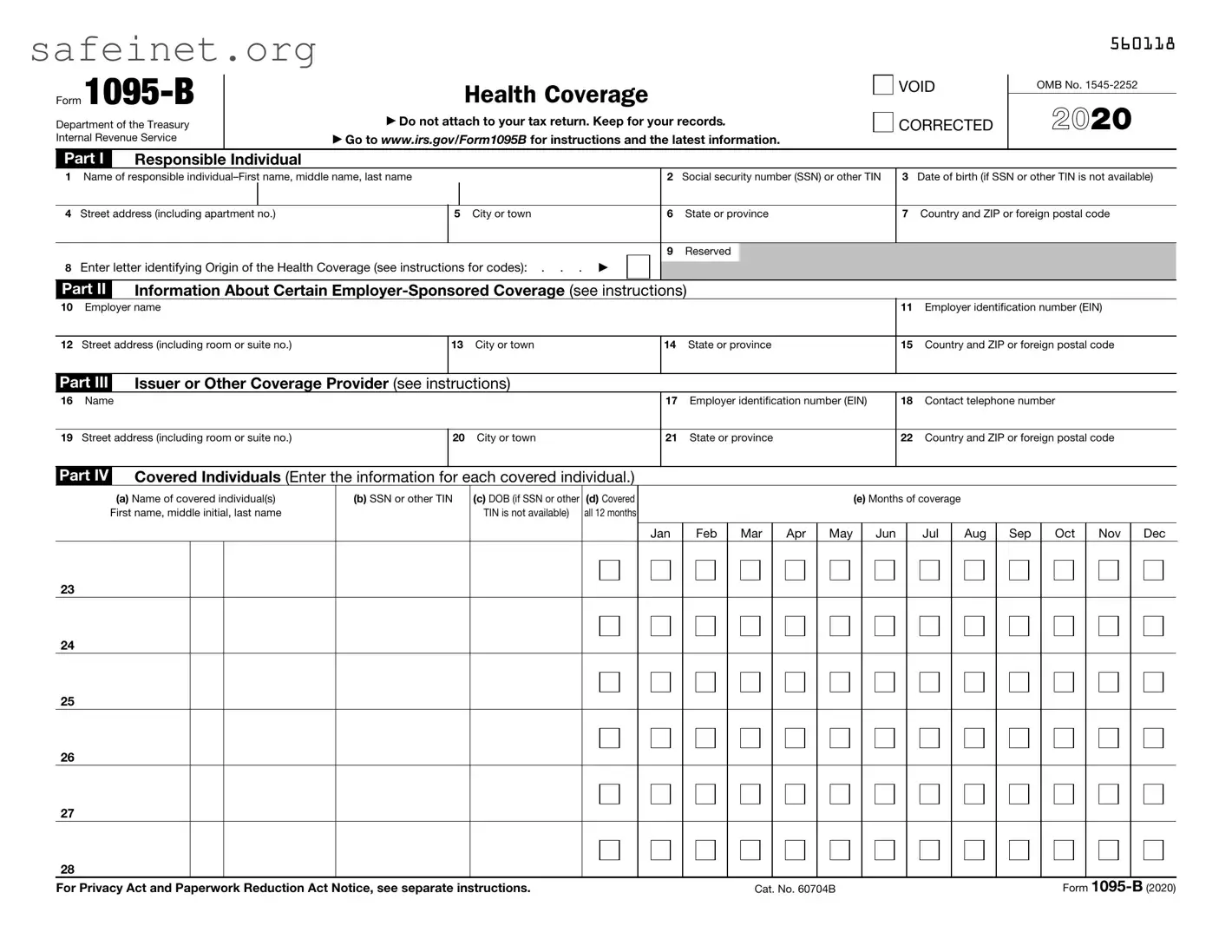

What is the IRS 1095-B form?

The IRS 1095-B form is a tax document used to report information about individuals who are covered by minimum essential health coverage. It is issued by health insurance providers and offers details on the coverage type and the months during which coverage was available to the individual.

Who receives the 1095-B form?

Individuals who have health coverage through providers such as insurance companies, self-insured employers, or government programs like Medicaid will receive the 1095-B form. If you were covered for any month during the year, you should expect to receive this form.

Why is the 1095-B form important?

The 1095-B form provides proof of health coverage, which is necessary for complying with the Affordable Care Act. While the individual mandate penalty was reduced to $0 at the federal level, some states have their own health insurance requirements that mandate proof of coverage.

How do I use the information on the 1095-B form?

The information on the 1095-B form serves as documentation for your tax return. You do not need to submit it with your tax return, but you should keep it for your records. It can help confirm your health coverage status for the tax year in question.

What happens if I do not receive my 1095-B form?

If you do not receive your 1095-B form and believe you should have, you should contact your health insurance provider. They can provide you with a copy or confirm your coverage status. It is important to ensure that you have this information available for your taxes.

Can I access the 1095-B form online?

Many insurance providers offer online access to tax documents, including the 1095-B form. Check your provider’s website or contact customer service to inquire about how to obtain your form electronically.

Is the information on the 1095-B form the same as the 1095-A form?

No, the information on the 1095-B form is not the same as the 1095-A form. The 1095-A form is issued to individuals who purchase health insurance through the Health Insurance Marketplace, while the 1095-B form pertains to other forms of health coverage.

What if I find an error on my 1095-B form?

If you notice any errors on your 1095-B form, contact your health insurance provider immediately. They can issue a corrected form if necessary. It is crucial to rectify any inaccuracies before filing your taxes.

Do I need to file the 1095-B form with my tax return?

You do not need to file the 1095-B form with your tax return. However, you should keep it for your records as it serves as proof of health coverage for the tax year.