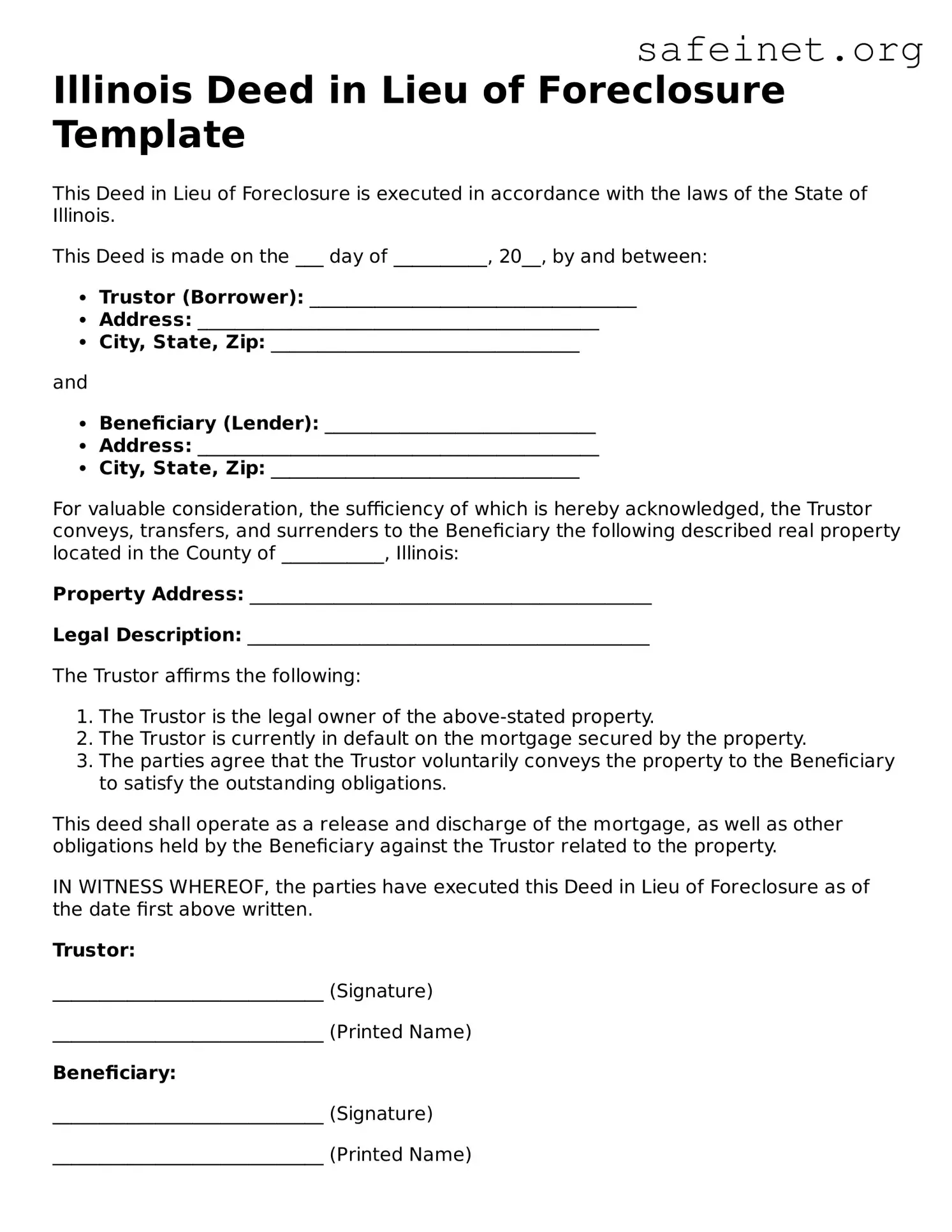

Illinois Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed in accordance with the laws of the State of Illinois.

This Deed is made on the ___ day of __________, 20__, by and between:

- Trustor (Borrower): ___________________________________

- Address: ___________________________________________

- City, State, Zip: _________________________________

and

- Beneficiary (Lender): _____________________________

- Address: ___________________________________________

- City, State, Zip: _________________________________

For valuable consideration, the sufficiency of which is hereby acknowledged, the Trustor conveys, transfers, and surrenders to the Beneficiary the following described real property located in the County of ___________, Illinois:

Property Address: ___________________________________________

Legal Description: ___________________________________________

The Trustor affirms the following:

- The Trustor is the legal owner of the above-stated property.

- The Trustor is currently in default on the mortgage secured by the property.

- The parties agree that the Trustor voluntarily conveys the property to the Beneficiary to satisfy the outstanding obligations.

This deed shall operate as a release and discharge of the mortgage, as well as other obligations held by the Beneficiary against the Trustor related to the property.

IN WITNESS WHEREOF, the parties have executed this Deed in Lieu of Foreclosure as of the date first above written.

Trustor:

_____________________________ (Signature)

_____________________________ (Printed Name)

Beneficiary:

_____________________________ (Signature)

_____________________________ (Printed Name)

STATE OF ILLINOIS

COUNTY OF __________________

Subscribed and sworn to before me this ___ day of __________, 20__.

_____________________________ (Notary Public)

My commission expires: _______________