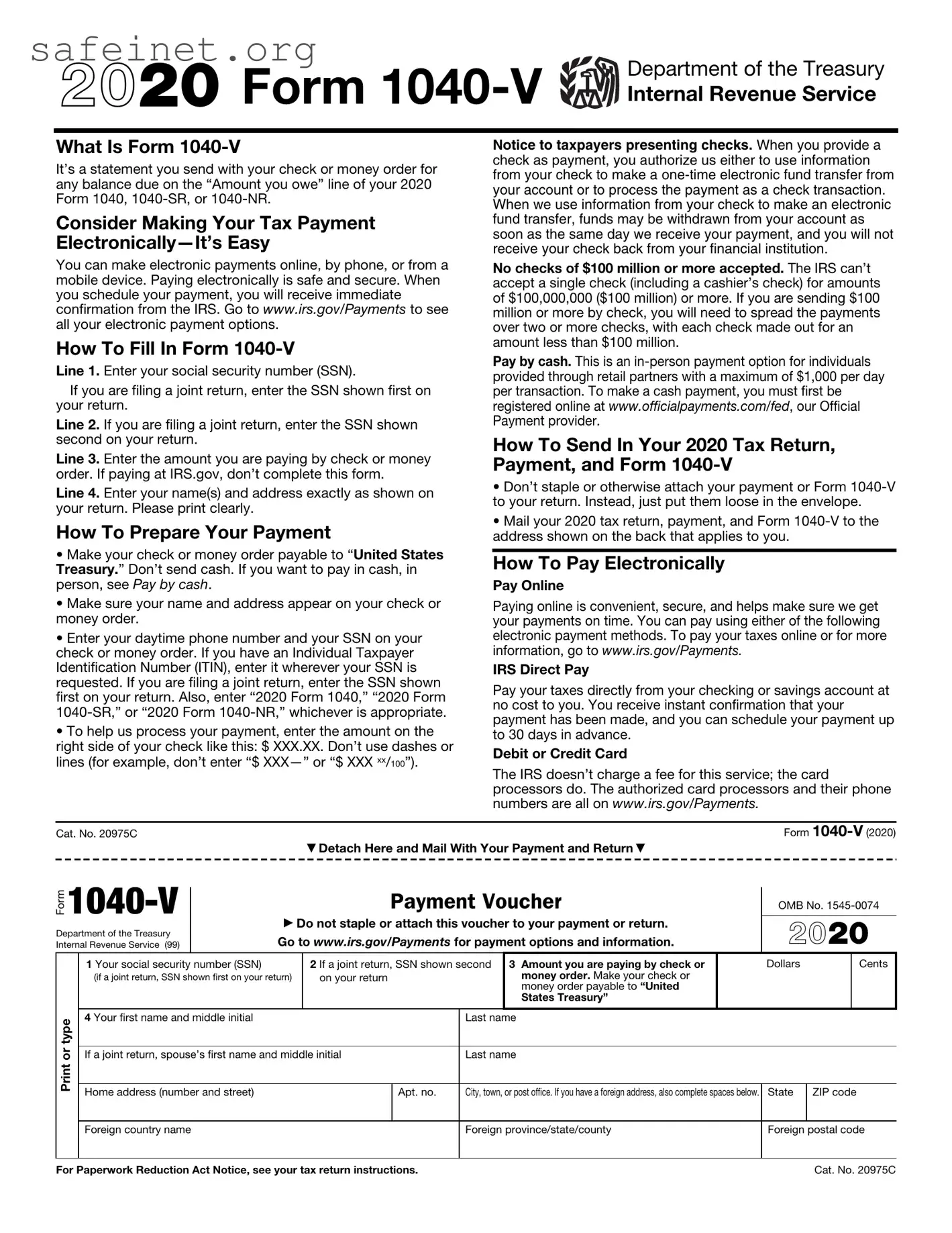

What is the IRS 1040-V form?

The IRS 1040-V form, also known as the Payment Voucher, is used by taxpayers to submit payments for their individual income tax. When you owe tax and are sending in a payment, this form ensures that your payment is applied correctly to your tax account.

Who should use the 1040-V form?

If you are mailing a payment for your tax liability and you have filed your Form 1040, 1040-SR, or 1040-NR, you should use the 1040-V form. It is particularly useful for individuals who prefer to pay their taxes via check or money order instead of through electronic methods.

When should I send the 1040-V form?

The form should be sent along with your payment when you are filing your federal income tax return. It's important to mail it to the address designated by the IRS for your specific situation. This helps ensure timely processing and accurate application of your payment.

How can I obtain the 1040-V form?

You can easily obtain the 1040-V form from the IRS website. It's available for download in PDF format. You can also find it in various tax filing software, or you may request a physical copy by reaching out to the IRS directly.

What payment methods can I use with the 1040-V form?

Acceptable payment methods include a personal check, money order, or cashier's check made out to the "United States Treasury." Make sure to include your Social Security number on the payment to ensure it is applied correctly to your account.

Do I need to include my tax return with the 1040-V form?

No, you do not need to include your tax return with the 1040-V when you send in your payment. The 1040-V is meant to accompany your payment only. However, you should keep a copy of your tax return for your records.

What if I don’t include the 1040-V form with my payment?

If you do not send the 1040-V form with your payment, the IRS may still process your payment, but it may take longer to apply it correctly. To avoid any confusion or delays, it's best to include the voucher whenever you make a payment.

Is there a penalty for not using the 1040-V form?

There is no specific penalty for failing to use the 1040-V form. However, not using it can result in processing delays, which might lead to additional penalties if payment is not correctly attributed to your tax account in a timely manner. It’s advisable to use the form to prevent any issues.

Can I file the 1040-V form electronically?

The IRS 1040-V form itself cannot be filed electronically. However, if you are filing your tax return electronically and owe money, you can often pay your tax due through electronic means directly from the filing platform. The 1040-V is strictly for mailed payments.

Where do I send the 1040-V form?

The address for where to send the 1040-V form depends on your location and whether you are including a payment for a return or extension. You can find the correct mailing address on the IRS website or in the instructions accompanying your tax return. This ensures that your payment reaches the right place without unnecessary delays.