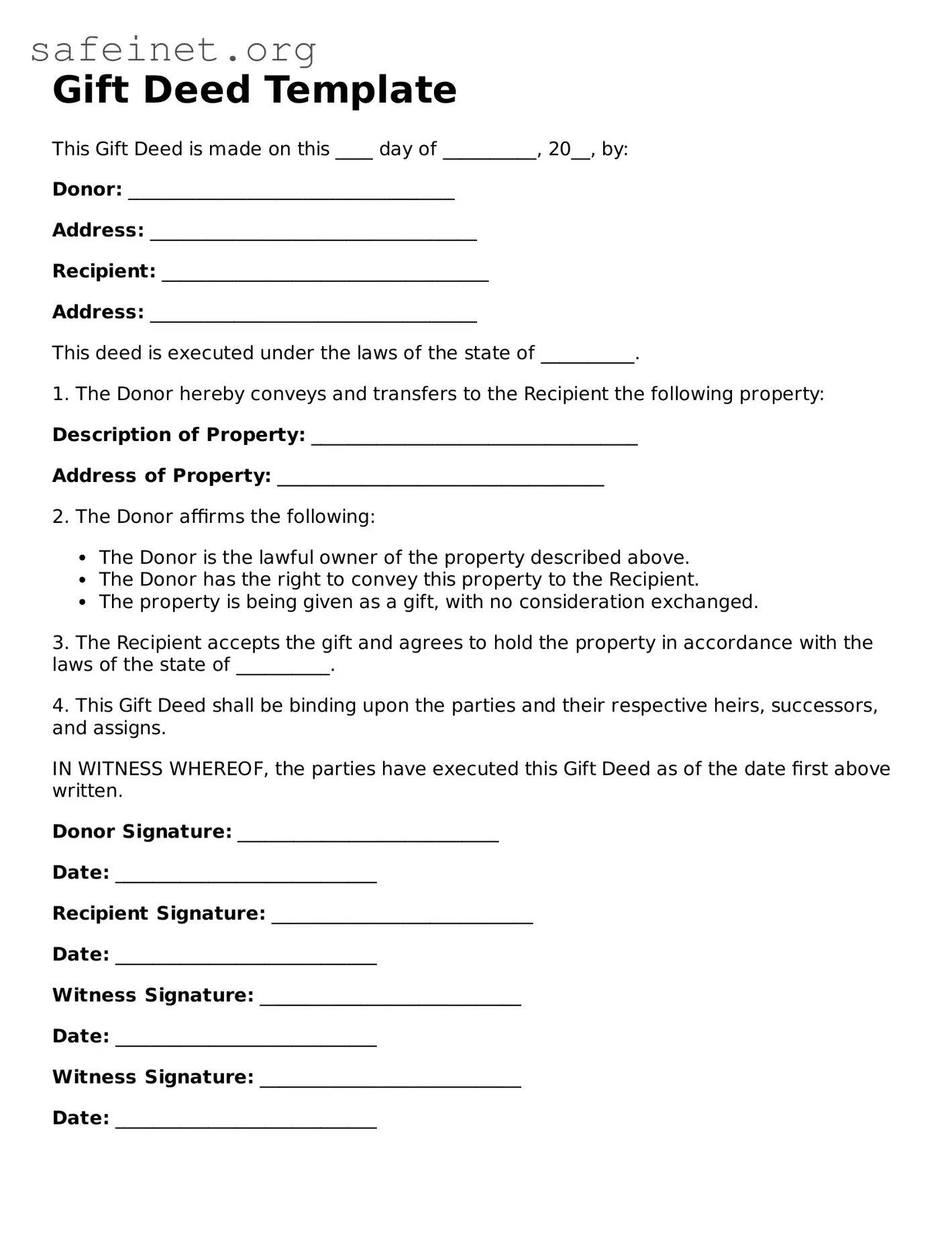

Gift Deed Template

This Gift Deed is made on this ____ day of __________, 20__, by:

Donor: ___________________________________

Address: ___________________________________

Recipient: ___________________________________

Address: ___________________________________

This deed is executed under the laws of the state of __________.

1. The Donor hereby conveys and transfers to the Recipient the following property:

Description of Property: ___________________________________

Address of Property: ___________________________________

2. The Donor affirms the following:

- The Donor is the lawful owner of the property described above.

- The Donor has the right to convey this property to the Recipient.

- The property is being given as a gift, with no consideration exchanged.

3. The Recipient accepts the gift and agrees to hold the property in accordance with the laws of the state of __________.

4. This Gift Deed shall be binding upon the parties and their respective heirs, successors, and assigns.

IN WITNESS WHEREOF, the parties have executed this Gift Deed as of the date first above written.

Donor Signature: ____________________________

Date: ____________________________

Recipient Signature: ____________________________

Date: ____________________________

Witness Signature: ____________________________

Date: ____________________________

Witness Signature: ____________________________

Date: ____________________________