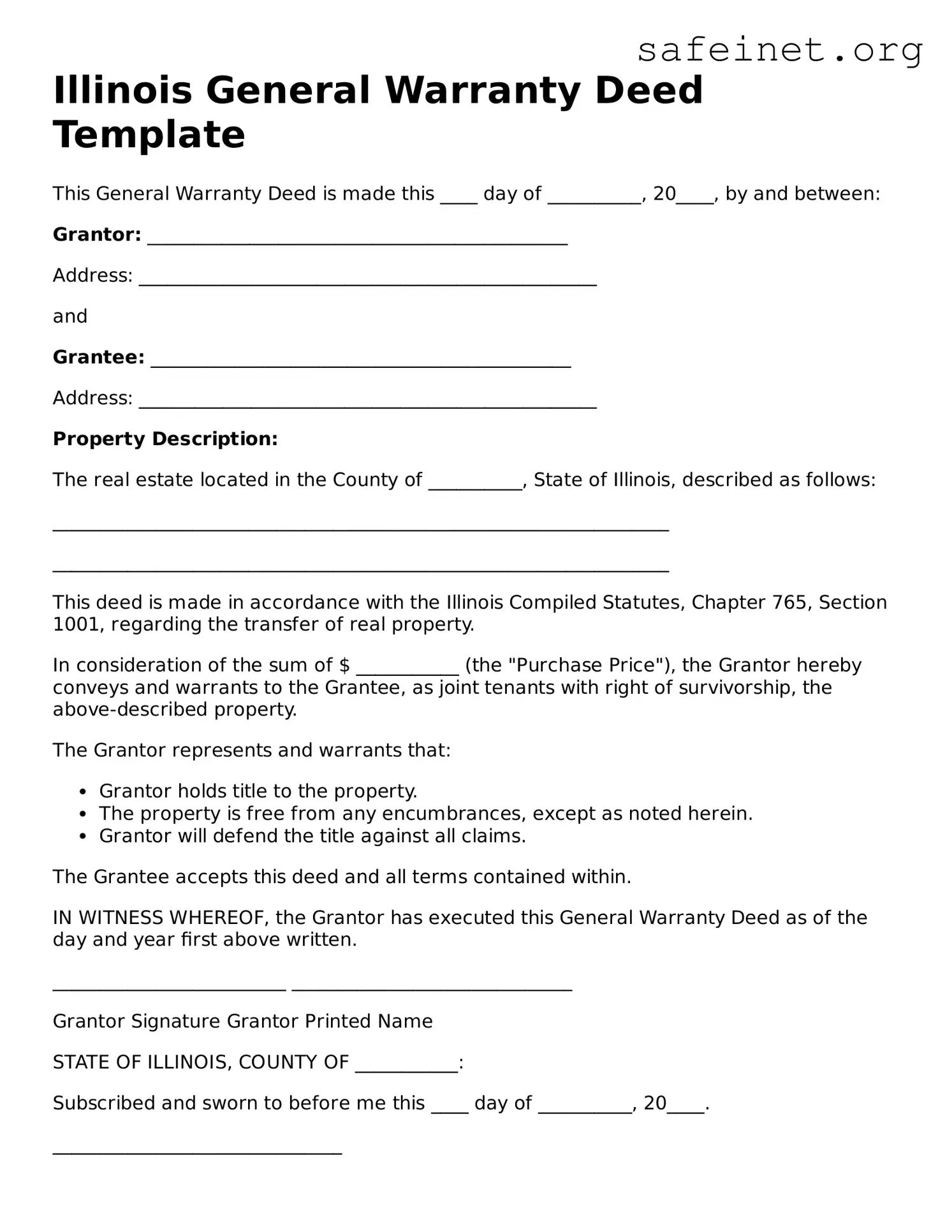

Illinois General Warranty Deed Template

This General Warranty Deed is made this ____ day of __________, 20____, by and between:

Grantor: _____________________________________________

Address: _________________________________________________

and

Grantee: _____________________________________________

Address: _________________________________________________

Property Description:

The real estate located in the County of __________, State of Illinois, described as follows:

__________________________________________________________________

__________________________________________________________________

This deed is made in accordance with the Illinois Compiled Statutes, Chapter 765, Section 1001, regarding the transfer of real property.

In consideration of the sum of $ ___________ (the "Purchase Price"), the Grantor hereby conveys and warrants to the Grantee, as joint tenants with right of survivorship, the above-described property.

The Grantor represents and warrants that:

- Grantor holds title to the property.

- The property is free from any encumbrances, except as noted herein.

- Grantor will defend the title against all claims.

The Grantee accepts this deed and all terms contained within.

IN WITNESS WHEREOF, the Grantor has executed this General Warranty Deed as of the day and year first above written.

_________________________ ______________________________

Grantor Signature Grantor Printed Name

STATE OF ILLINOIS, COUNTY OF ___________:

Subscribed and sworn to before me this ____ day of __________, 20____.

_______________________________

Notary Public Signature

My Commission Expires: ___________