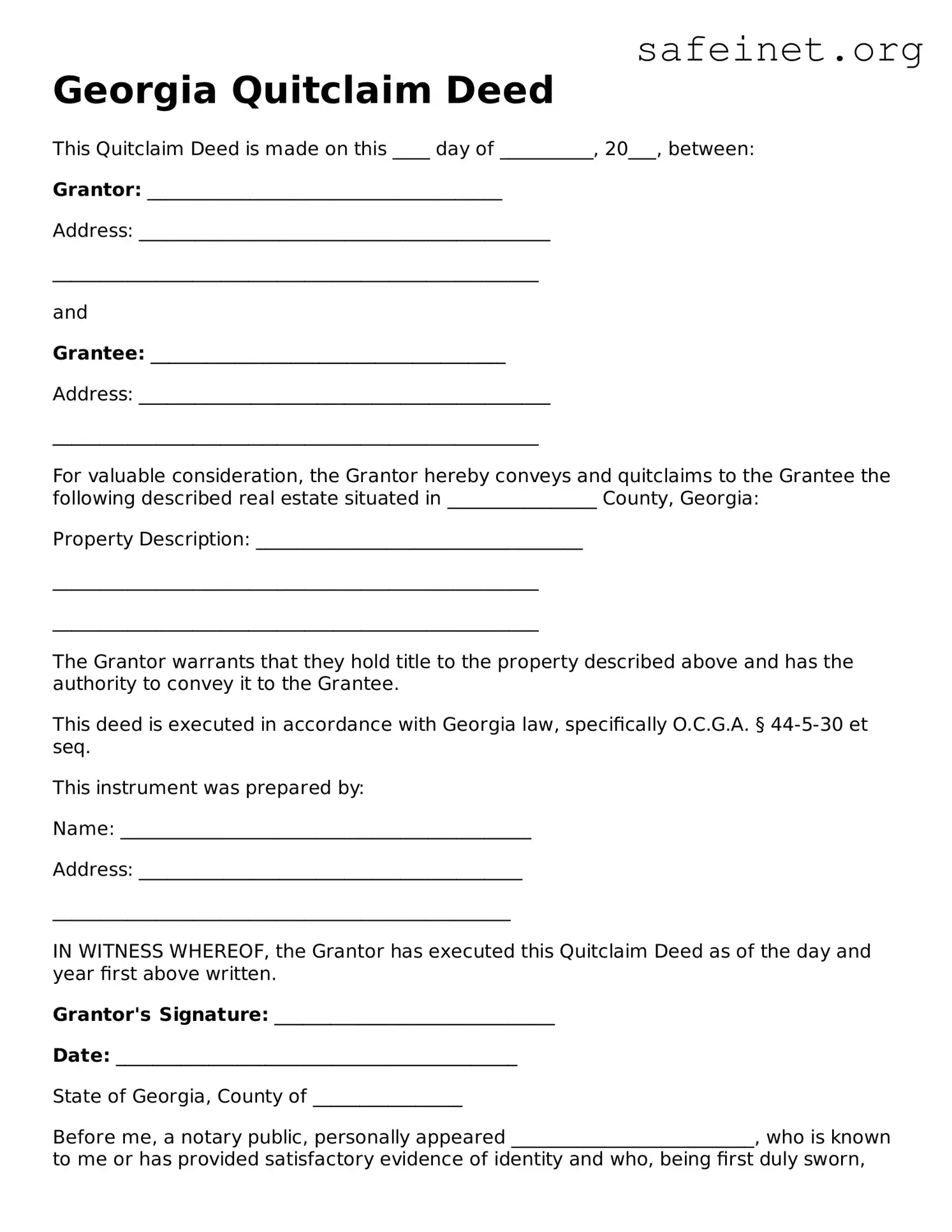

Georgia Quitclaim Deed

This Quitclaim Deed is made on this ____ day of __________, 20___, between:

Grantor: ______________________________________

Address: ____________________________________________

____________________________________________________

and

Grantee: ______________________________________

Address: ____________________________________________

____________________________________________________

For valuable consideration, the Grantor hereby conveys and quitclaims to the Grantee the following described real estate situated in ________________ County, Georgia:

Property Description: ___________________________________

____________________________________________________

____________________________________________________

The Grantor warrants that they hold title to the property described above and has the authority to convey it to the Grantee.

This deed is executed in accordance with Georgia law, specifically O.C.G.A. § 44-5-30 et seq.

This instrument was prepared by:

Name: ____________________________________________

Address: _________________________________________

_________________________________________________

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed as of the day and year first above written.

Grantor's Signature: ______________________________

Date: ___________________________________________

State of Georgia, County of ________________

Before me, a notary public, personally appeared __________________________, who is known to me or has provided satisfactory evidence of identity and who, being first duly sworn, deposes and says that they executed this Quitclaim Deed.

Notary Public Signature: _____________________________

Date: ____________________________________________

My Commission Expires: ___________________________