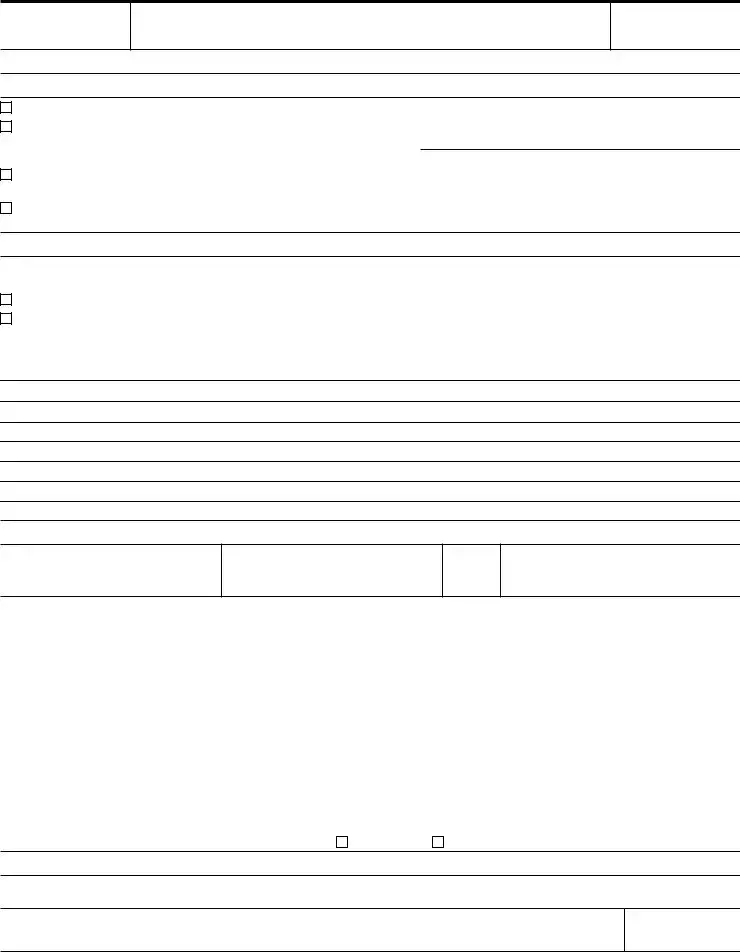

Section E – Representative, Conservator, Parent or Guardian Information (Required if completing Form 14039 on someone else’s behalf)

Check only ONE of the following five boxes next to the reason you are submitting this form

1. The taxpayer is deceased and I am the surviving spouse

• No attachments are required, including death certificate.

2. The taxpayer is deceased and I am the court-appointed or certified personal representative

• Attach a copy of the court certificate showing your appointment.

3. The taxpayer is deceased and a court-appointed or certified personal representative has not been appointed

• |

Attach copy of death certificate or formal notification from a government office informing next of kin of the decedent’s death. |

• |

Indicate your relationship to decedent: |

Child |

Parent/Legal Guardian |

Other |

4. The taxpayer is unable to complete this form and I am the appointed conservator or have Power of Attorney/Declaration of Representative authorization per IRS Form 2848

•Attach a copy of documentation showing your appointment as conservator or POA authorization.

•If you have an IRS issued Centralized Authorization File (CAF) number, enter the nine-digit number:

5. The person is my dependent child or my dependent relative

By checking this box and signing below you are indicating that you are an authorized representative, as parent, guardian or legal guardian, to file a legal document on the dependent’s behalf.

• Indicate your relationship to person: |

Parent/Legal Guardian |

Fiduciary Relationship per IRS Form 56 |

|

Power of Attorney |

Other |

Representative's name |

|

|

|

|

Last name |

|

First name |

|

Middle initial |

|

|

|

|

|

|

Representative’s current mailing address (City, town or post |

office, state, and ZIP code) |

|

|

|

|

|

|

|

Representative’s telephone number |

|

|

|

|

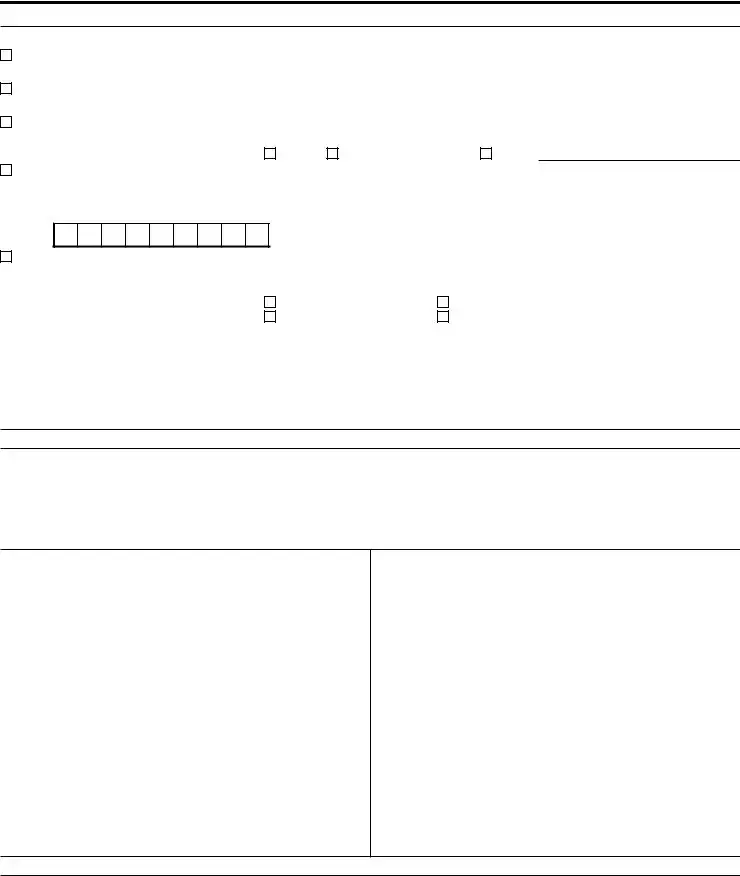

Instructions for Submitting this Form

Submit this completed and signed form to the IRS via Mail or FAX to specialized IRS processing areas dedicated to assist you. In Section C of this form, be sure to include the Social Security Number in the ‘Taxpayer Identification Number’ field.

Help us avoid delays:

•Choose one method of submitting this form either by Mail or by FAX, not both.

•Please provide clear and readable photocopies of any additional information you may choose to provide.

•Note that ‘tax returns’ may not be submitted to either the mailing address or FAX number.

|

Submitting by Mail |

|

Submitting by FAX |

• |

If you checked Box 1 in Section B in response to a notice or |

• |

If you checked Box 1 in Section B of Form 14039 and are |

|

letter received from the IRS, return this form and if possible, a |

|

submitting this form in response to a notice or letter received |

|

copy of the notice or letter to the address contained in the |

|

from the IRS. If it provides a FAX number, you should send |

|

notice or letter. |

|

there. |

• |

If you checked Box 1 in Section B of Form 14039, are unable |

|

If no FAX number is shown on the notice or letter, please follow |

|

to file your tax return electronically because the primary and/ |

|

the mailing instructions on the notice or letter. |

|

or secondary SSN was misused, attach this Form 14039 to the |

• |

Include a cover sheet marked ‘Confidential’. |

|

back of your paper tax return and submit to the IRS location |

• |

If you checked Box 2 in Section B of Form 14039 (no current |

|

where you normally file your tax return. |

• |

If you’ve already filed your paper return, please submit this |

|

tax-related issue), FAX this form toll-free to: |

|

855-807-5720 |

|

Form 14039 to the IRS location where you normally file. Refer to |

|

|

the ‘Where Do You File’ section of your return instructions or visit |

|

|

|

IRS.gov and input the search term ‘Where to File’. |

|

|

•If you checked Box 2 in Section B of Form 14039 (no current tax-related issue), mail this form to:

Department of the Treasury

Internal Revenue Service

Fresno, CA 93888-0025

Privacy Act and Paperwork Reduction Notice

Our legal authority to request the information is 26 U.S.C. 6001. The primary purpose of the form is to provide a method of reporting identity theft issues to the IRS so that the IRS may document situations where individuals are or may be victims of identity theft. Additional purposes include the use in the determination of proper tax liability and to relieve taxpayer burden. The information may be disclosed only as provided by 26 U.S.C. 6103. Providing the information on this form is voluntary. However, if you do not provide the information it may be more difficult to assist you in resolving your identity theft issue. If you are a potential victim of identity theft and do not provide the required substantiation information, we may not be able to place a marker on your account to assist with future protection. If you are a victim of identity theft and do not provide the required information, it may be difficult for IRS to determine your correct tax liability. If you intentionally provide false information, you may be subject to criminal penalties. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103. Public reporting burden for this collection of information is estimated to average 15 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Do not send this form to this address. Instead, see the form for filing instructions. Notwithstanding any other provision of the law, no person is required to respond to, nor shall any person be subject to a penalty for failure to comply with, a collection of information subject to the requirements of the Paperwork Reduction Act, unless that collection of information displays a currently valid OMB Control Number.