What is a Last Will and Testament in Illinois?

A Last Will and Testament is a legal document that outlines how a person wishes to distribute their assets and property after their death. In Illinois, this document must meet specific legal requirements to be valid. It serves as an essential tool for ensuring that one's wishes are fulfilled and can help avoid potential disputes among survivors.

What are the requirements for creating a valid Last Will and Testament in Illinois?

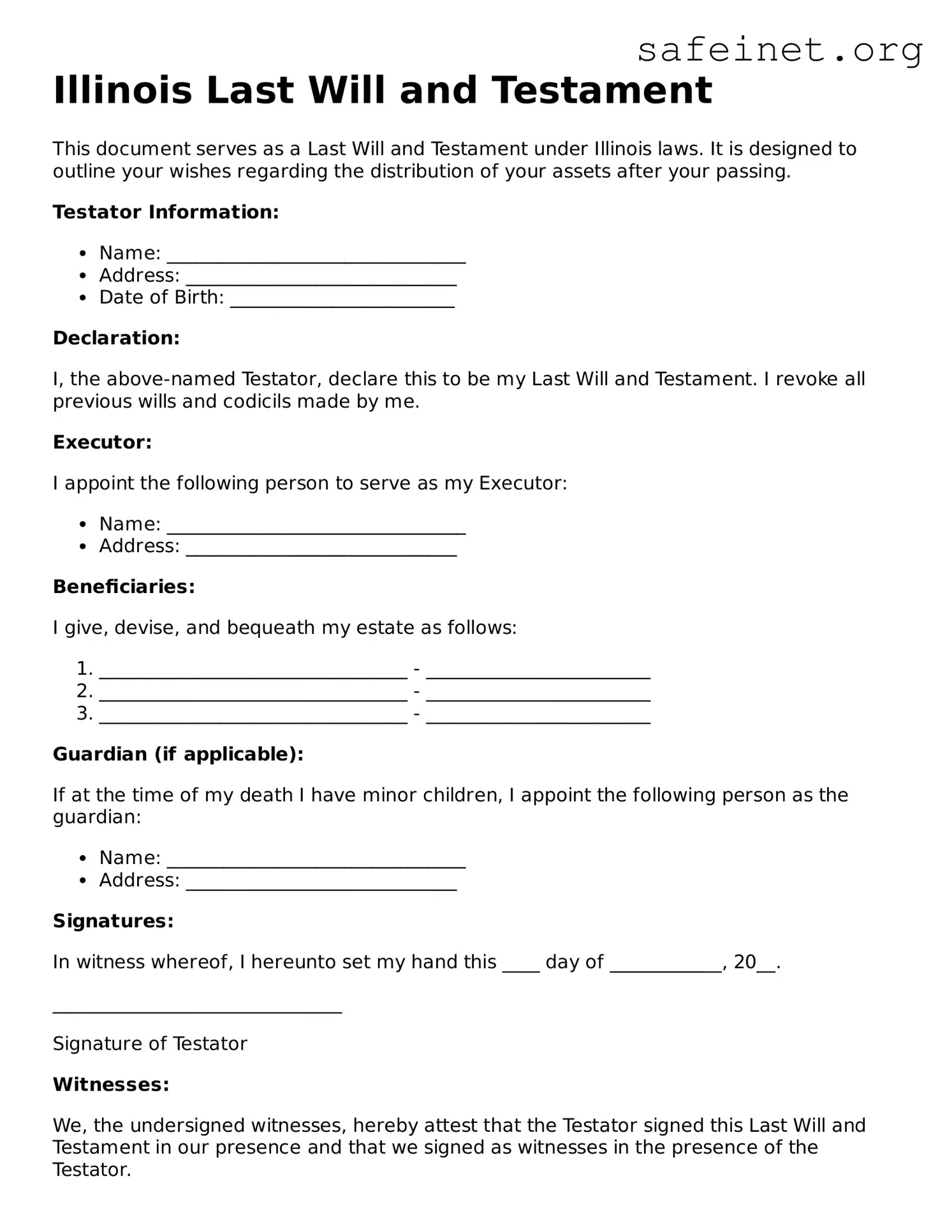

To create a valid Last Will and Testament in Illinois, you must be at least 18 years old and of sound mind at the time of drafting. The will must be in writing, either typed or handwritten, and must be signed by the testator (the person making the will). Additionally, it must be witnessed by at least two individuals who are not beneficiaries of the will. These witnesses must also sign the document in the presence of the testator, confirming authenticity.

Can I change my will once it is created?

Yes, you can change your will at any time while you are still alive and of sound mind. This can be done by creating a new will or by making a codicil, which is a legal document that amends the original will. It is crucial to follow proper legal procedures when making modifications to ensure that the changes are valid and enforceable.

What happens if I die without a will in Illinois?

If you die without a will in Illinois, your estate will be distributed according to the state's intestacy laws. These laws dictate how assets are divided among surviving relatives, which may not align with your personal wishes. This process can lead to complications, delays, and potential disputes among family members, making it advisable to prepare a will.

Can I write my will on my own, or do I need a lawyer?

While you can write your will on your own, consulting with an attorney is highly recommended. An experienced lawyer can help ensure that your will complies with all legal requirements and adequately addresses your unique circumstances. This guidance can be invaluable in reducing the likelihood of misunderstandings or legal challenges after your passing.

What assets can I include in my Last Will and Testament?

You may include a wide range of assets in your Last Will and Testament, such as real estate, bank accounts, personal belongings, vehicles, and investments. It is essential to detail your wishes clearly to avoid confusion. Keep in mind that certain assets, like life insurance policies and retirement accounts, often have designated beneficiaries and are not governed by your will.

What is the role of an executor in an Illinois will?

The executor is the person appointed in the will to manage the estate after the testator's death. This individual is responsible for ensuring that the terms of the will are carried out, paying any debts and taxes owed by the estate, and distributing the remaining assets to beneficiaries. It is crucial to choose a reliable and trustworthy person for this role.

How can I ensure that my will is properly executed?

To ensure proper execution of your will, follow the legal requirements closely, including signing and witnessing the document as stipulated by Illinois law. Store the will in a safe and accessible place, and inform your executor and key family members about its location. Regularly review and update the will as needed to reflect any life changes or shifts in your preferences.

Is it necessary to notarize a Last Will and Testament in Illinois?

While notarization is not required for a Last Will and Testament in Illinois, it can provide additional legal protection by verifying the identity of the testator and witnesses. If a will is notarized and created according to Illinois laws, it may be easier to uphold in court if questioned. Keeping a well-organized copy of the notarized will is advisable.