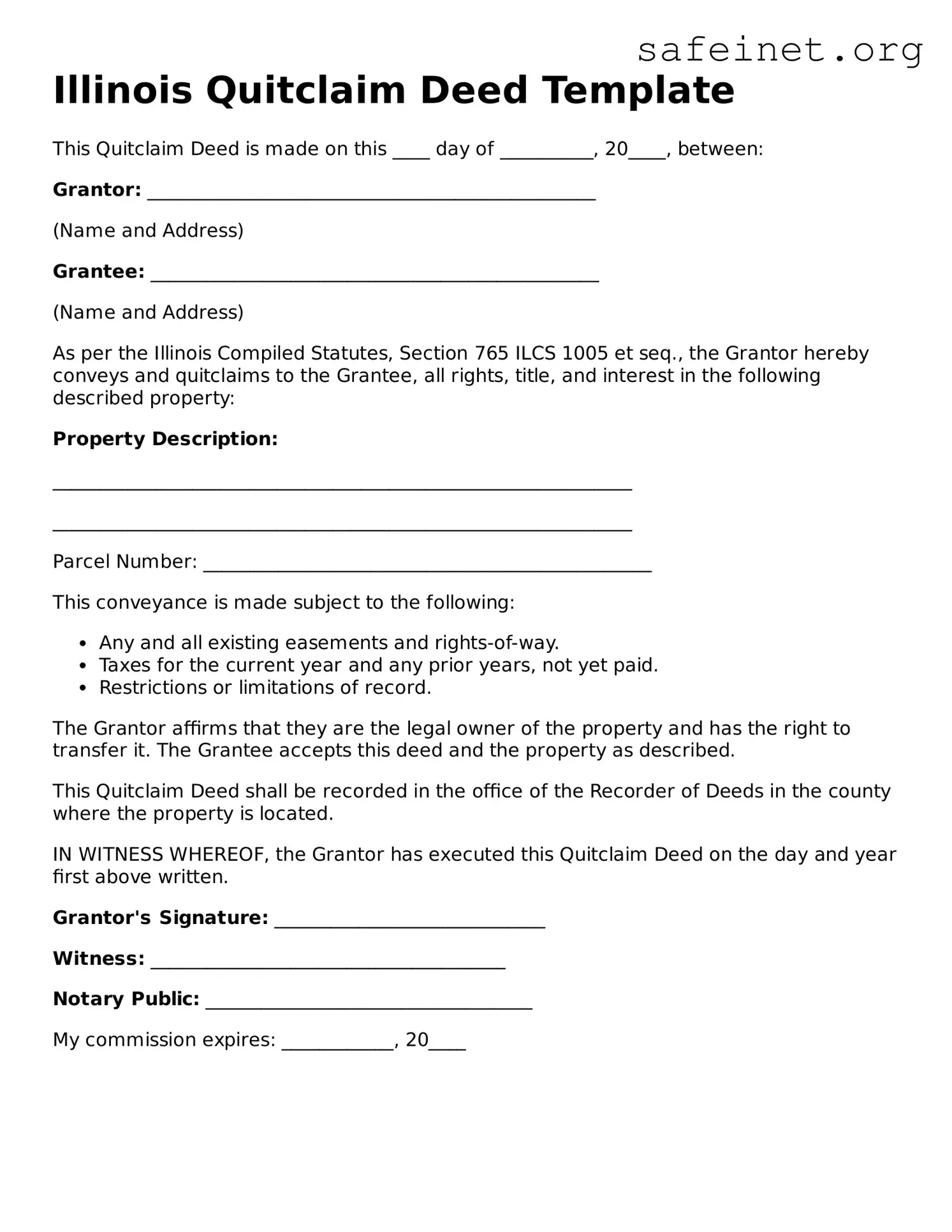

Illinois Quitclaim Deed Template

This Quitclaim Deed is made on this ____ day of __________, 20____, between:

Grantor: ________________________________________________

(Name and Address)

Grantee: ________________________________________________

(Name and Address)

As per the Illinois Compiled Statutes, Section 765 ILCS 1005 et seq., the Grantor hereby conveys and quitclaims to the Grantee, all rights, title, and interest in the following described property:

Property Description:

______________________________________________________________

______________________________________________________________

Parcel Number: ________________________________________________

This conveyance is made subject to the following:

- Any and all existing easements and rights-of-way.

- Taxes for the current year and any prior years, not yet paid.

- Restrictions or limitations of record.

The Grantor affirms that they are the legal owner of the property and has the right to transfer it. The Grantee accepts this deed and the property as described.

This Quitclaim Deed shall be recorded in the office of the Recorder of Deeds in the county where the property is located.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed on the day and year first above written.

Grantor's Signature: _____________________________

Witness: ______________________________________

Notary Public: ___________________________________

My commission expires: ____________, 20____