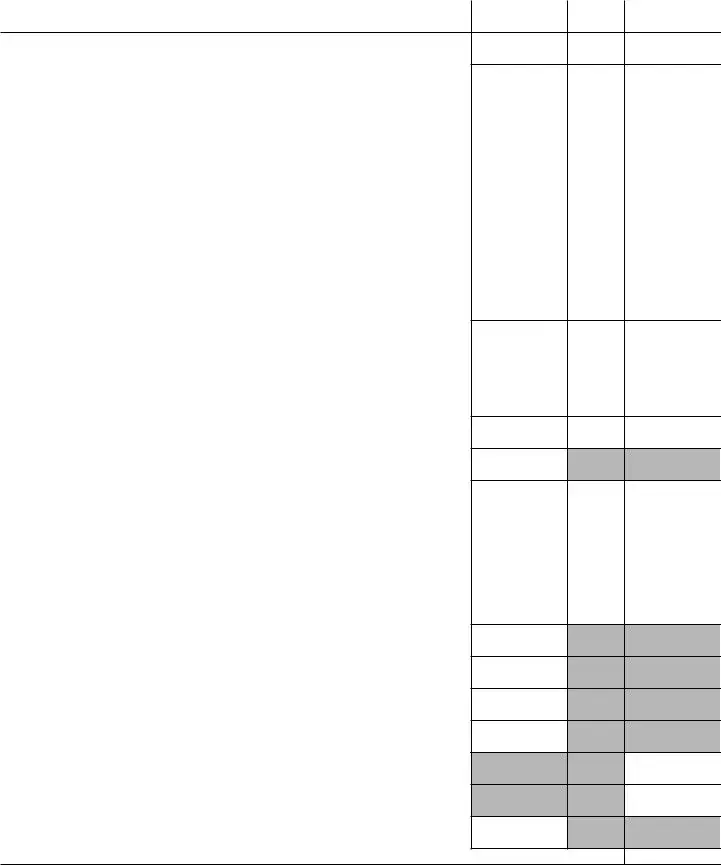

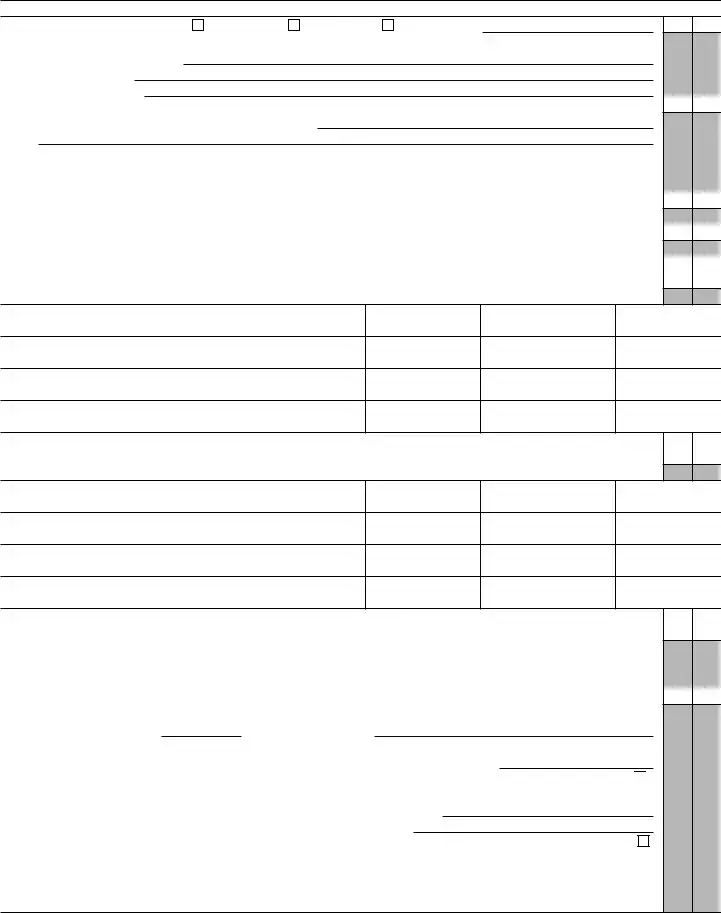

13Are the corporation’s total receipts (page 1, line 1a, plus lines 4 through 10) for the tax year and its total assets at the end of the

tax year less than $250,000? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

|

If “Yes,” the corporation is not required to complete Schedules L, M-1, and M-2. Instead, enter the total amount of cash |

|

distributions and the book value of property distributions (other than cash) made during the tax year |

$ |

14 |

Is the corporation required to file Schedule UTP (Form 1120), Uncertain Tax Position Statement? See instructions . . . . |

|

If “Yes,” complete and attach Schedule UTP. |

|

15a |

Did the corporation make any payments in 2019 that would require it to file Form(s) 1099? |

b |

If “Yes,” did or will the corporation file required Form(s) 1099? |

16During this tax year, did the corporation have an 80%-or-more change in ownership, including a change due to redemption of its

own stock? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17During or subsequent to this tax year, but before the filing of this return, did the corporation dispose of more than 65% (by value)

of its assets in a taxable, non-taxable, or tax deferred transaction? . . . . . . . . . . . . . . . . . .

18Did the corporation receive assets in a section 351 transfer in which any of the transferred assets had a fair market basis or fair

market value of more than $1 million? . . . . . . . . . . . . . . . . . . . . . . . . . . .

19During the corporation’s tax year, did the corporation make any payments that would require it to file Forms 1042 and 1042-S under chapter 3 (sections 1441 through 1464) or chapter 4 (sections 1471 through 1474) of the Code? . . . . . . . .

20 Is the corporation operating on a cooperative basis?. . . . . . . . . . . . . . . . . . . . . . .

21During the tax year, did the corporation pay or accrue any interest or royalty for which the deduction is not allowed under section

267A? See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If “Yes,” enter the total amount of the disallowed deductions |

$ |

22Does the corporation have gross receipts of at least $500 million in any of the 3 preceding tax years? (See sections 59A(e)(2)

and (3)) . |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

If “Yes,” complete and attach Form 8991.

23Did the corporation have an election under section 163(j) for any real property trade or business or any farming business in effect

|

during the tax year? See instructions |

24 |

Does the corporation satisfy one or more of the following? See instructions |

aThe corporation owns a pass-through entity with current, or prior year carryover, excess business interest expense.

bThe corporation’s aggregate average annual gross receipts (determined under section 448(c)) for the 3 tax years preceding the current tax year are more than $26 million and the corporation has business interest expense.

cThe corporation is a tax shelter and the corporation has business interest expense. If “Yes,” to any, complete and attach Form 8990.

25 |

Is the corporation attaching Form 8996 to certify as a Qualified Opportunity Fund? |

|

If “Yes,” enter amount from Form 8996, line 14 . . . . |

$ |

If checked, the corporation may have to file

If checked, the corporation may have to file