What is an Investment Letter of Intent?

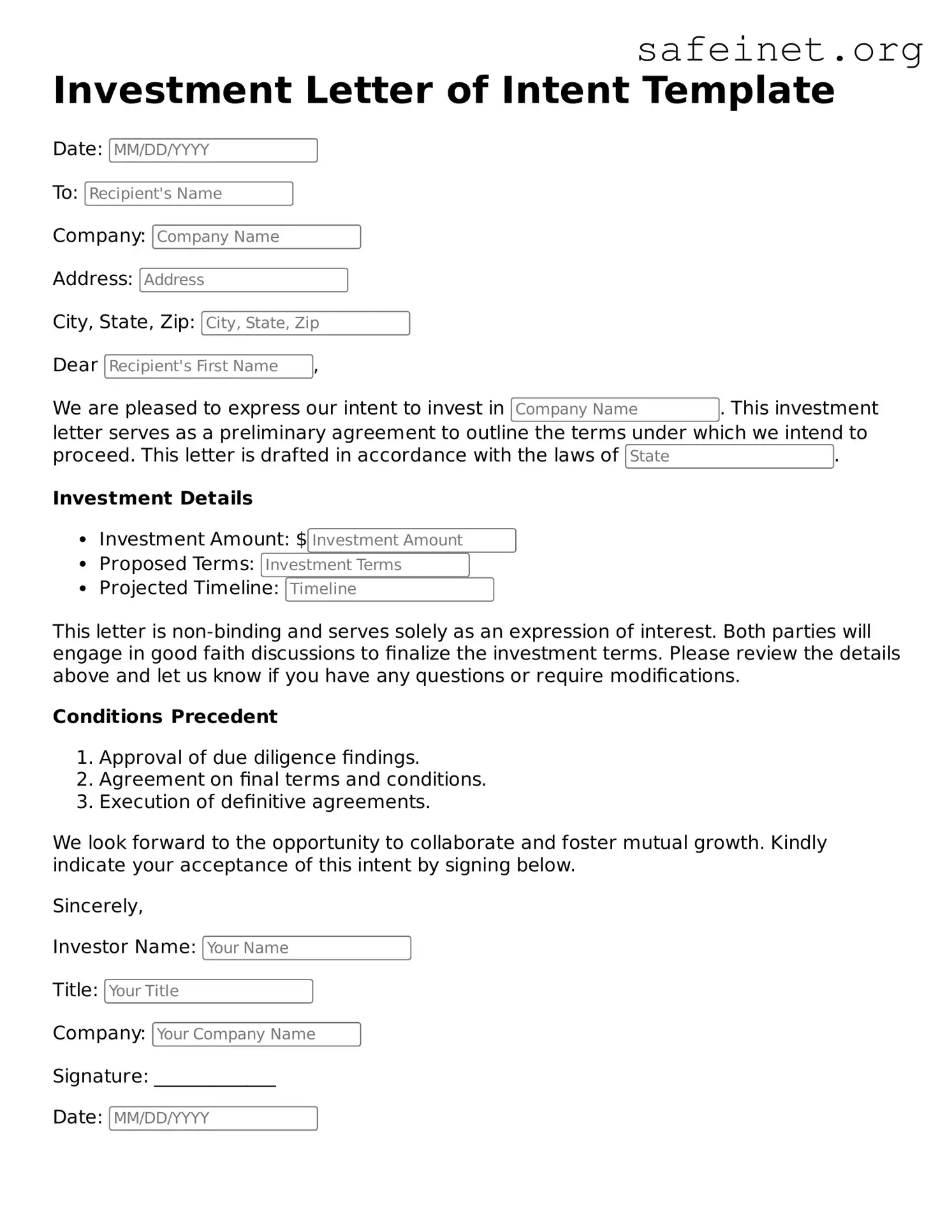

An Investment Letter of Intent is a document that outlines the preliminary agreement between two parties regarding an investment opportunity. It serves as a formal indication of interest and intention to proceed with detailed negotiations and due diligence.

Who typically uses an Investment Letter of Intent?

This document is commonly used by investors and businesses seeking funding. Investors can be individuals, corporations, or venture capitalists. Businesses may be startups or established companies looking to secure capital for growth or operational needs.

Is an Investment Letter of Intent legally binding?

The Investment Letter of Intent is generally not legally binding, as it is primarily a statement of intent. However, certain provisions within the letter may be binding, such as confidentiality or exclusivity agreements. It is important to clarify these details before signing.

What should be included in an Investment Letter of Intent?

Key elements of an Investment Letter of Intent typically include the names of the parties involved, a description of the investment opportunity, the amount of investment being proposed, the expected terms, and any conditions that must be met prior to finalizing the agreement.

How long does it take to prepare an Investment Letter of Intent?

The preparation time for an Investment Letter of Intent can vary depending on the complexity of the investment opportunity and the specifics involved. Generally, it can take anywhere from a few days to a couple of weeks to draft and finalize the document.

What happens after an Investment Letter of Intent is signed?

Once signed, the parties usually engage in further discussions and due diligence. This process involves examining financial statements, assessing risks, and negotiating the final investment agreement. Both parties aim to come to a mutual understanding before proceeding.

Can the terms of the Investment Letter of Intent be amended later?

Yes, the terms of an Investment Letter of Intent can be amended if both parties agree. It is advisable to document any changes clearly to avoid misunderstandings in the future. Written amendments are recommended for clarity and record-keeping.

What should I consider before signing an Investment Letter of Intent?

Prior to signing, consider the implications of the investment, the terms proposed, and how the investment aligns with your goals. It may also be useful to seek legal or financial advice to ensure that all aspects are understood and acceptable.

Is it necessary to consult a lawyer when preparing an Investment Letter of Intent?

While it is not mandatory to consult a lawyer, doing so can be beneficial. A legal professional can provide guidance, help clarify terms, and ensure that your interests are adequately protected throughout the investment process.

What are the consequences of not following through after signing an Investment Letter of Intent?

Not following through after signing an Investment Letter of Intent could damage your reputation and relationships with potential investors or business partners. While it may not have legal consequences, it is always advisable to communicate openly with the involved parties about any changes in intentions.