What is the Georgia Independent Contractor Agreement form?

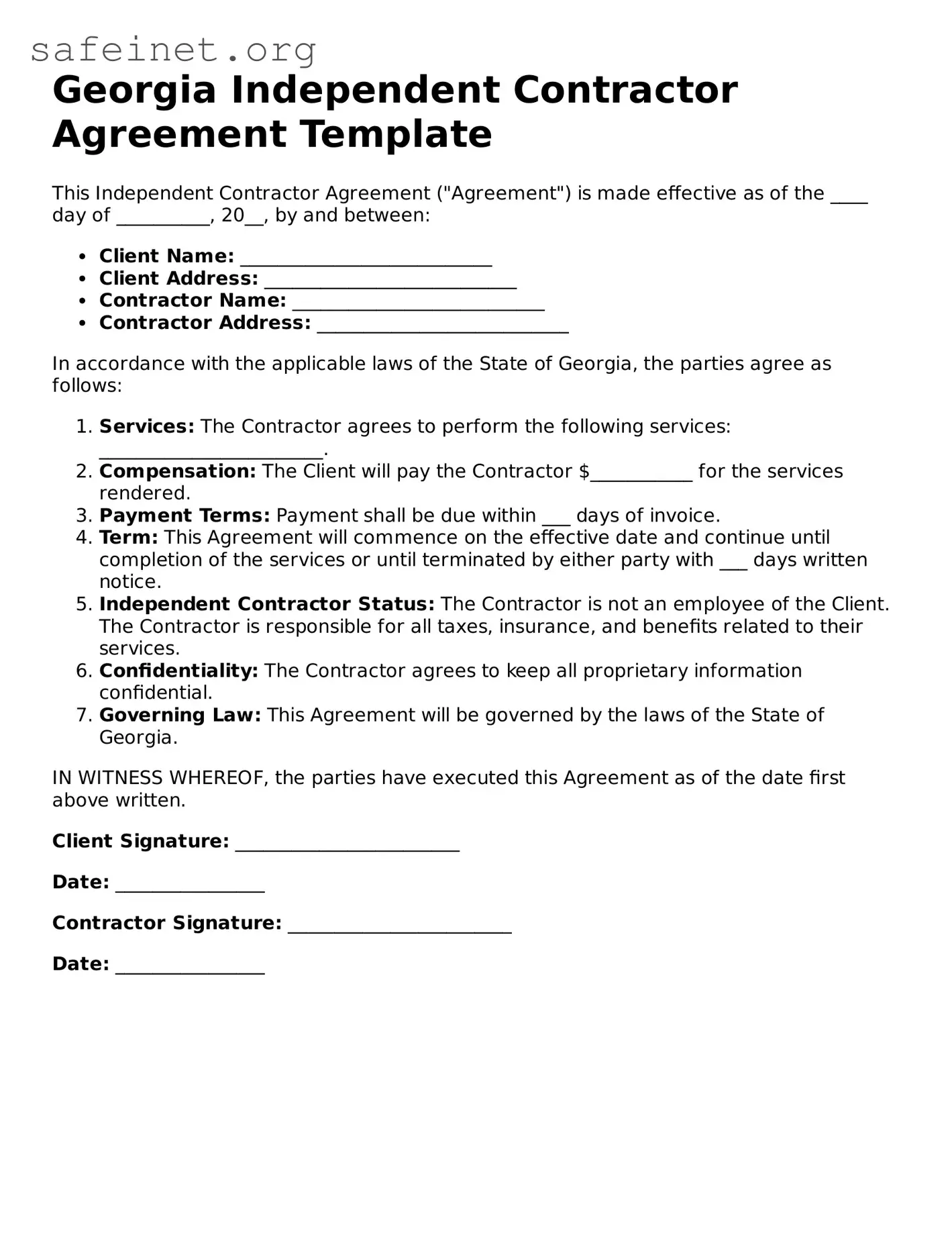

The Georgia Independent Contractor Agreement form is a legal document used to define the terms of a working relationship between a company and an independent contractor. It outlines the specific services to be performed, compensation, and other important conditions of the work arrangement.

Who should use this agreement?

This agreement is best suited for businesses that hire independent contractors for specific projects or services. It is also beneficial for independent contractors who want to clearly define their relationship with the hiring entity.

What are the key components of the agreement?

Key components typically include the scope of work, payment terms, and duration of the agreement. Additionally, it may address confidentiality, ownership of work products, and termination conditions.

Is the agreement legally binding?

Yes, when signed by both parties, the agreement is legally binding. It is important for both the contractor and the company to comply with the terms set forth to avoid legal disputes.

Can the agreement be modified?

Yes, the agreement can be modified. Any changes should be documented in writing and signed by both parties to ensure that all modifications are enforceable.

Are there specific state laws that apply to this agreement?

Yes, the agreement must comply with Georgia state laws governing independent contracting and employment. It is important to be aware of local regulations to ensure compliance.

What happens if there is a dispute?

In the event of a dispute, the agreement may specify how disputes will be resolved, which can include mediation, arbitration, or litigation. It is crucial to follow the procedures outlined in the agreement for resolution.

Do I need a lawyer to create this agreement?

While it is not strictly necessary to hire a lawyer, consulting with one is advisable to ensure that the agreement meets all legal requirements and adequately protects both parties’ interests.

How can I terminate the agreement?

The agreement should include termination clauses that outline how either party can terminate the contract. This may involve providing notice within a specified time frame or fulfilling certain conditions.

Where can I find a template for the Georgia Independent Contractor Agreement?

Templates for the Georgia Independent Contractor Agreement can often be found online through legal resources or professional websites. Ensure that any template used is suitable for your specific situation and meets Georgia law.