What is an Illinois Loan Agreement form?

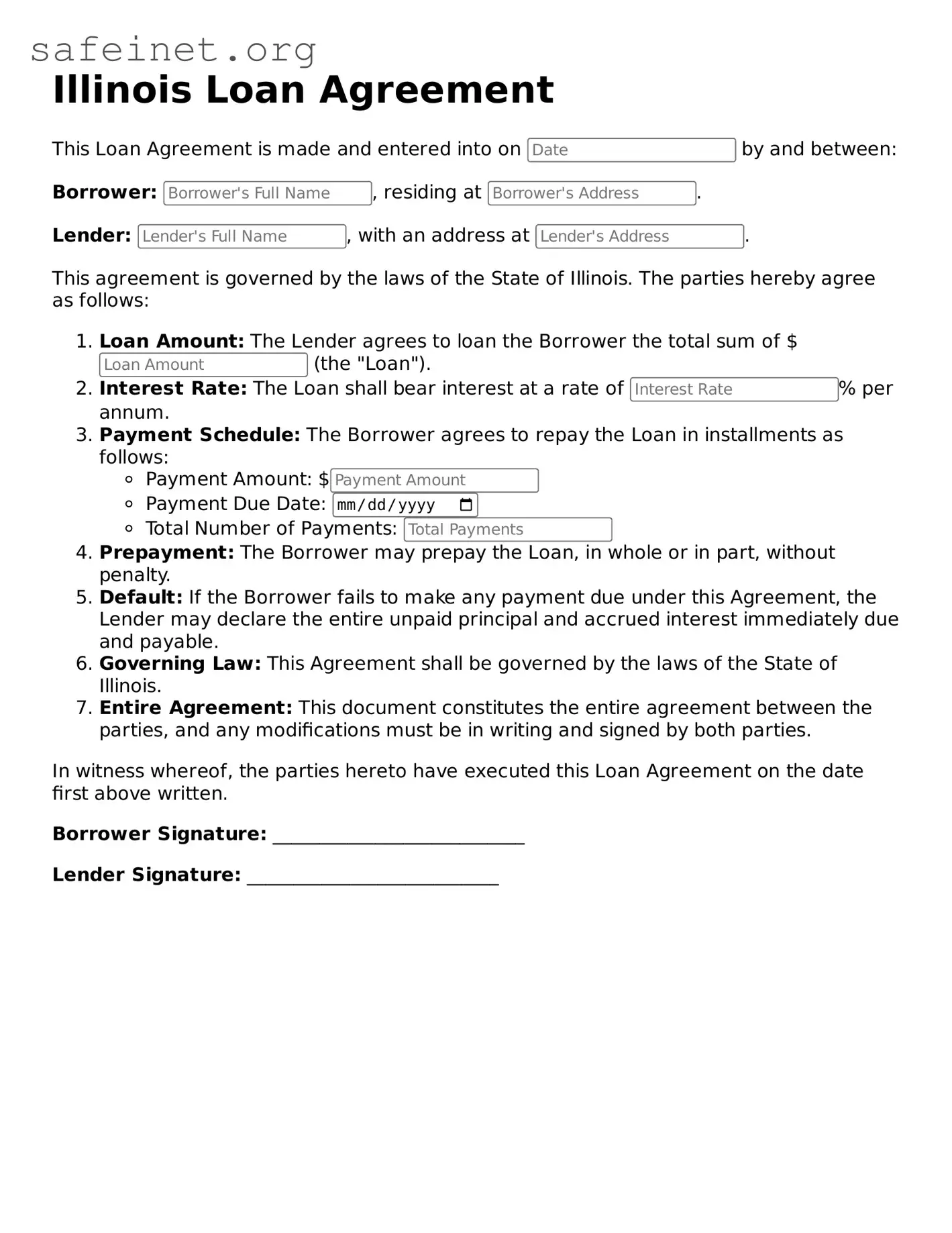

The Illinois Loan Agreement form is a legal document that outlines the terms and conditions under which one party borrows money from another party. This form is used to ensure that both the lender and borrower understand their obligations and rights under the loan.

Who should use this form?

This form is designed for individuals or businesses in Illinois that wish to formalize a loan arrangement. Whether you are borrowing or lending money, using this form helps prevent misunderstandings and provides legal protection for both parties involved.

What information is required to complete the form?

To fill out the Illinois Loan Agreement form, you will need to provide details such as the names and addresses of both the lender and the borrower, the amount of money being loaned, the interest rate (if any), repayment terms, and any collateral being offered to secure the loan.

Can I customize the Loan Agreement form?

Yes, while the form provides a basic framework, you can customize it to fit your specific agreement. However, it is essential to ensure that any changes comply with Illinois laws to maintain the agreement's validity.

What happens if the borrower defaults on the loan?

If the borrower fails to repay the loan as agreed, the lender may have the right to take legal action to recover the owed amount. This could include garnishing wages, seizing collateral, or other remedies as outlined in the agreement.

Is it necessary to have the Loan Agreement notarized?

While it is not legally required to notarize the agreement, having it notarized adds a layer of authenticity and can make the document more credible in a court setting if disputes arise.

Can the Loan Agreement be terminated early?

Yes, the Loan Agreement can be terminated early if both parties agree to the terms in writing. This could happen if the borrower pays off the loan in full before the agreed-upon term ends, or if both parties decide to renegotiate the agreement.

Do I need a lawyer to create or review this form?

While you do not necessarily need a lawyer to create or review the Illinois Loan Agreement form, consulting with one can be beneficial. A legal professional can help ensure that the agreement complies with state laws and effectively protects your interests.

What are the consequences of not having a written Loan Agreement?

Without a written loan agreement, misunderstandings and disputes may arise regarding the terms of the loan. This lack of clarity can lead to potential legal challenges, making it harder to enforce repayment or resolve grievances.

What should I do if there is a dispute over the Loan Agreement?

If a dispute arises, the first step is to review the terms of the agreement closely. Attempting to resolve the issue directly with the other party can be effective. If that fails, mediation or legal action may be necessary depending on the severity of the breach.