Form 1065 (2019) |

|

|

Page 3 |

Schedule B |

Other Information (continued) |

|

c Is the partnership required to adjust the basis of partnership assets under section 743(b) or 734(b) because of a |

|

Yes No |

substantial built-in loss (as defined under section 743(d)) or substantial basis reduction (as defined under section |

|

734(d))? If “Yes,” attach a statement showing the computation and allocation of the basis adjustment. See |

|

instructions |

|

11Check this box if, during the current or prior tax year, the partnership distributed any property received in a like- kind exchange or contributed such property to another entity (other than disregarded entities wholly owned by the

partnership throughout the tax year) . . . . . . . . . . . . . . . . . . . . . . . .

12At any time during the tax year, did the partnership distribute to any partner a tenancy-in-common or other

undivided interest in partnership property? . . . . . . . . . . . . . . . . . . . . . . . .

13If the partnership is required to file Form 8858, Information Return of U.S. Persons With Respect To Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs), enter the number of Forms 8858 attached. See

instructions . . . . . . . . . . . . . . . . . . . . . . . . . .

14Does the partnership have any foreign partners? If “Yes,” enter the number of Forms 8805, Foreign Partner’s

Information Statement of Section 1446 Withholding Tax, filed for this partnership . . .

15Enter the number of Forms 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships, attached

to this return . . . . . . . . . . . . . . . . . . . . . . . . . .

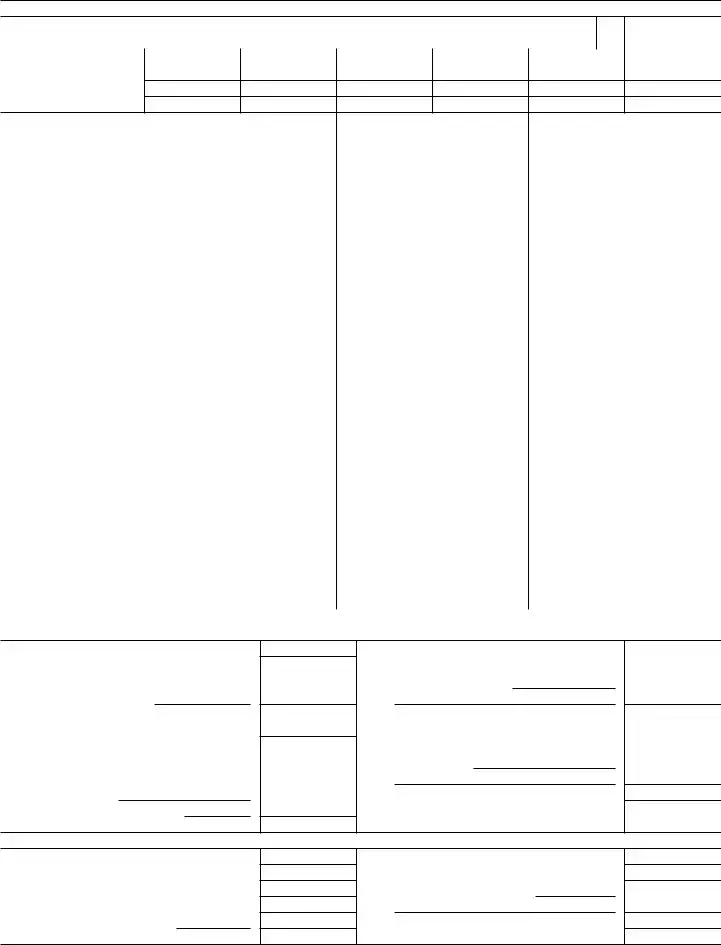

16a |

Did you make any payments in 2019 that would require you to file Form(s) 1099? See instructions |

b |

If “Yes,” did you or will you file required Form(s) 1099? |

17Enter the number of Forms 5471, Information Return of U.S. Persons With Respect To Certain Foreign

Corporations, attached to this return . . . . . . . . . . . . . . . . . .

18 Enter the number of partners that are foreign governments under section 892 . . . .

19During the partnership’s tax year, did the partnership make any payments that would require it to file Form 1042 and 1042-S under chapter 3 (sections 1441 through 1464) or chapter 4 (sections 1471 through 1474)? . . . .

20Was the partnership a specified domestic entity required to file Form 8938 for the tax year? See the Instructions

for Form 8938 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21Is the partnership a section 721(c) partnership, as defined in Regulations section 1.721(c)-1T(b)(14)? . . . . .

22During the tax year, did the partnership pay or accrue any interest or royalty for which the deduction is not allowed

under section 267A? See instructions . . . . . . . . . . . . . . . . . . . . . . . . .

If “Yes,” enter the total amount of the disallowed deductions |

$ |

23Did the partnership have an election under section 163(j) for any real property trade or business or any farming

business in effect during the tax year? See instructions . . . . . . . . . . . . . . . . . . . .

24 Does the partnership satisfy one or more of the following? See instructions . . . . . . . . . . . . .

aThe partnership owns a pass-through entity with current, or prior year carryover, excess business interest expense.

bThe partnership’s aggregate average annual gross receipts (determined under section 448(c)) for the 3 tax years preceding the current tax year are more than $26 million and the partnership has business interest.

cThe partnership is a tax shelter (see instructions) and the partnership has business interest expense. If “Yes” to any, complete and attach Form 8990.

25Is the partnership electing out of the centralized partnership audit regime under section 6221(b)? See instructions.

If “Yes,” the partnership must complete Schedule B-2 (Form 1065). Enter the total from Schedule B-2, Part III, line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If “No,” complete Designation of Partnership Representative below.

Designation of Partnership Representative (see instructions)

Enter below the information for the partnership representative (PR) for the tax year covered by this return.