What is the IRS 1042-S form?

The IRS 1042-S form is used to report income that is paid to non-resident aliens, foreign partnerships, foreign corporations, and other foreign entities. It is primarily used to report U.S. source income that is subject to withholding tax. This can include various types of income such as interest, dividends, royalties, and compensation for services performed in the U.S.

Who needs to file the 1042-S form?

The responsibility to file the 1042-S form falls on the withholding agent. This can be an individual or an organization that pays income to a non-resident alien. It is essential for them to file this form to report the income paid and the amount of tax withheld. Non-resident recipients of the income may also need to receive a copy of the form for their tax records.

When is the 1042-S form due?

The 1042-S form is generally due on March 15 of the year following the calendar year in which the income was paid. If this date falls on a weekend or a holiday, the due date is extended to the next business day. It's important for withholding agents to stay on top of this deadline to avoid penalties for late filing.

How do I obtain a copy of the 1042-S form?

You can obtain a copy of the 1042-S form through the IRS website or by contacting the IRS directly. Additionally, many tax preparation software programs will also provide the form as part of their services. If you've received income that requires a 1042-S from a U.S. payer, they should provide you with your copy as well.

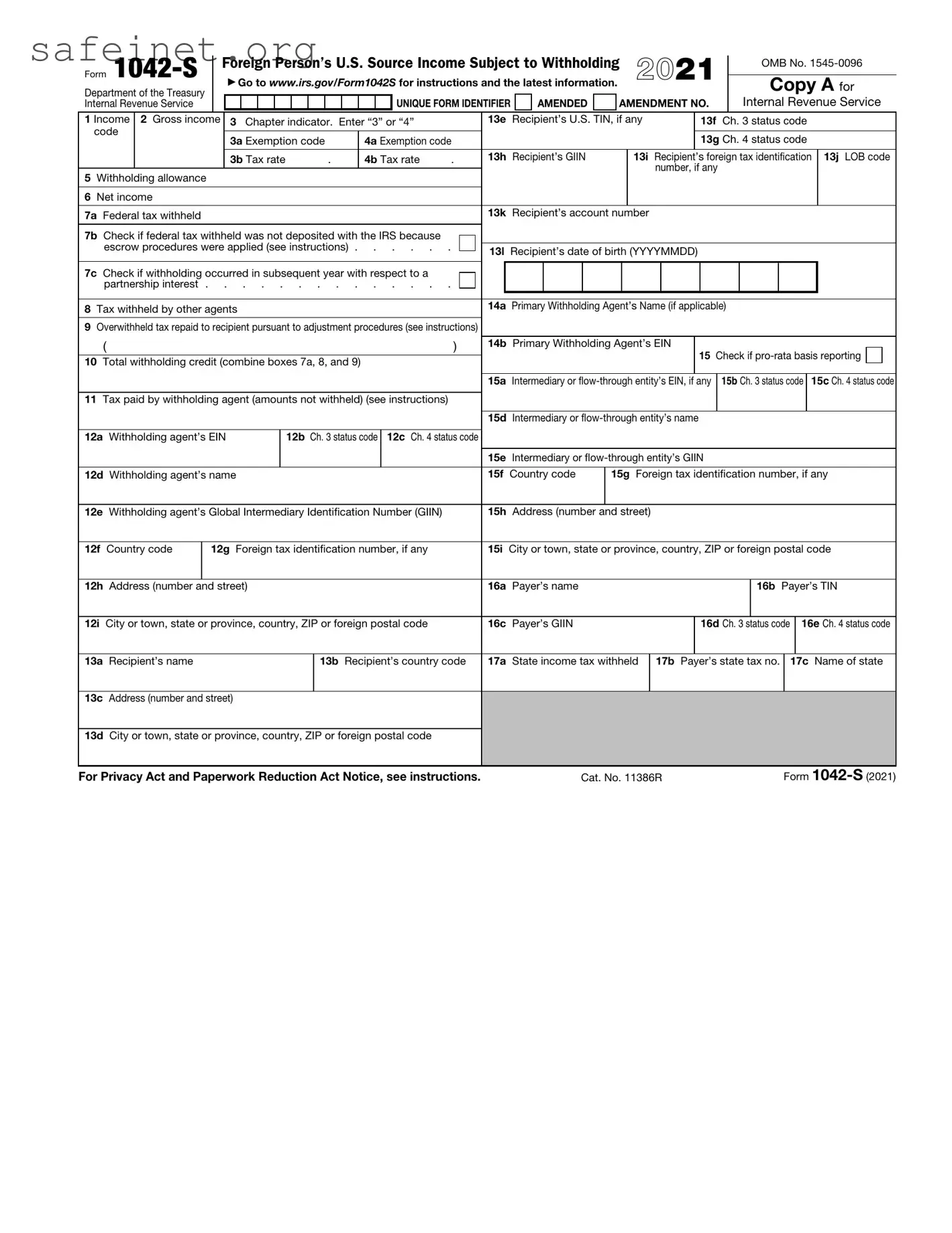

What information is included on the 1042-S form?

The 1042-S form includes details such as the recipient’s name, address, and taxpayer identification number (TIN), along with the income amount, the type of income, and the amount of U.S. federal tax withheld. This data is vital for both the IRS and the recipient to ensure accurate tax reporting.

Do I need to report the 1042-S income on my tax return?

Yes, if you are a non-resident alien who has received a 1042-S form, you must report that income on your tax return. The income needs to be detailed according to the requirements of your specific tax situation. Even if tax was withheld, reporting it is important for compliance and reconciliation purposes.

What if I don't receive a 1042-S form but I think I should?

If you believe you should have received a 1042-S form but didn't, reach out to the entity that paid you the income. They may have overlooked sending it. It’s also a good idea to keep your records organized, as you may need supporting documents. If they’re unable to provide it, you should still report the income on your tax return.

What penalties are associated with not filing the 1042-S form?

Failure to file the 1042-S form on time may result in penalties. The IRS can impose fines that vary based on how late the form is filed. If the form is filed more than 30 days late but before August 1, the penalty can be reduced, but it’s always better to adhere to deadlines to avoid complications.

Where do I send the 1042-S form?

The IRS provides specific mailing addresses depending on whether you are filing electronically or by mail. If you are filing electronically, you will typically use specific software designed for this purpose. For paper submissions, refer to the IRS instructions for Form 1042-S which will have the correct address based on your location and filing method.