The IRS 1095-A form is related to health coverage offered through the Health Insurance Marketplace. It provides information about the coverage, including who is covered and what the premium costs are. Like the 1094-C, it helps the IRS track compliance with the Affordable Care Act. Individuals use the 1095-A when filing their taxes to reconcile premium tax credits received during the year.

The IRS 1095-B form serves as proof of minimum essential coverage. Issued by health insurers or government programs, it details who is covered under the health plan. Similar to the 1094-C, it confirms compliance with health coverage requirements mandated by the Affordable Care Act, assisting taxpayers in demonstrating that they had coverage throughout the year.

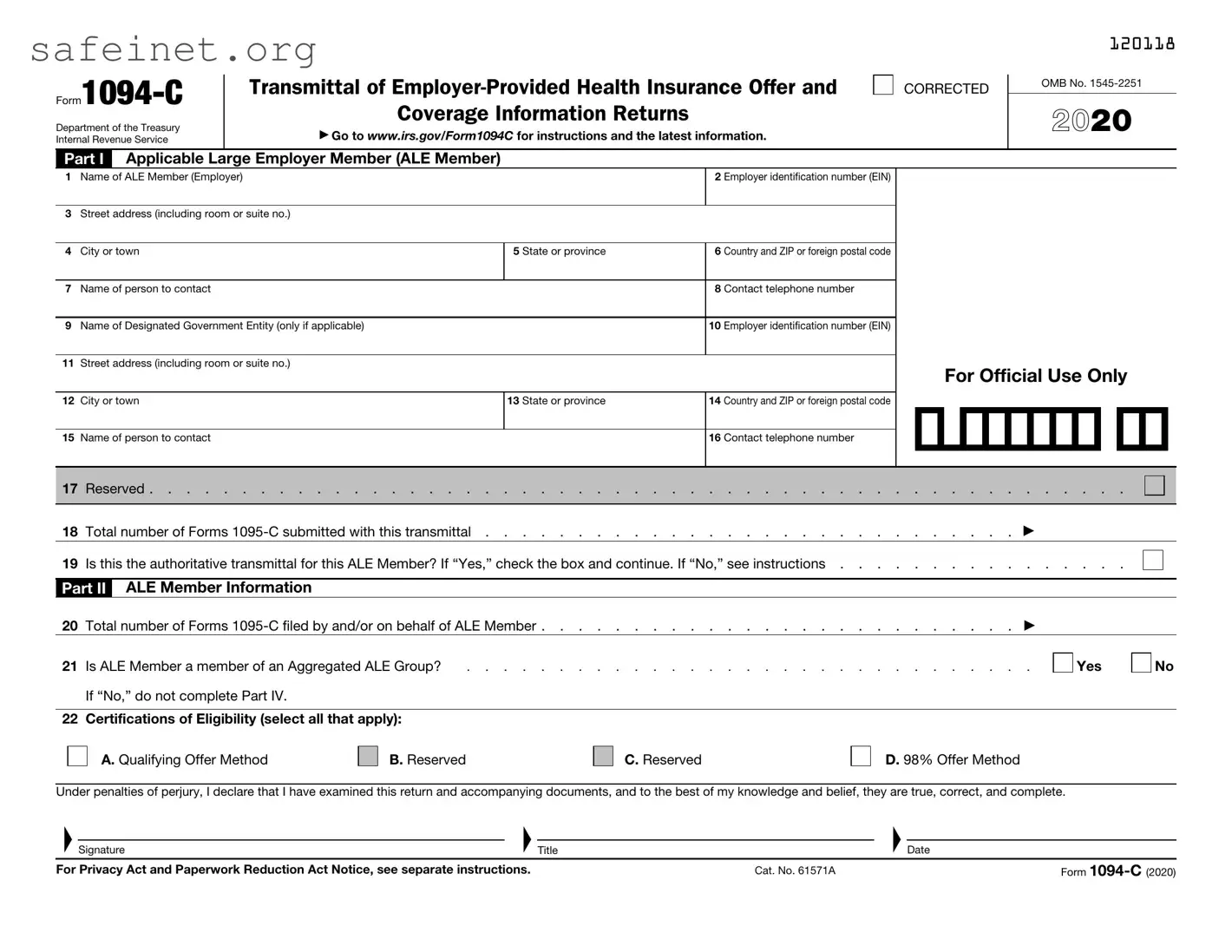

The IRS 1095-C form is closely related to 1094-C, as both are used by applicable large employers (ALEs). The 1095-C provides information about the health insurance offered to employees. It informs the IRS and employees about the coverage's affordability and minimum value. Together with the 1094-C, these forms help ensure that employers meet their obligations under the Affordable Care Act.

The IRS W-2 form reports wages and tax withheld from employees’ paychecks. While it does not focus on health coverage specifically, it is similar in that it communicates vital employment and income information to both the IRS and the employee. The W-2 assists in determining eligibility for certain tax benefits that may relate to health insurance costs, just as the 1094-C aids in reporting insurance information.

The IRS 941 form is the Employer's Quarterly Federal Tax Return. It documents employment taxes withheld from employee paychecks. Similarly to the 1094-C, the 941 highlights employer responsibilities regarding employee compensation and tax obligations. Both forms are crucial in ensuring compliance with federal regulations, although they focus on different aspects of employment and associated benefits.

The Form 990 is a public document that tax-exempt organizations, including charities and non-profits, file with the IRS. It includes financial information about the organization’s operations, including employee benefits. While the significance of 990 does not lie directly in health insurance, the reporting requirements draw parallels in terms of transparency and accountability in providing benefits, as does the 1094-C for employers.

The Schedule C form is for sole proprietors to report income and expenses. Though it focuses on individual income, it also requires reporting of health insurance deductions. This connection to health coverage is similar to that of the 1094-C which outlines employer-offered coverage. Both forms allow taxpayers to account for health expenses related to their financial responsibilities.

The IRS 1040 form is the standard individual income tax return form. Taxpayers use it to report their annual income and claim deductions, such as those for health insurance premiums. While 1094-C focuses on employer-provided health coverage, both documents play essential roles in helping taxpayers report compliance with healthcare regulations and assess their tax situations.