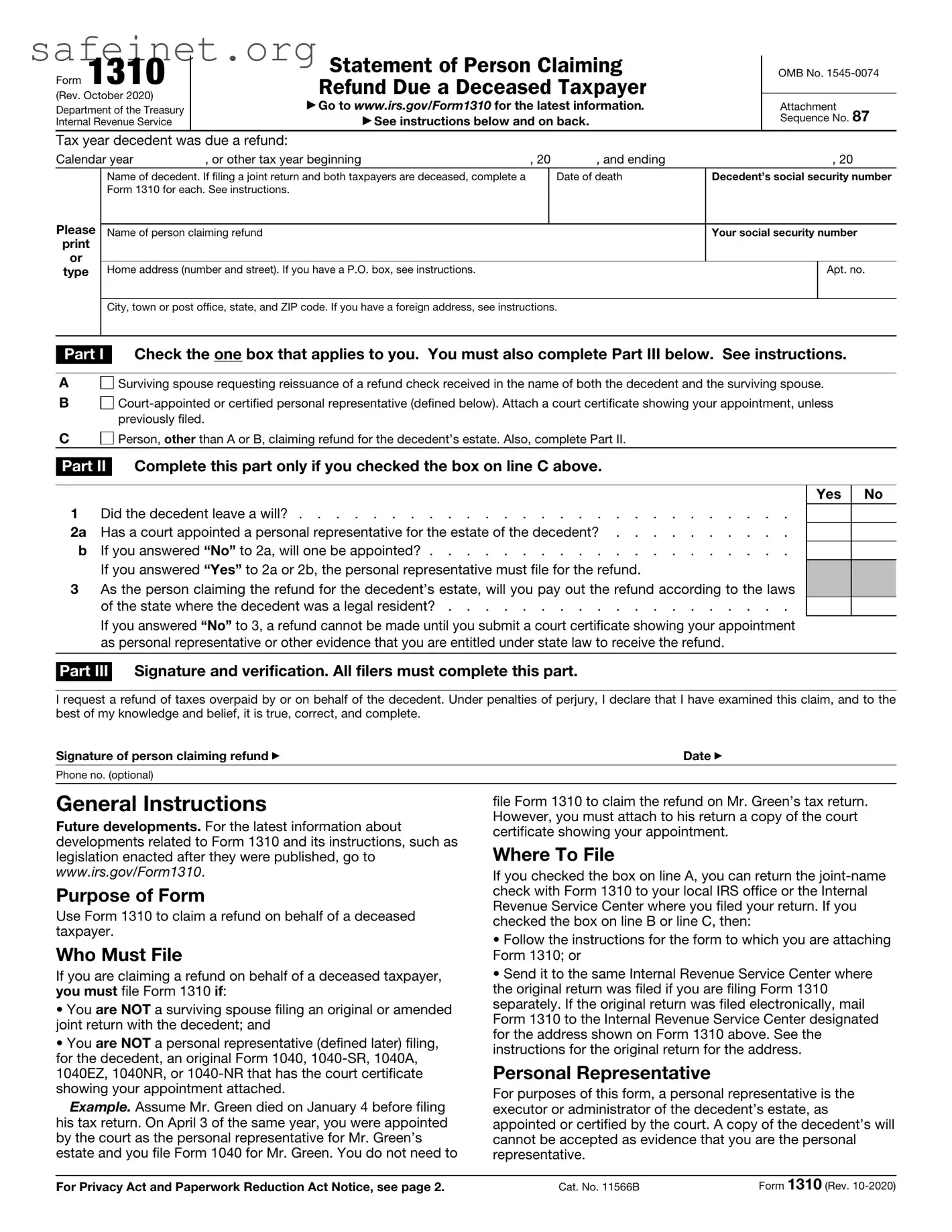

What is the IRS 1310 form?

The IRS 1310 form is used to claim a refund on behalf of a deceased taxpayer. This form allows survivors, such as heirs or personal representatives, to receive any tax refunds that the deceased individual was owed at the time of their passing. Completing this form is essential for the proper processing of the refund request by the Internal Revenue Service (IRS).

Who needs to file the IRS 1310 form?

How do I complete the IRS 1310 form?

To complete the IRS 1310 form, start by providing your information as the claimant at the top. Then, fill in the taxpayer's details, including their name, Social Security number, and filing status. The form will require you to provide your relationship to the deceased and, if applicable, attach any necessary supporting documentation, such as proof of death. Lastly, sign and date the form, ensuring submission with the appropriate tax return or as a standalone document.

Where do I send the completed IRS 1310 form?

The completed IRS 1310 form should be sent to the address specified for the IRS service center handling the deceased taxpayer's final tax return. If filing a return along with the form, include both documents in the same envelope. Double-check the IRS website or instructions for the specific mailing address, as it can vary depending on the type of return filed and your location.

Is there a deadline for filing the IRS 1310 form?

Yes, there is a deadline for filing the IRS 1310 form. It must be submitted along with the final tax return or within two years following the date of the taxpayer’s death. If you miss this deadline, you may lose the opportunity to claim the refund, so timely action is crucial.

What supporting documentation is required with the IRS 1310 form?

Supporting documentation typically includes a copy of the death certificate, the taxpayer's final tax return, and proof of your relationship to the deceased. If you are an executor or administrator, you may need to provide additional legal documents that demonstrate your authority to act on behalf of the deceased.

Can I file the IRS 1310 form electronically?

Currently, the IRS 1310 form cannot be filed electronically. It must be printed, completed, and mailed to the IRS. Always check the IRS website for the most current filing procedures as they occasionally implement new electronic filing options.

Person,

Person,