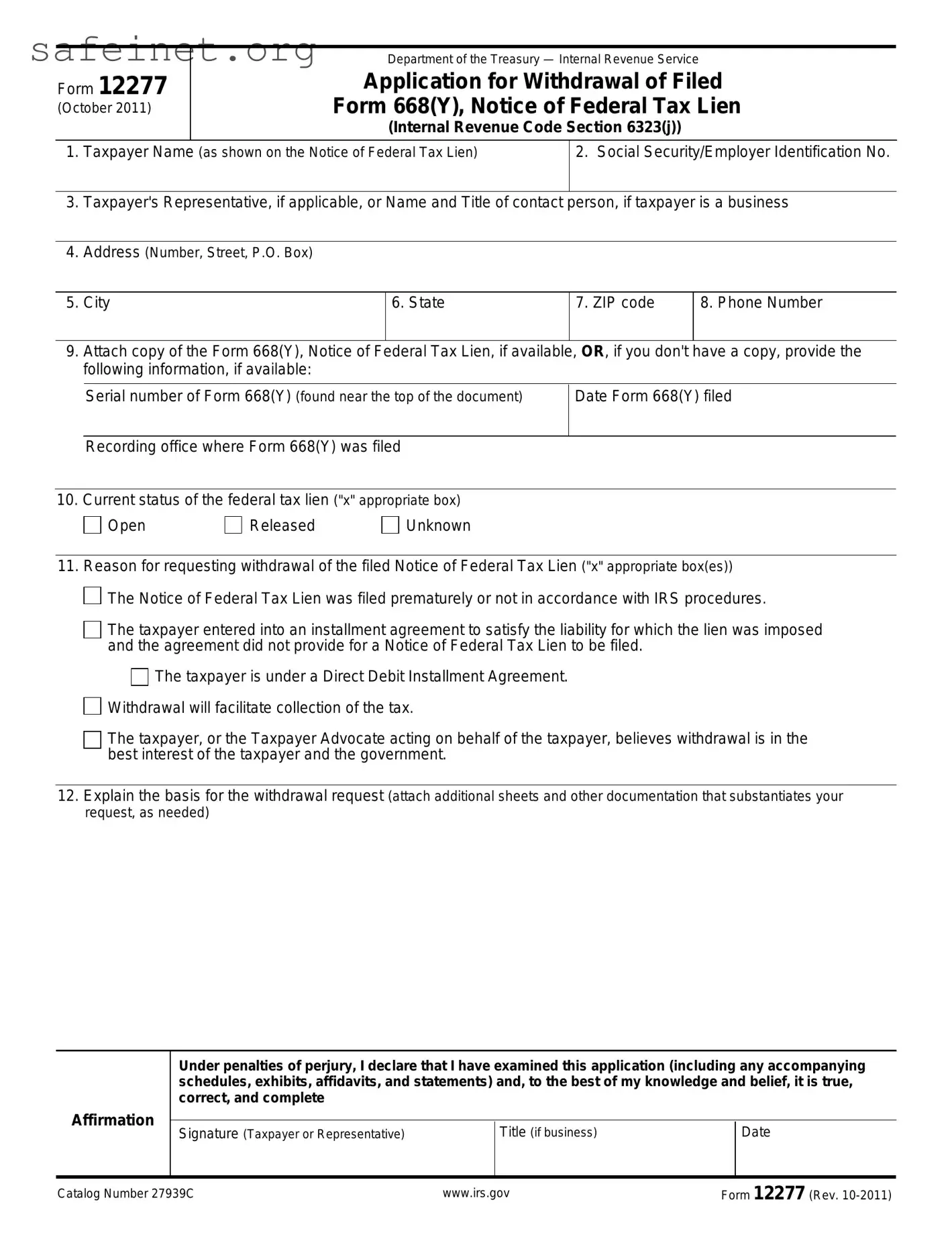

The IRS Form 12277, which is used to request the withdrawal of a federal tax lien, shares similarities with Form 4506, the Request for Copy of Tax Return. Both documents require taxpayers to provide personal information and details about the tax situation. They facilitate communication with the IRS and help taxpayers manage their records. While Form 4506 is focused on obtaining copies of past returns, Form 12277 directly addresses the removal of liens that may impact credit and financial dealings.

Another document similar to Form 12277 is Form 1040, the individual income tax return. Like Form 12277, the 1040 is a crucial tool in managing tax obligations. Both forms require accurate personal information and detailed financial data. The 1040 reflects an individual's tax liability, while Form 12277 addresses the legal status of unpaid tax debt, with an aim to rectify credit issues stemming from tax liens.

Form 941, the Employer's Quarterly Federal Tax Return, also relates to Form 12277 in certain ways. Both forms involve the IRS and tax reporting but cater to different audiences—individual taxpayers for the 12277 and employers for the 941. Completing both forms often requires meticulous calculation and disclosure of tax-related figures, maintaining an accurate record for compliance purposes.

Similar to the IRS Form 12277, Form 4868, which is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, allows taxpayers a means of dealing with their tax obligations. The primary similarity lies in the goal of managing tax-related issues; however, Form 4868 extends the deadline for filing a return, whereas Form 12277 directly seeks to address liens that may have already been imposed.

Additionally, Form 843, the Claim for Refund and Request for Abatement, offers another parallel. This document allows taxpayers to request a refund or abatement of certain taxes, penalties, or interest. Like Form 12277, it demands specific details concerning the taxpayer's situation and serves to mitigate tax burdens, albeit through different methods.

Form 2848, the Power of Attorney and Declaration of Representative, also shares similarities with Form 12277. Both forms serve as means of communication and authority in dealings with the IRS. While Form 2848 allows taxpayers to grant representatives the ability to act on their behalf, Form 12277 empowers individuals to take steps toward resolving tax liens specifically.

Form 9465, the Installment Agreement Request, complements the intentions of Form 12277 well. Taxpayers experiencing difficulty with tax debts can use Form 9465 to propose a payment plan. Like Form 12277, it addresses financial hardship and aims for resolution with the IRS, although it takes a different approach by allowing for gradual payment.

Form 13768, the Request for a Certificate of Release of Federal Tax Lien, directly aligns with the objectives of Form 12277. Both forms deal with lien-related issues, but while Form 12277 seeks to withdraw a lien, Form 13768 is used to confirm that a lien has been fully released. This makes it a critical step for taxpayers looking to clear their financial records.

Finally, Form 1099, especially the 1099-MISC, can resonate with the subject of Form 12277. While the 1099 series primarily serves to report income received throughout the year, it also represents aspects of financial responsibility and record-keeping. It's important for tax compliance, much like how Form 12277 aims to correct tax liabilities that can adversely affect one’s financial standing.

The Notice of Federal Tax Lien was filed prematurely or not in accordance with IRS procedures.

The Notice of Federal Tax Lien was filed prematurely or not in accordance with IRS procedures.

The taxpayer, or the Taxpayer Advocate acting on behalf of the taxpayer, believes withdrawal is in the best interest of the taxpayer and the government.

The taxpayer, or the Taxpayer Advocate acting on behalf of the taxpayer, believes withdrawal is in the best interest of the taxpayer and the government.