Note: The form, instructions, or publication you are looking for begins

after this coversheet.

Please review the updated information below.

New Information for Form 1040-X Filers

E-filing is available for amending 2019 and 2020 returns that were originally e-filed. E-filing amended returns will result in much faster processing and refunds. See IRS.gov/Form1040X and IRS.gov/filing/amended- return-frequently-asked-questions. Contact your preferred tax software provider to verify their participation in amended return e-filing, for specific instructions needed to submit an amended return, and for answers to any questions. An amended return for tax year 2019 or 2020 can also be filed on paper. As of February 2021, the most recent paper Form 1040-X is the January 2020 revision. If the taxpayer is amending their 2020 calendar year return, they should manually enter “2020” in the entry box next to “calendar year” on the line below the calendar year checkboxes. They should then complete the form as usual, using the most recent revision of Form 1040-X and the Instructions for Form 1040 for the tax year being amended.

New Mailing Addresses for Form 1040-X if You Can’t E-file

Addresses for mailing paper Forms 1040-X have changed for amended returns.

Note: All addresses must have at least three full lines of text to meet USPS requirements; USPS may reject mail that does not meet that standard—therefore, be sure to use all three lines in the addresses listed below.

If you are amending your return because of any of the situations listed next, use the corresponding address.

IF you are filing Form 1040-X: |

THEN mail Form 1040-X to: |

|

|

In response to a notice you received from the IRS |

The address shown in the notice |

|

|

With Form 1040NR or 1040NR-EZ; or from a foreign country, U.S. |

Department of the Treasury |

possession or territory*; or use an APO or FPO address; or file Form |

Internal Revenue Service |

2555, 2555-EZ, or 4563; or are or were a dual-status alien |

Austin, TX 73301-0215 |

|

|

*If you live in American Samoa, Puerto Rico, Guam, the U.S. Virgin Islands, or the Northern Mariana Islands, see Pub. 570 at IRS. gov/Pub570.

If none of the situations listed above apply to you, mail your amended return to the address shown next that applies to you. Addresses for people living in Alabama, Alaska, Arkansas, California, Georgia, Hawaii, Illinois, Indiana, Iowa, Michigan, Minnesota, Ohio, Oklahoma, Washington, and Wisconsin have changed.

|

If you live in: |

THEN mail Form 1040-X to: |

|

|

|

|

|

|

Alabama, Arkansas, Florida, Georgia, |

Department of the Treasury |

|

|

Internal Revenue Service |

|

|

Louisiana, Mississippi, Oklahoma, or Texas |

|

|

Austin, TX 73301-0052 |

|

|

|

|

|

|

|

|

|

|

Through June 18, 2021, use: |

Starting June 19, 2021, use: |

|

Alaska, California, or Hawaii: |

Department of the Treasury |

Department of the Treasury |

|

Internal Revenue Service |

Internal Revenue Service |

|

|

|

|

Fresno, CA 93888-0422 |

Ogden, UT 84201-0052 |

|

|

|

|

|

Connecticut, Delaware, District of Columbia, |

|

|

|

Illinois, Indiana, Kentucky, Maine, Maryland, |

|

|

|

Massachusetts, Minnesota, Missouri, |

Department of the Treasury |

|

|

New Hampshire, New Jersey, New York, |

Internal Revenue Service |

|

|

North Carolina, Pennsylvania, Rhode Island, |

Kansas City, MO 64999-0052 |

|

|

South Carolina, Tennessee, Vermont, Virginia, |

|

|

|

West Virginia, or Wisconsin |

|

|

|

|

|

|

|

Arizona, Colorado, Idaho, Iowa, Kansas, |

Department of the Treasury |

|

|

Michigan, Montana, Nebraska, Nevada, |

|

|

Internal Revenue Service |

|

|

New Mexico, North Dakota, Ohio, Oregon, |

|

|

Ogden, UT 84201-0052 |

|

|

South Dakota, Utah, Washington, or Wyoming |

|

|

|

|

|

|

|

|

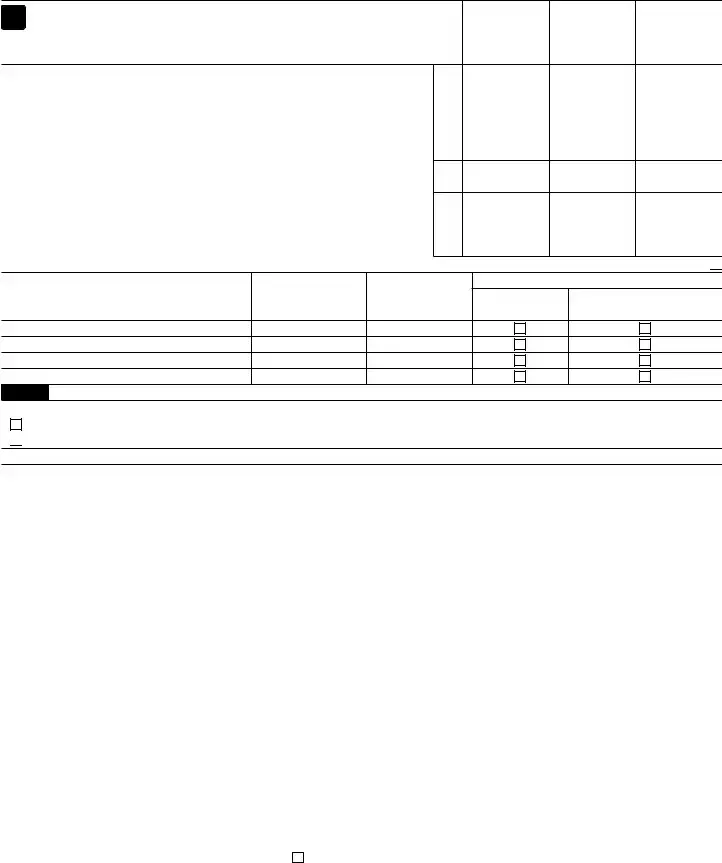

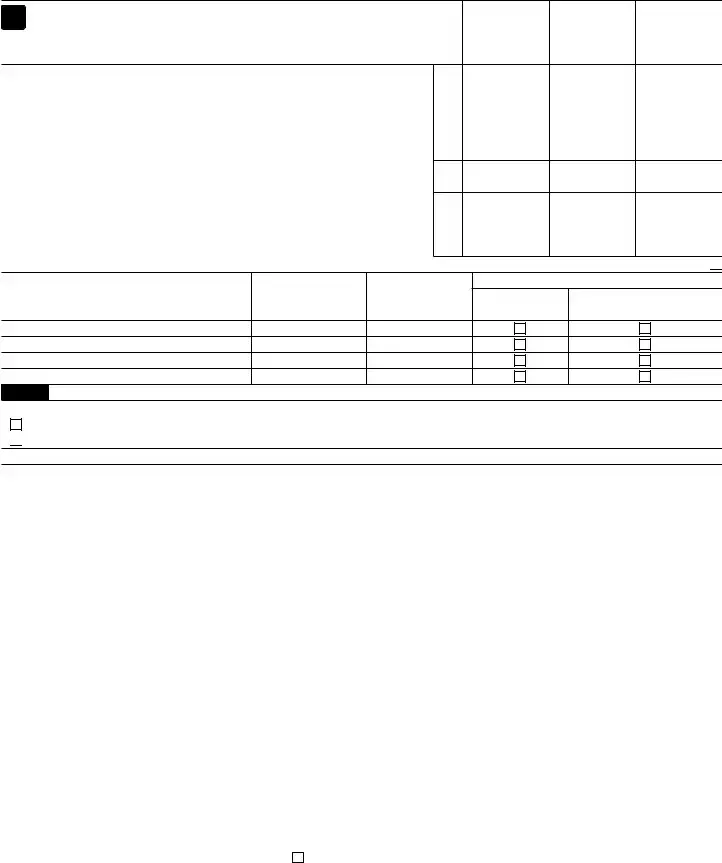

Full-year health care coverage (or, for amended 2018 returns only, exempt). If amending a 2019 return, leave blank. See instructions.

Form 1040-X

(Rev. January 2020)

Department of the Treasury—Internal Revenue Service

Amended U.S. Individual Income Tax Return

▶Go to www.irs.gov/Form1040X for instructions and the latest information.

This return is for calendar year |

2019 |

Other year. Enter one: calendar year |

|

or fiscal year (month and year ended):

Your first name and middle initial |

Last name |

|

Your social security number |

|

|

|

|

If joint return, spouse’s first name and middle initial |

Last name |

|

Spouse’s social security number |

|

|

|

|

Current home address (number and street). If you have a P.O. box, see instructions. |

Apt. no. |

Your phone number |

|

|

|

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below. See instructions. |

|

Foreign province/state/county

Amended return filing status. You must check one box even if you are not changing your filing status. Caution: In general, you can’t change your filing status from a joint return to separate returns after the due date.

Single |

Married filing jointly |

Married filing separately (MFS) |

Qualifying widow(er) (QW) |

Head of household (HOH) |

If you checked the MFS box, enter the name of spouse. If you checked the HOH or QW box, enter the child’s name if the qualifying person is a child but not your dependent. ▶

Use Part III on the back to explain any changes |

A. Original amount |

B. Net change— |

C. Correct |

reported or as |

amount of increase |

|

previously adjusted |

or (decrease)— |

amount |

Income and Deductions |

(see instructions) |

explain in Part III |

|

1Adjusted gross income. If a net operating loss (NOL) carryback is

|

included, check here . . . . . . . . . . . . . . . ▶ |

1 |

2 |

Itemized deductions or standard deduction |

2 |

3 |

Subtract line 2 from line 1 |

3 |

4a |

Exemptions (amended 2017 or earlier returns only). If changing, |

|

|

complete Part I on page 2 and enter the amount from line 29 . . . . |

4a |

b |

Qualified business income deduction (amended 2018 or later returns only) |

4b |

5Taxable income. Subtract line 4a or 4b from line 3. If the result is zero

or less, enter -0- |

. . . . . . . . . . . . . . . . . . |

5 |

Tax Liability

6Tax. Enter method(s) used to figure tax (see instructions):

|

|

6 |

7 |

Credits. If a general business credit carryback is included, check here ▶ |

7 |

8 |

Subtract line 7 from line 6. If the result is zero or less, enter -0- . . . |

8 |

9Health care: individual responsibility (amended 2018 or earlier returns

|

only). See instructions |

9 |

10 |

Other taxes |

10 |

11 |

Total tax. Add lines 8, 9, and 10 |

11 |

Payments

12Federal income tax withheld and excess social security and tier 1 RRTA

|

tax withheld. (If changing, see instructions.) |

12 |

13 |

Estimated tax payments, including amount applied from prior year’s return |

13 |

14 |

Earned income credit (EIC) |

14 |

15 |

Refundable credits from: |

Schedule 8812 Form(s) |

2439 |

4136 |

|

|

8863 |

8885 |

8962 or |

other (specify): |

|

|

15 |

16Total amount paid with request for extension of time to file, tax paid with original return, and additional

tax paid after return was filed |

16 |

17 Total payments. Add lines 12 through 15, column C, and line 16 |

17 |

Refund or Amount You Owe |

|

|

|

|

18 |

Overpayment, if any, as shown on original return or as previously adjusted by the IRS |

18 |

19 |

Subtract line 18 from line 17. (If less than zero, see instructions.) |

19 |

20 |

Amount you owe. If line 11, column C, is more than line 19, enter the difference |

20 |

21 |

If line 11, column C, is less than line 19, enter the difference. This is the amount overpaid on this return |

21 |

22 |

Amount of line 21 you want refunded to you |

22 |

23 |

Amount of line 21 you want applied to your (enter year): |

estimated tax |

23 |

|

|

|

|

Complete and sign this form on page 2. |

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 11360L |

Form 1040-X (Rev. 1-2020) |

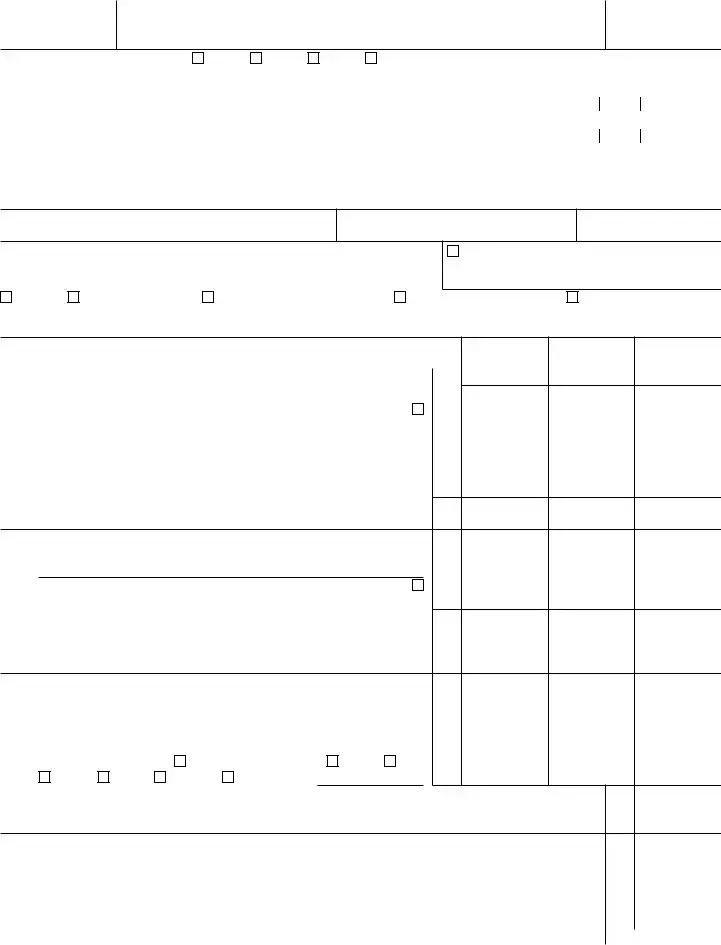

Form 1040-X (Rev. 1-2020) |

Page 2 |

Part I |

Exemptions and Dependents |

|

Complete this part only if any information relating to exemptions (to dependents if amending your 2018 or later return) has changed from what you reported on the return you are amending. This would include a change in the number of exemptions (of dependents if amending your 2018 or later return).

▲! |

For amended 2018 or later returns only, leave lines 24, 28, and 29 blank. |

A. Original number B. Net change |

C. Correct |

CAUTION |

Fill in all other applicable lines. |

of exemptions or |

number |

|

Note: See the Forms 1040 and 1040-SR, or Form 1040A, instructions |

amount reported |

or amount |

|

or as previously |

|

|

for the tax year being amended. See also the Form 1040-X instructions. |

adjusted |

|

24Yourself and spouse. Caution: If someone can claim you as a

|

dependent, you can’t claim an exemption for yourself. If amending your |

|

|

2018 or later return, leave line blank |

24 |

25 |

Your dependent children who lived with you |

25 |

26 |

Your dependent children who didn’t live with you due to divorce or separation |

26 |

27 |

Other dependents |

27 |

28Total number of exemptions. Add lines 24 through 27. If amending your

2018 or later return, leave line blank |

28 |

29Multiply the number of exemptions claimed on line 28 by the exemption amount shown in the instructions for line 29 for the year you are

amending. Enter the result here and on line 4a on page 1 of this form. If |

|

amending your 2018 or later return, leave line blank |

29 |

30 List ALL dependents (children and others) claimed on this amended return. If more than 4 dependents, see inst. and ✓ here ▶

Dependents (see instructions):

(b)Social security number

(d)✓ if qualifies for (see instructions):

|

Child tax credit |

Credit for other dependents |

|

(amended 2018 or later returns only) |

|

|

Part II Presidential Election Campaign Fund

Checking below won’t increase your tax or reduce your refund.

Check here if you didn’t previously want $3 to go to the fund, but now do.

Check here if this is a joint return and your spouse did not previously want $3 to go to the fund, but now does. Part III Explanation of Changes. In the space provided below, tell us why you are filing Form 1040-X.

Check here if this is a joint return and your spouse did not previously want $3 to go to the fund, but now does. Part III Explanation of Changes. In the space provided below, tell us why you are filing Form 1040-X.

▶Attach any supporting documents and new or changed forms and schedules.

Remember to keep a copy of this form for your records.

Under penalties of perjury, I declare that I have filed an original return and that I have examined this amended return, including accompanying schedules and statements, and to the best of my knowledge and belief, this amended return is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information about which the preparer has any knowledge.

Sign Here

▲ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your signature |

|

Date |

|

|

Your occupation |

|

|

|

▲ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s signature. If a joint return, both must sign. |

|

Date |

|

|

Spouse’s occupation |

|

|

|

Paid Preparer Use Only |

|

|

|

|

|

|

|

|

|

▲ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s signature |

|

Date |

|

|

Firm’s name (or yours if self-employed) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Print/type preparer’s name |

|

|

|

|

Firm’s address and ZIP code |

|

|

|

|

|

|

Check if self-employed |

|

|

|

PTIN |

|

|

|

|

|

Phone number |

|

|

EIN |

|

|

|

|

|

|

|

|

|

|

For forms and publications, visit www.irs.gov. |

|

|

|

|

|

|

|

|

Form 1040-X (Rev. 1-2020) |

Check here if this is a joint return and your spouse did not previously want $3 to go to the fund, but now does.

Check here if this is a joint return and your spouse did not previously want $3 to go to the fund, but now does.