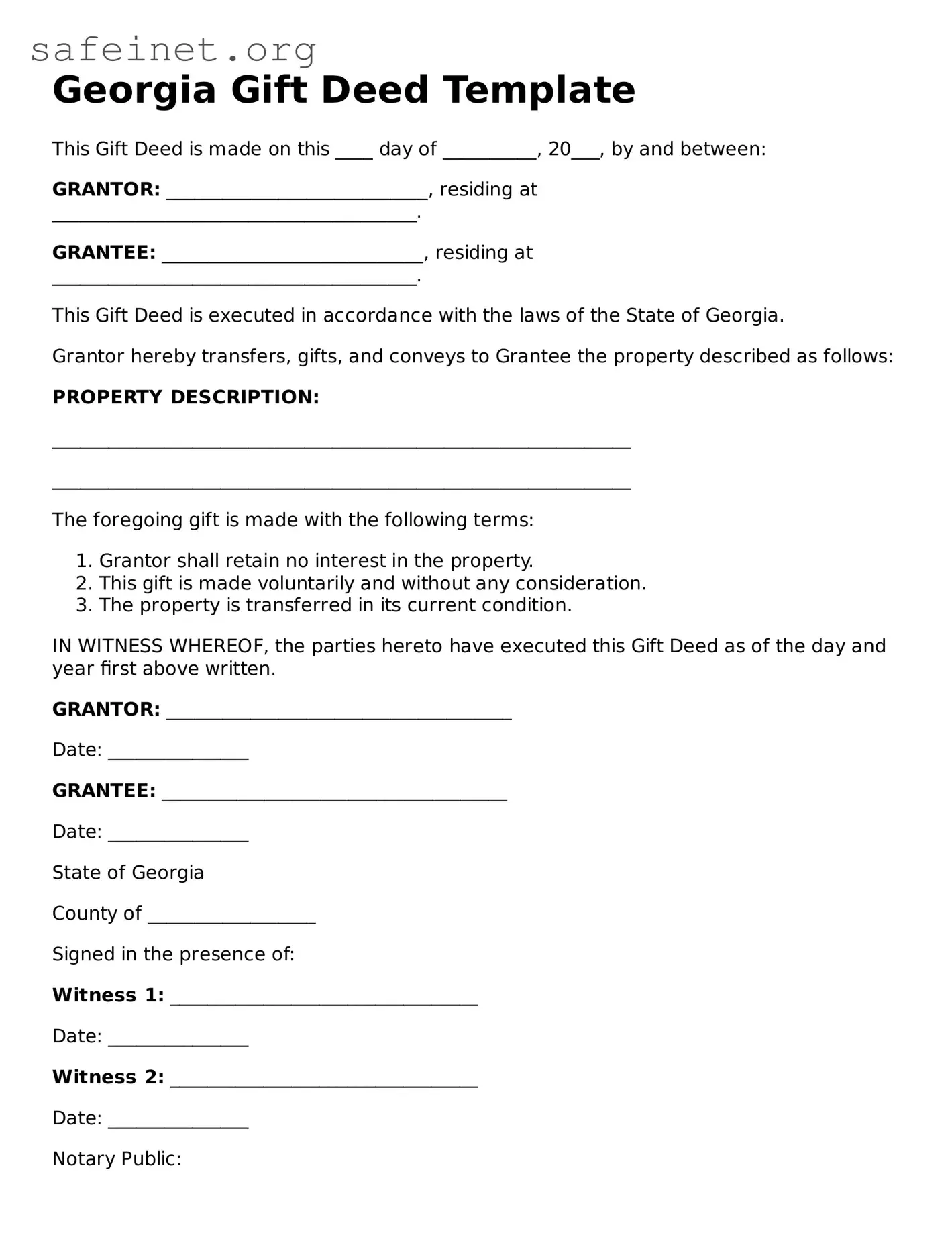

Georgia Gift Deed Template

This Gift Deed is made on this ____ day of __________, 20___, by and between:

GRANTOR: ____________________________, residing at _______________________________________.

GRANTEE: ____________________________, residing at _______________________________________.

This Gift Deed is executed in accordance with the laws of the State of Georgia.

Grantor hereby transfers, gifts, and conveys to Grantee the property described as follows:

PROPERTY DESCRIPTION:

______________________________________________________________

______________________________________________________________

The foregoing gift is made with the following terms:

- Grantor shall retain no interest in the property.

- This gift is made voluntarily and without any consideration.

- The property is transferred in its current condition.

IN WITNESS WHEREOF, the parties hereto have executed this Gift Deed as of the day and year first above written.

GRANTOR: _____________________________________

Date: _______________

GRANTEE: _____________________________________

Date: _______________

State of Georgia

County of __________________

Signed in the presence of:

Witness 1: _________________________________

Date: _______________

Witness 2: _________________________________

Date: _______________

Notary Public:

____________________________________

My Commission Expires: ________________