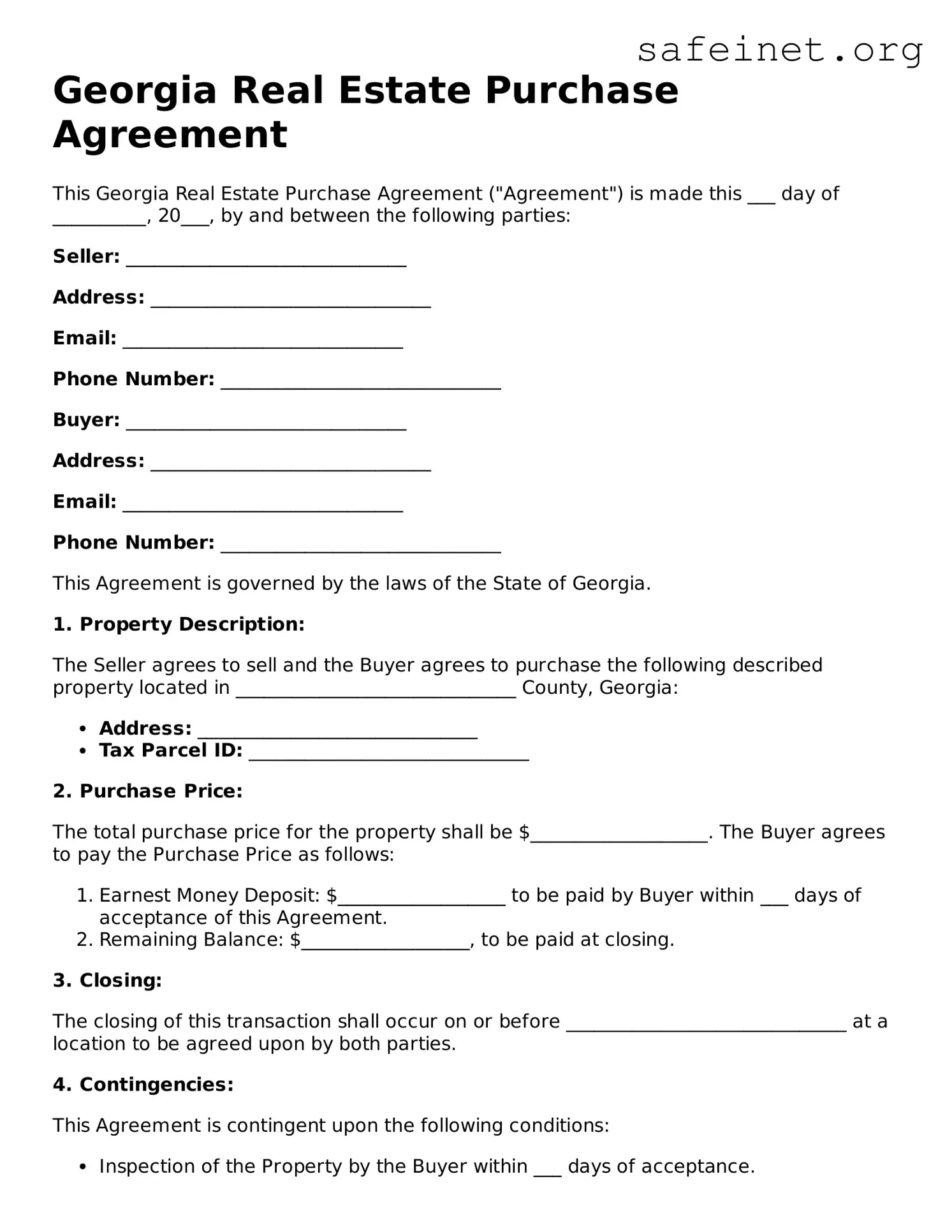

Georgia Real Estate Purchase Agreement

This Georgia Real Estate Purchase Agreement ("Agreement") is made this ___ day of __________, 20___, by and between the following parties:

Seller: ______________________________

Address: ______________________________

Email: ______________________________

Phone Number: ______________________________

Buyer: ______________________________

Address: ______________________________

Email: ______________________________

Phone Number: ______________________________

This Agreement is governed by the laws of the State of Georgia.

1. Property Description:

The Seller agrees to sell and the Buyer agrees to purchase the following described property located in ______________________________ County, Georgia:

- Address: ______________________________

- Tax Parcel ID: ______________________________

2. Purchase Price:

The total purchase price for the property shall be $___________________. The Buyer agrees to pay the Purchase Price as follows:

- Earnest Money Deposit: $__________________ to be paid by Buyer within ___ days of acceptance of this Agreement.

- Remaining Balance: $__________________, to be paid at closing.

3. Closing:

The closing of this transaction shall occur on or before ______________________________ at a location to be agreed upon by both parties.

4. Contingencies:

This Agreement is contingent upon the following conditions:

- Inspection of the Property by the Buyer within ___ days of acceptance.

- Financing approval for the Buyer within ___ days of acceptance.

5. Disclosures:

The Seller agrees to provide all necessary disclosures required by law, including but not limited to:

- Lead-Based Paint Disclosure if the property was built prior to 1978.

- Property Condition Disclosure.

6. Additional Terms:

Any additional terms and conditions of this Agreement shall be attached as an exhibit and made a part of this Agreement.

7. Signatures:

IN WITNESS WHEREOF, the parties have executed this Georgia Real Estate Purchase Agreement as of the day and year first above written.

Seller's Signature: ______________________________ Date: ________________

Buyer's Signature: ______________________________ Date: ________________