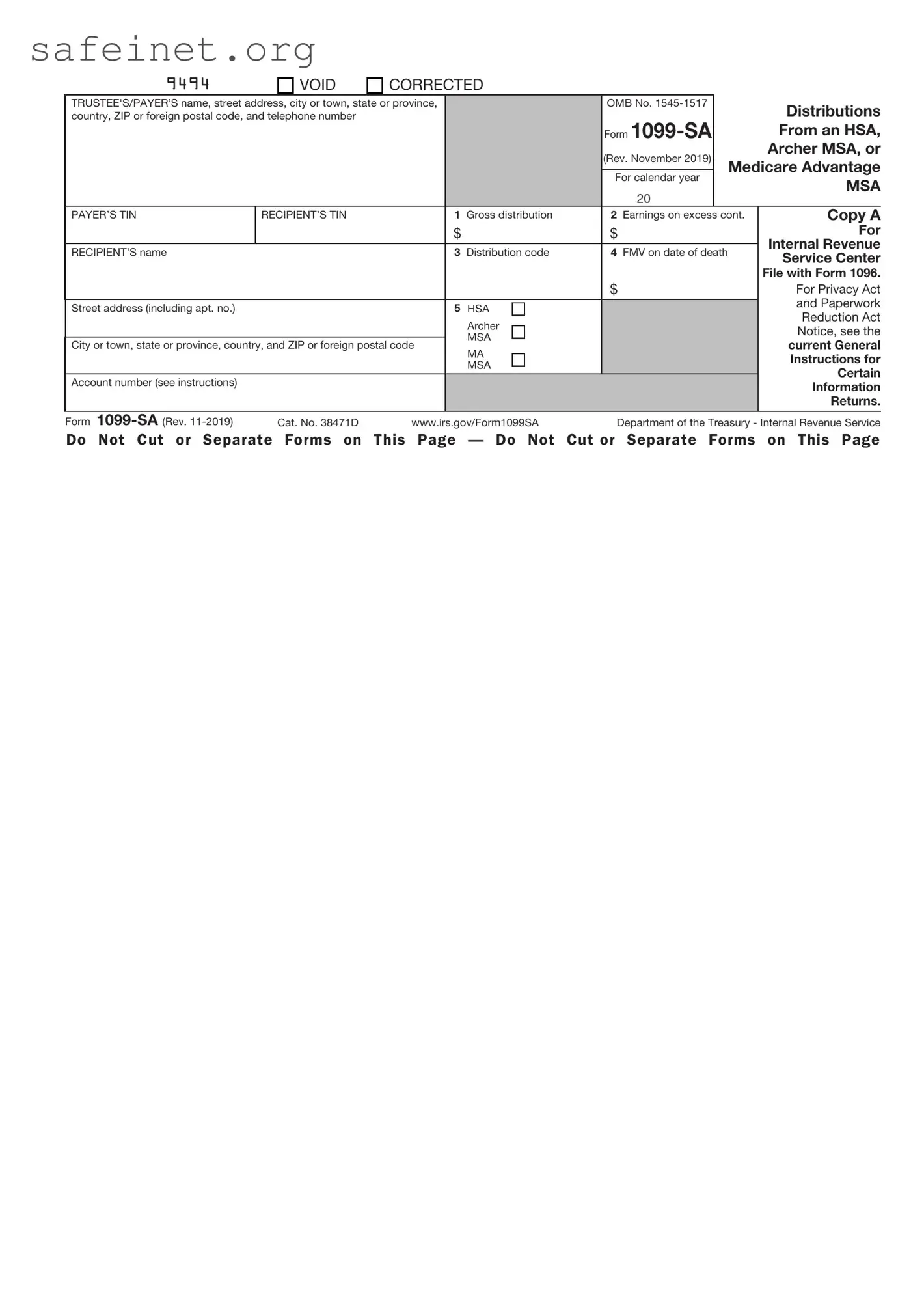

What is the IRS 1099-SA form?

The IRS 1099-SA form is a tax document used to report distributions made from Health Savings Accounts (HSAs), Archer Medical Savings Accounts (MSAs), or Medicare Advantage MSAs. If you have withdrawn funds from one of these accounts in a given tax year, the form provides necessary information for both you and the IRS regarding the amount and purpose of the distributions.

Who receives the 1099-SA form?

If you have taken a distribution from your HSA, Archer MSA, or Medicare Advantage MSA, your account custodian will provide you with the 1099-SA form. The custodian is responsible for completing this form and sending it to you and the IRS by January 31 of the year following the tax year in which distributions occurred.

What information is included on the 1099-SA?

The form contains several key pieces of information. This includes your name, address, and taxpayer identification number, along with the name and address of the account custodian. Most importantly, it reports the total distributions made from your account during the tax year. Additionally, the form specifies the types of distributions received—qualified medical expenses, non-qualified distributions, etc.—which is crucial for your tax reporting.

Do I need to report the amounts shown on a 1099-SA?

Yes, you must report the amounts from the 1099-SA when filing your federal tax return. This document helps determine your taxable income and any potential tax liabilities. If your distributions were used for qualified medical expenses, they may not be taxable. However, distributions used for non-qualified purposes typically are. Consult IRS guidelines to understand how these amounts may affect your tax obligations.

What happens if I don’t receive a 1099-SA?

If you believe you should have received a 1099-SA, but it hasn't arrived, reach out to your account custodian. It's possible they may have sent it to an incorrect address, or perhaps a mistake was made in reporting your distributions. Even if you do not receive it, you still have the responsibility to report any distributions used for tax purposes.

Can I correct an error on my 1099-SA?

If you notice an error on your 1099-SA form, you should contact the custodian of your account as soon as possible. They can issue a corrected form, known as a 1099-SA with corrections, which you will then need to use for accurate tax reporting. It is important to resolve these errors before you file your tax return to avoid complications with the IRS.

What are the penalties for reporting incorrect information from a 1099-SA?

Incorrectly reporting distributions from your 1099-SA can lead to various penalties, including additional taxes owed or fines from the IRS. If the IRS discovers discrepancies, they may impose penalties for failure to accurately report income or for improper withdrawals. Consulting with a tax professional can help clarify your situation and minimize potential penalties.

Are there any tax implications if I use HSA funds for non-medical expenses?

Using HSA funds for non-medical expenses typically incurs penalties and taxes. Specifically, non-qualified distributions are subject to income tax and, if taken before age 65, a 20% penalty. After you turn 65, while you will still owe income tax on non-qualified distributions, the penalty will not apply. Awareness of these implications is crucial for managing your HSA effectively.

How do I obtain a copy of my 1099-SA?

Your account custodian is responsible for providing you with a copy of your 1099-SA. If you need a duplicate, you can request it directly from them. Some custodians may also offer the ability to access your forms electronically through their online platforms, giving you easier access to your financial documents.

What is the deadline for the 1099-SA form to be issued?

The deadline for custodians to provide the 1099-SA form to account holders is usually January 31st of the year following the tax year in which the distributions were made. This timeline ensures you have sufficient time to review the information and report it accurately on your tax return before the tax filing deadline.