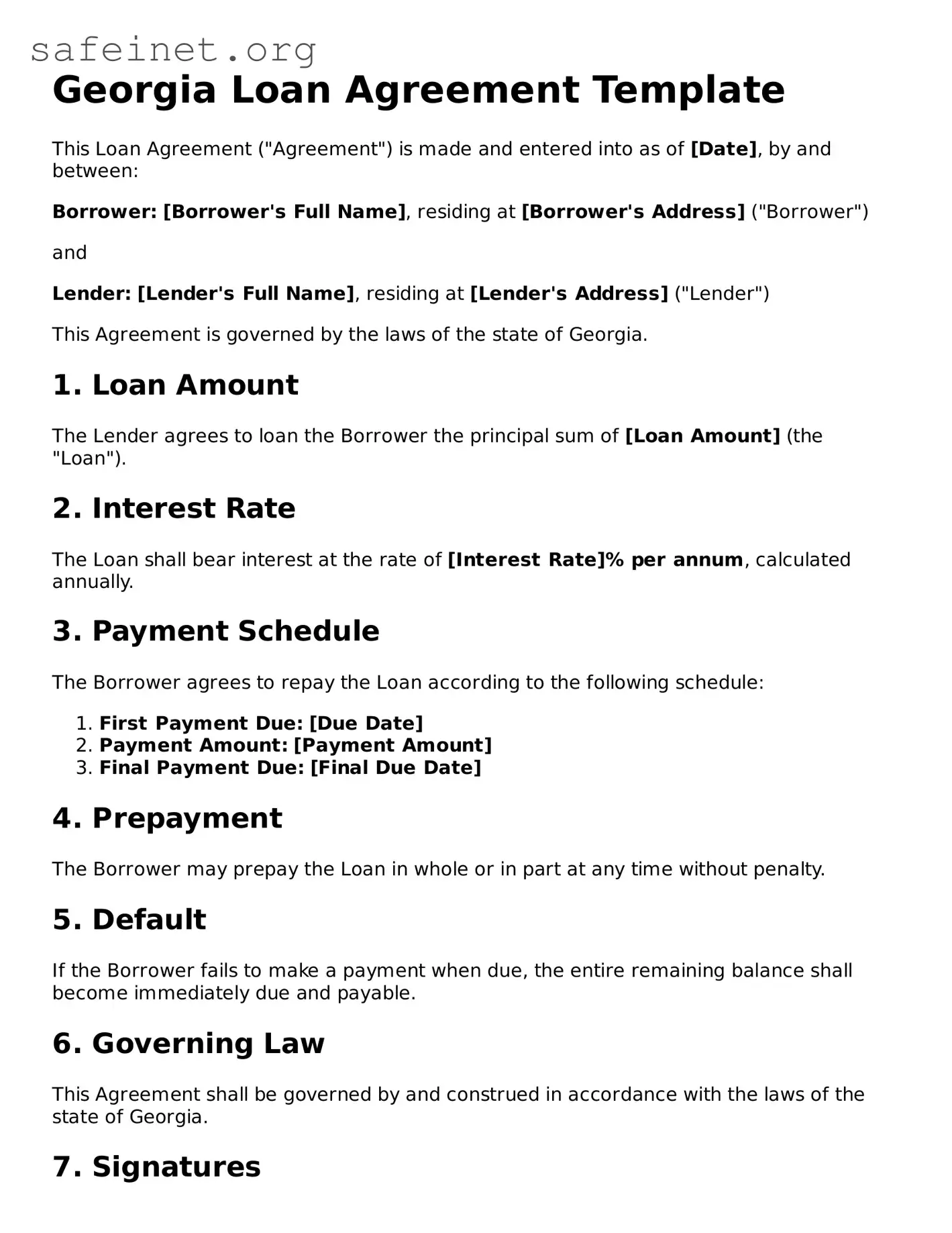

Georgia Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into as of [Date], by and between:

Borrower: [Borrower's Full Name], residing at [Borrower's Address] ("Borrower")

and

Lender: [Lender's Full Name], residing at [Lender's Address] ("Lender")

This Agreement is governed by the laws of the state of Georgia.

1. Loan Amount

The Lender agrees to loan the Borrower the principal sum of [Loan Amount] (the "Loan").

2. Interest Rate

The Loan shall bear interest at the rate of [Interest Rate]% per annum, calculated annually.

3. Payment Schedule

The Borrower agrees to repay the Loan according to the following schedule:

- First Payment Due: [Due Date]

- Payment Amount: [Payment Amount]

- Final Payment Due: [Final Due Date]

4. Prepayment

The Borrower may prepay the Loan in whole or in part at any time without penalty.

5. Default

If the Borrower fails to make a payment when due, the entire remaining balance shall become immediately due and payable.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the state of Georgia.

7. Signatures

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the day and year first above written.

Borrower's Signature: ___________________________

Print Name: [Borrower's Full Name]

Lender's Signature: ___________________________

Print Name: [Lender's Full Name]