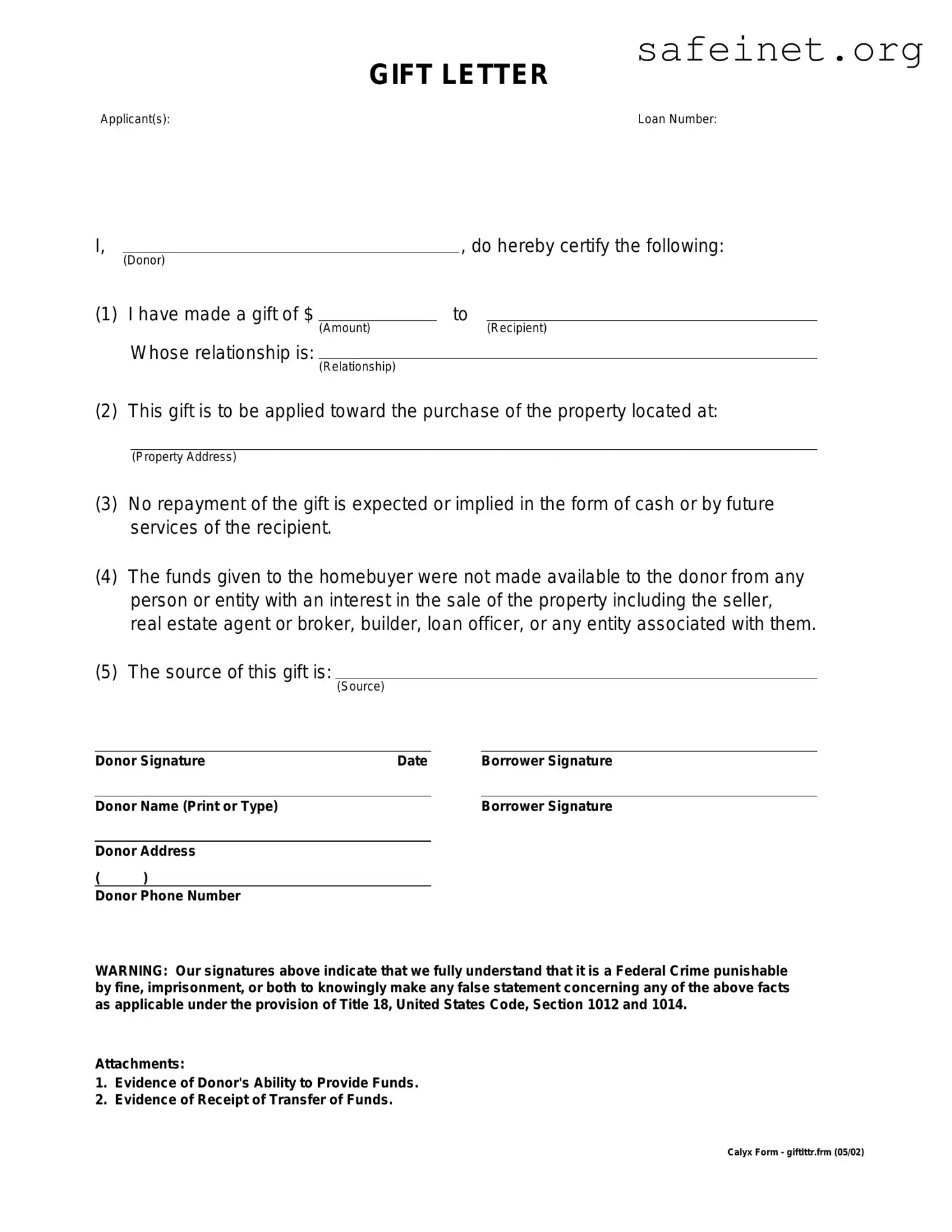

What is a Gift Letter form?

A Gift Letter form is a document used to verify that a monetary gift is given to a buyer without the expectation of repayment. It serves as evidence that the funds come from a legitimate source and helps facilitate the home mortgage approval process. Lenders require this letter to ensure borrowers can account for their down payment funds and that they are not incurring additional debt.

Who needs to provide a Gift Letter?

This form is typically needed by homebuyers who receive financial assistance from family members or friends for a down payment. If your down payment comes entirely or partly from a gift, the lender will likely require a Gift Letter to verify its legitimacy.

What information must be included in the Gift Letter?

The Gift Letter should include specific details such as the donor's name, address, and relationship to the recipient, as well as the amount of the gift. It should explicitly state that the funds are a gift and not a loan, meaning there is no expectation of repayment. Additionally, the letter may need to be signed and dated by the donor.

Can a Gift Letter be used for any purpose?

Generally, a Gift Letter is used for home purchases, specifically for down payments or closing costs. However, lenders may have specific rules about how the funds can be used, so it is essential to clarify with your loan officer whether the use of the gift funds aligns with their guidelines.

Are there any limits on the amount that can be gifted?

While there is no set limit on how much money can be gifted, the Internal Revenue Service allows individuals to gift a certain amount each year without incurring a gift tax. As of 2023, this limit is $17,000 per person. However, any amount above this may require additional tax considerations for the donor, but it does not typically affect the recipient's mortgage process.

Do I need an attorney to prepare a Gift Letter?

No, it is not necessary to hire an attorney to prepare a Gift Letter. Most lenders provide a standard template that you can fill out. However, if you have specific legal questions or concerns, you may wish to consult an attorney to ensure all details are correct and meet your lender's requirements.

What if the gift is from a source outside my family?

Gifts from non-family members are often viewed differently by lenders. While some lenders may accept gifts from friends or colleagues, they may require additional documentation to verify the source and ensure that it is indeed a gift and not a loan. It's best to discuss this situation with your lender to understand their specific requirements.