|

Purpose of This Package |

Farmers and fishermen. If at least two-thirds of your |

|

Use Form 1040-ES to figure and pay your estimated tax |

gross income for 2019 or 2020 is from farming or fishing, |

|

for 2020. |

substitute 662/3% for 90% in (2a) under General Rule. |

|

|

Estimated tax is the method used to pay tax on income |

Household employers. When estimating the tax on your |

|

|

2020 tax return, include your household employment |

|

that isn’t subject to withholding (for example, earnings |

|

taxes if either of the following applies. |

|

from self-employment, interest, dividends, rents, alimony, |

|

• |

You will have federal income tax withheld from wages, |

|

etc.). In addition, if you don’t elect voluntary withholding, |

|

you should make estimated tax payments on other |

pensions, annuities, gambling winnings, or other income. |

|

• |

You would be required to make estimated tax payments |

|

taxable income, such as unemployment compensation |

|

and the taxable part of your social security benefits. |

to avoid a penalty even if you didn’t include household |

|

employment taxes when figuring your estimated tax. |

|

Change of address. If your address has changed, file |

|

Higher income taxpayers. If your adjusted gross |

|

Form 8822, to update your record. |

|

income (AGI) for 2019 was more than $150,000 ($75,000 |

|

Future developments. For the latest information about |

|

if your filing status for 2020 is married filing separately), |

|

developments related to Form 1040-ES and its |

substitute 110% for 100% in (2b) under General Rule, |

|

instructions, such as legislation enacted after they were |

earlier. This rule doesn’t apply to farmers or fishermen. |

|

published, go to IRS.gov/Form1040ES. |

Increase Your Withholding |

|

|

|

|

|

|

Who Must Make Estimated Tax |

|

If you also receive salaries and wages, you may be able to |

|

Payments |

avoid having to make estimated tax payments on your |

|

The estimated tax rules apply to: |

other income by asking your employer to take more tax |

|

• |

U.S. citizens and resident aliens; |

out of your earnings. To do this, file a new Form W-4, |

|

• |

Residents of Puerto Rico, the U.S. Virgin Islands, |

Employee's Withholding Certificate, with your employer. |

|

Guam, the Commonwealth of the Northern Mariana |

|

Generally, if you receive a pension or annuity you can |

|

Islands, and American Samoa; and |

|

|

use Form W-4P, Withholding Certificate for Pension or |

|

• Nonresident aliens (use Form 1040-ES (NR)). |

|

Annuity Payments, to start or change your withholding |

|

General Rule |

from these payments. |

|

In most cases, you must pay estimated tax for 2020 if both |

|

You also can choose to have federal income tax |

|

of the following apply. |

withheld from certain government payments. For details, |

|

|

1. You expect to owe at least $1,000 in tax for 2020, |

see Form W-4V, Voluntary Withholding Request. |

|

after subtracting your withholding and refundable credits. |

|

|

You can use the Tax Withholding Estimator at |

|

|

2. You expect your withholding and refundable credits |

TIP |

IRS.gov/W4App to determine whether you need |

|

to be less than the smaller of: |

|

|

|

|

|

|

|

to have your withholding increased or decreased. |

|

or a. 90% of the tax to be shown on your 2020 tax return, |

Additional Information You May Need |

|

|

b. 100% of the tax shown on your 2019 tax return. |

You can find most of the information you will need in Pub. |

|

Your 2019 tax return must cover all 12 months. |

505, Tax Withholding and Estimated Tax, and in the |

|

Note. These percentages may be different if you are a |

instructions for the 2019 Form 1040 and 1040-SR. |

|

|

For details on how to get forms and publications, see |

|

farmer, fisherman, or higher income taxpayer. See |

|

|

Special Rules, later. |

the 2019 Instructions for Form 1040 and 1040-SR. |

|

Exception. You don’t have to pay estimated tax for 2020 |

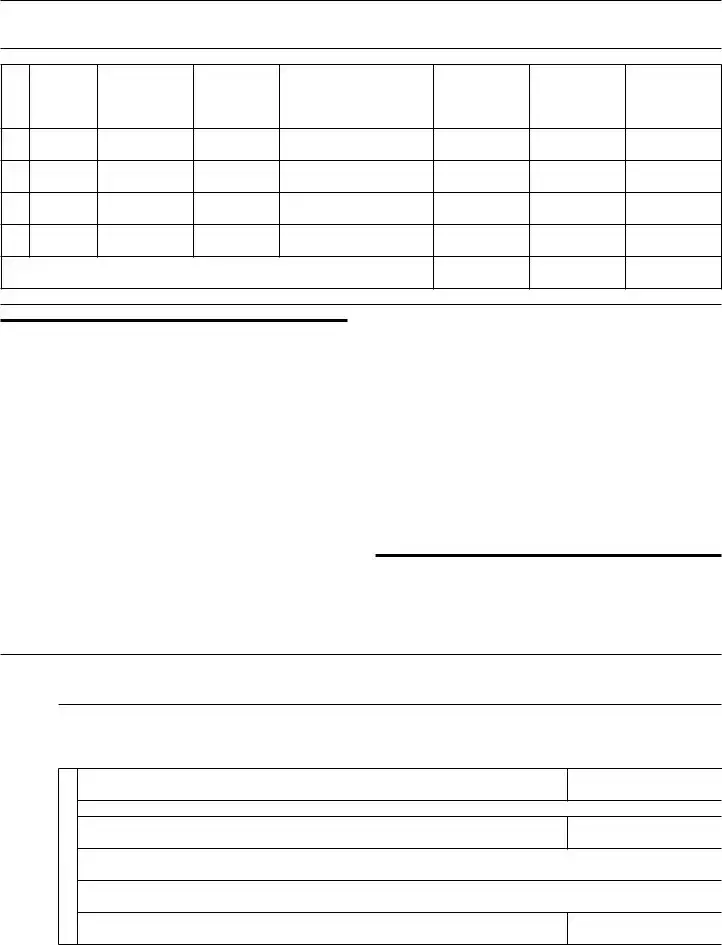

What's New |

|

if you were a U.S. citizen or resident alien for all of 2019 |

In figuring your 2020 estimated tax, be sure to consider |

|

and you had no tax liability for the full 12-month 2019 tax |

|

the following. |

|

year. You had no tax liability for 2019 if your total tax was |

|

Extended tax provisions. Recent legislation extended |

|

zero or you didn’t have to file an income tax return. |

|

Special Rules |

certain tax benefits that had expired at the end of 2017 |

|

through 2020. These tax benefits include the following. |

|

There are special rules for farmers, fishermen, certain |

• |

Tuition and fees deduction. |

|

household employers, and certain higher income |

• |

Deduction for mortgage insurance premiums. |

|

taxpayers. |

• |

Nonbusiness energy property credit. |

|

|

|

|

|

• |

Alternative fuel vehicle refueling credit. |