Note: The form, instructions, or publication you are looking

for begins after this coversheet.

Please review the updated information below.

Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040, 1040-SR, and 1040-NR for Tax Year 2018 and Tax Year 2019

Under Proposed Regulations 113295-18, an excess deduction on termination of an estate or trust allowed in arriving at adjusted gross income (Internal Revenue Code (IRC) section 67(e) expenses) is reported as an adjustment to income on Forms 1040, 1040-SR, and 1040-NR; non-miscellaneous itemized deductions are reported, as applicable, on Schedule A (Form 1040 or 1040-SR) or Schedule A (Form 1040-NR); and miscellaneous itemized deductions are not deductible. Taxpayers may rely on the proposed regulations for tax years of beneficiaries beginning after 2017 and before the final regulations are published.

For tax year 2019, an excess deduction for IRC section 67(e) expenses is reported as a write-in on Schedule 1 (Form 1040 or 1040-SR), Part II, line 22, or Form 1040-NR, line 34. On the dotted line next to line 22 or line 34 (depending on which form is filed), enter the amount of the adjustment and identify it using the code “ED67(e)”. Include the amount of the adjustment in the total amount reported on line 22 or line 34.

For tax year 2018, an excess deduction for IRC section 67(e) expenses is reported as a write-in on Schedule 1 (Form 1040), line 36, or Form 1040-NR, line 34. On the dotted line next to line 36 or line 34, (depending on which form is filed), enter the amount of the adjustment and identify it using the code “ED67(e)”. Include the amount of the adjustment in the total amount reported on line 36 or line 34.

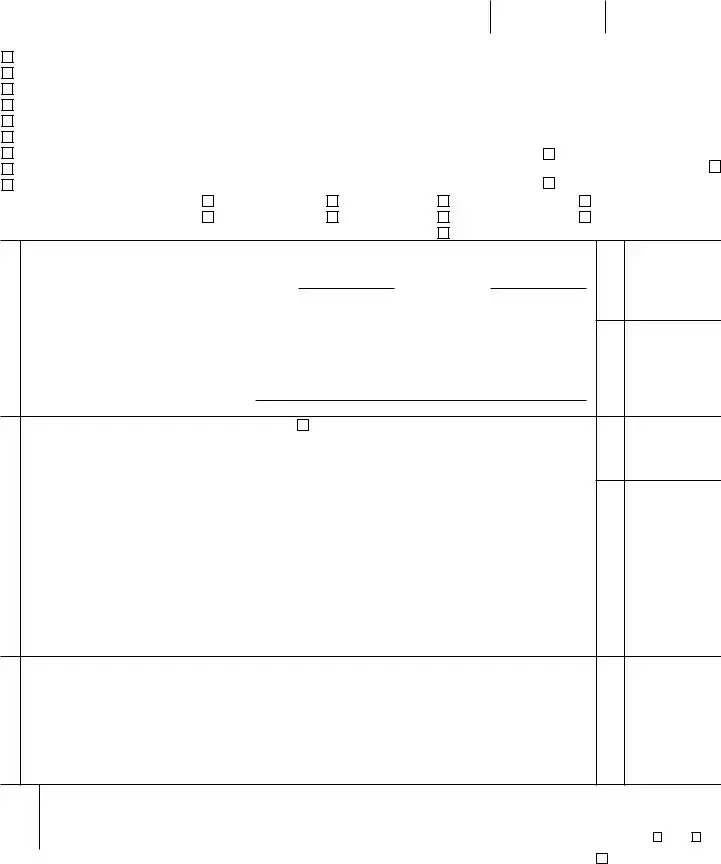

Schedule A Charitable Deduction. Don’t complete for a simple trust or a pooled income fund.

1Amounts paid or permanently set aside for charitable purposes from gross income. See instructions

2 |

Tax-exempt income allocable to charitable contributions. See instructions |

3 |

Subtract line 2 from line 1 |

4Capital gains for the tax year allocated to corpus and paid or permanently set aside for charitable

purposes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6Section 1202 exclusion allocable to capital gains paid or permanently set aside for charitable purposes. See instructions . . . . . . . . . . . . . . . . . . . . . . . . .

7 Charitable deduction. Subtract line 6 from line 5. Enter here and on page 1, line 13 . . . . . .

Schedule B Income Distribution Deduction

1 |

Adjusted total income. See instructions |

2 |

Adjusted tax-exempt interest |

3 |

Total net gain from Schedule D (Form 1041), line 19, column (1). See instructions |

4 |

Enter amount from Schedule A, line 4 (minus any allocable section 1202 exclusion) |

5 |

Capital gains for the tax year included on Schedule A, line 1. See instructions |

6Enter any gain from page 1, line 4, as a negative number. If page 1, line 4, is a loss, enter the loss as a

positive number . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Distributable net income. Combine lines 1 through 6. If zero or less, enter -0- . . . . . . . .

8If a complex trust, enter accounting income for the tax year as determined

|

under the governing instrument and applicable local law |

8 |

9 |

Income required to be distributed currently |

10 |

Other amounts paid, credited, or otherwise required to be distributed |

11 |

Total distributions. Add lines 9 and 10. If greater than line 8, see instructions |

12 |

Enter the amount of tax-exempt income included on line 11 |

13 |

Tentative income distribution deduction. Subtract line 12 from line 11 |

14 |

Tentative income distribution deduction. Subtract line 2 from line 7. If zero or less, enter -0- . . . |

15 |

Income distribution deduction. Enter the smaller of line 13 or line 14 here and on page 1, line 18 . |

1

2

3

4

5

6

7

9

10

11

12

13

14

15

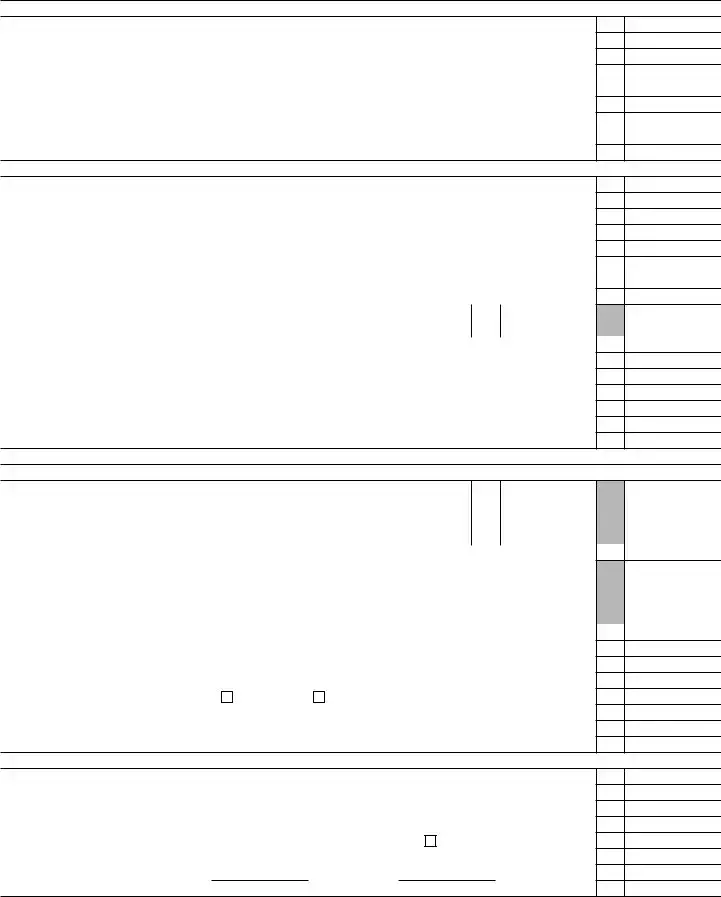

Schedule G Tax Computation and Payments (see instructions)

Part I — Tax Computation

1Tax:

|

|

|

|

|

|

a |

Tax on taxable income. See instructions |

1a |

b |

Tax on lump-sum distributions. Attach Form 4972 |

1b |

c |

Alternative minimum tax (from Schedule I (Form 1041), line 54) |

1c |

d |

Total. Add lines 1a through 1c |

2a |

Foreign tax credit. Attach Form 1116 |

2a |

|

b |

General business credit. Attach Form 3800 |

2b |

|

c |

Credit for prior year minimum tax. Attach Form 8801 |

2c |

|

d |

Bond credits. Attach Form 8912 |

2d |

|

e |

Total credits. Add lines 2a through 2d |

3 |

Subtract line 2e from line 1d. If zero or less, enter -0- |

4 |

Tax on the ESBT portion of the trust (from ESBT Tax Worksheet, line 17). See instructions . . . . |

5 |

Net investment income tax from Form 8960, line 21 |

6 |

Recapture taxes. Check if from: |

Form 4255 |

Form 8611 |

7 |

Household employment taxes. Attach Schedule H (Form 1040 or 1040-SR) |

8 |

Other taxes and amounts due |

9 |

Total tax. Add lines 3 through 8. Enter here and on page 1, line 24 |

10 2019 estimated tax payments and amount applied from 2018 return . . . . . . . . . . .

11Estimated tax payments allocated to beneficiaries (from Form 1041-T) . . . . . . . . . . .

12 |

Subtract line 11 from line 10 |

13 |

Tax paid with Form 7004. See instructions |

14 |

Federal income tax withheld. If any is from Form(s) 1099, check here |

. . . . . . . . . |

15 |

2019 net 965 tax liability from Form 965-A, Part I, column (f), line 3 |

16 |

Other payments: a Form 2439 |

; b Form 4136 |

; Total . . |

17 |

Total payments. Add lines 12 through 15 and 16c. Enter here and on page 1, line 26 |

Form 1041 (2019) |

Page 3 |

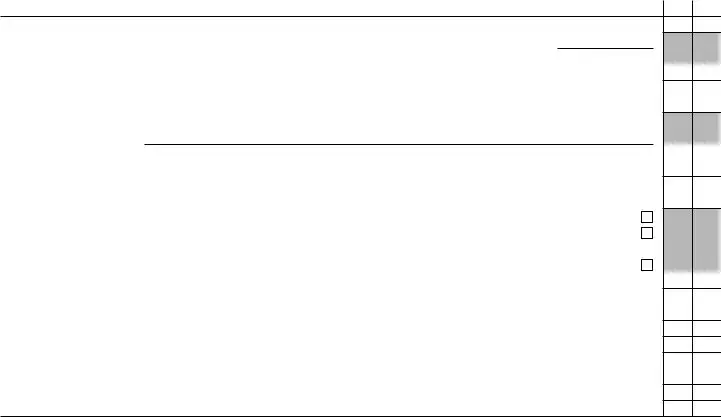

Other Information |

Yes No |

1Did the estate or trust receive tax-exempt income? If “Yes,” attach a computation of the allocation of expenses.

Enter the amount of tax-exempt interest income and exempt-interest dividends . . . |

$ |

2Did the estate or trust receive all or any part of the earnings (salary, wages, and other compensation) of any

individual by reason of a contract assignment or similar arrangement? . . . . . . . . . . . . . . .

3At any time during calendar year 2019, did the estate or trust have an interest in or a signature or other authority over a bank, securities, or other financial account in a foreign country? . . . . . . . . . . . . . .

See the instructions for exceptions and filing requirements for FinCEN Form 114. If “Yes,” enter the name of the foreign country

4During the tax year, did the estate or trust receive a distribution from, or was it the grantor of, or transferor to, a

foreign trust? If “Yes,” the estate or trust may have to file Form 3520. See instructions . . . . . . . . .

5Did the estate or trust receive, or pay, any qualified residence interest on seller-provided financing? If “Yes,” see

the instructions for the required attachment . . . . . . . . . . . . . . . . . . . . . . .

6 If this is an estate or a complex trust making the section 663(b) election, check here. See instructions . .

7 To make a section 643(e)(3) election, attach Schedule D (Form 1041), and check here. See instructions . .

8If the decedent’s estate has been open for more than 2 years, attach an explanation for the delay in closing the

estate, and check here . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 Are any present or future trust beneficiaries skip persons? See instructions . . . . . . . . . . . . .

10Was the trust a specified domestic entity required to file Form 8938 for the tax year (see the Instructions for

Form 8938)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11a Did the estate or trust distribute S corporation stock for which it made a section 965(i) election? . . . . . .

bIf “Yes,” did each beneficiary enter into an agreement to be liable for the net tax liability? See instructions . . .

12Did the estate or trust make a section 965(i) election for S corporation stock held on the last day of the tax year?

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 ESBTs only. Does the ESBT have a nonresident alien grantor? If “Yes,” see instructions . . . . . . . .

14ESBTs only. Did the S portion of the trust claim a qualified business income deduction? If “Yes,” see instructions

Form 1041 (2019)