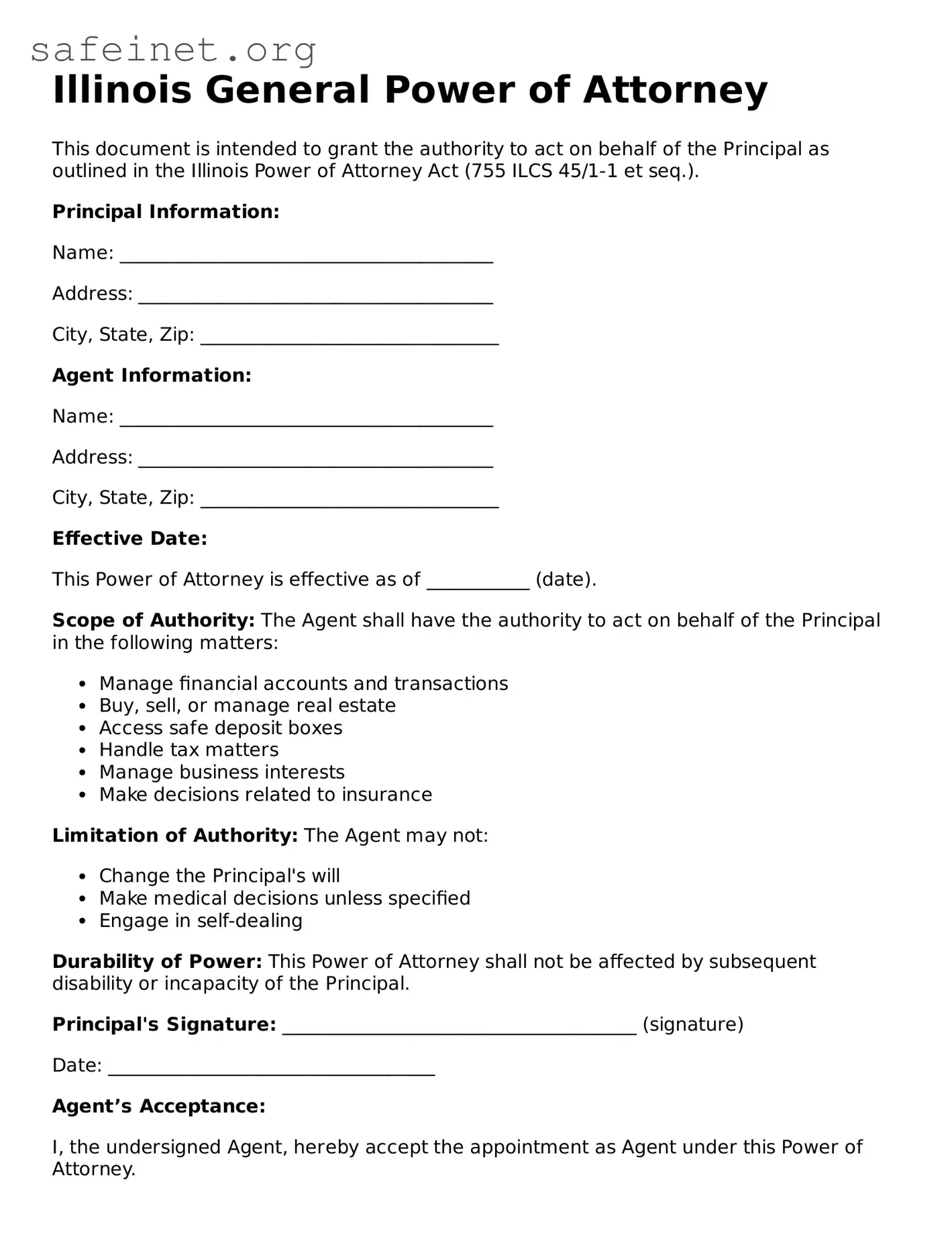

Illinois General Power of Attorney

This document is intended to grant the authority to act on behalf of the Principal as outlined in the Illinois Power of Attorney Act (755 ILCS 45/1-1 et seq.).

Principal Information:

Name: ________________________________________

Address: ______________________________________

City, State, Zip: ________________________________

Agent Information:

Name: ________________________________________

Address: ______________________________________

City, State, Zip: ________________________________

Effective Date:

This Power of Attorney is effective as of ___________ (date).

Scope of Authority: The Agent shall have the authority to act on behalf of the Principal in the following matters:

- Manage financial accounts and transactions

- Buy, sell, or manage real estate

- Access safe deposit boxes

- Handle tax matters

- Manage business interests

- Make decisions related to insurance

Limitation of Authority: The Agent may not:

- Change the Principal's will

- Make medical decisions unless specified

- Engage in self-dealing

Durability of Power: This Power of Attorney shall not be affected by subsequent disability or incapacity of the Principal.

Principal's Signature: ______________________________________ (signature)

Date: ___________________________________

Agent’s Acceptance:

I, the undersigned Agent, hereby accept the appointment as Agent under this Power of Attorney.

Signature: ___________________________________

Date: ___________________________________

Witnesses:

- __________________________________________ (name & signature)

- __________________________________________ (name & signature)

Notarization:

State of Illinois

County of ________________________________

Subscribed and sworn before me on this _____ day of ___________, 20__.

__________________________________________ (Notary Public Signature)

My Commission Expires: ____________________