What is a Transfer-on-Death Deed in Illinois?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in Illinois to transfer ownership of their real estate to designated beneficiaries upon their death. This deed operates outside the probate process, making the transfer simpler and often quicker for the beneficiaries.

Who can create a Transfer-on-Death Deed?

Any individual who is the sole owner or co-owner of the property can create a Transfer-on-Death Deed. This includes individuals who hold title to a property as tenants in common or joint tenants. However, both owners must agree if the property is jointly owned, and the process may vary slightly depending on ownership type.

How does one complete a Transfer-on-Death Deed?

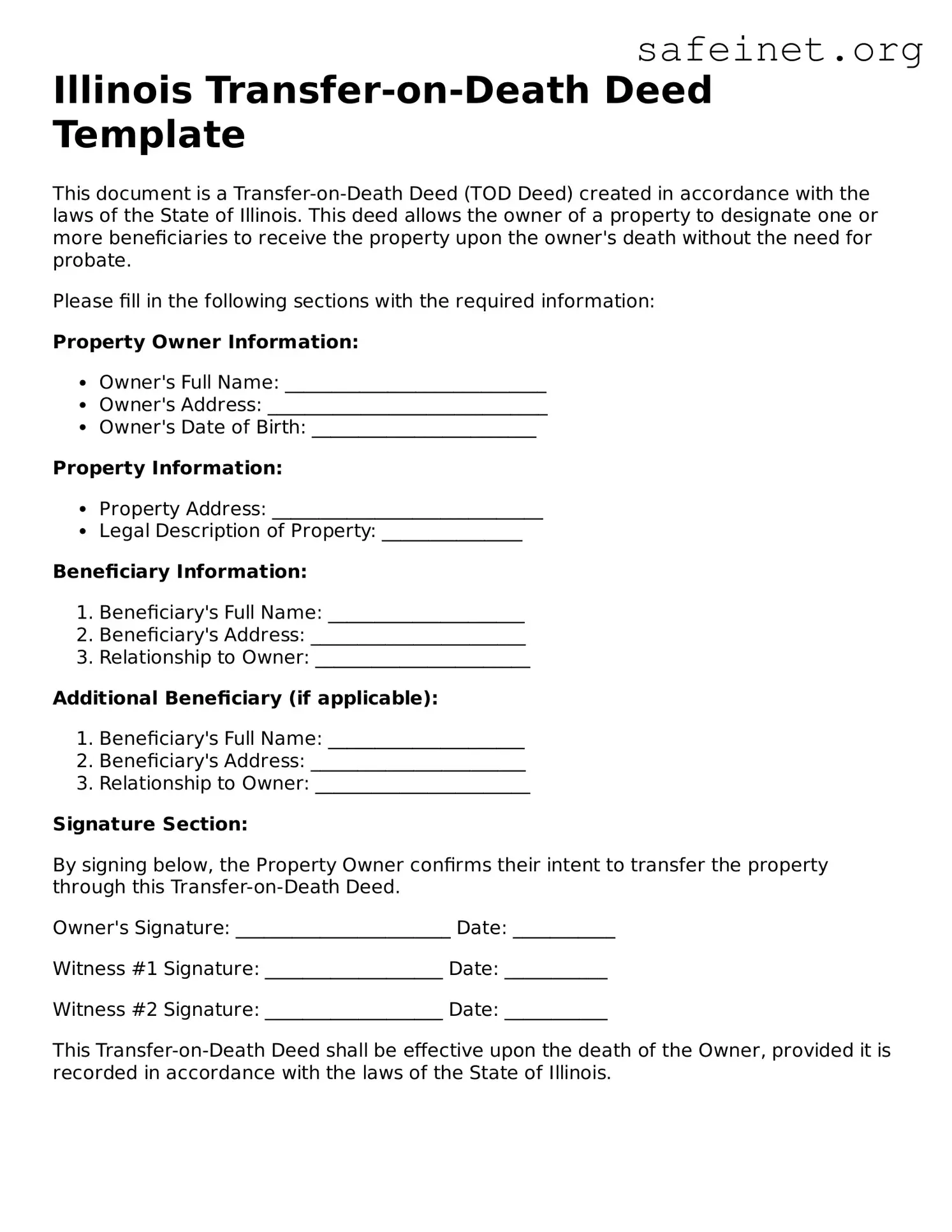

To complete a Transfer-on-Death Deed in Illinois, the property owner must fill out the form with necessary details such as the owner's name, the property description, and the names of the beneficiaries. The document must be signed by the owner in the presence of a notary. Once signed, it should be filed with the county Recorder’s Office where the property is located to ensure it is legally effective.

Can I revoke or change a Transfer-on-Death Deed after it is created?

Yes, a Transfer-on-Death Deed can be revoked or changed at any time before the owner’s death. To revoke the deed, the owner must file a formal revocation document with the county Recorder’s Office. If changes are needed, a new deed can be created and recorded, replacing the old one. It is essential to follow proper procedures to avoid confusion regarding the property’s ownership.

What happens if the beneficiary predeceases the owner?

If the designated beneficiary dies before the owner, ownership of the property will not automatically transfer. Instead, the deed will need to be reviewed to determine if alternative beneficiaries are listed or if the property enters probate to determine its rightful heirs. If the owner wishes to change beneficiaries, this can be accomplished by revoking the initial deed and creating a new one.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger immediate tax consequences. However, beneficiaries may be liable for property taxes after the transfer occurs. Additionally, estate taxes may apply based on the total value of the estate upon the owner’s death. It's advisable to consult a tax professional for guidance specific to individual circumstances.

Does a Transfer-on-Death Deed affect mortgage obligations?

A Transfer-on-Death Deed does not eliminate the mortgage obligations. If the owner of a mortgaged property passes away, the beneficiaries will inherit the property along with any outstanding debts, including the mortgage. It is important for beneficiaries to communicate with the lender to understand the next steps regarding the mortgage obligations after the property transfer.

Can I use a Transfer-on-Death Deed for all types of property in Illinois?

A Transfer-on-Death Deed can only be used for residential real estate, such as single-family homes, condominiums, and certain types of properties. It cannot be used for commercial real estate, vehicles, or personal property. Specific regulations and limitations may apply, so it's best to consult a legal advisor if there are questions about a particular case.