What is a General Power of Attorney in Georgia?

A General Power of Attorney (POA) in Georgia is a legal document that allows you to appoint someone to act on your behalf in a wide range of financial and legal matters. This can include managing your bank accounts, paying bills, signing contracts, and making insurance decisions. It is crucial for handling affairs when you are unable to do so yourself.

Who can be appointed as an agent under a General Power of Attorney?

You can appoint any competent adult as your agent in a General Power of Attorney. This person should be trustworthy, as they will have significant control over your financial affairs. Common choices include family members, trusted friends, or professionals such as attorneys or accountants.

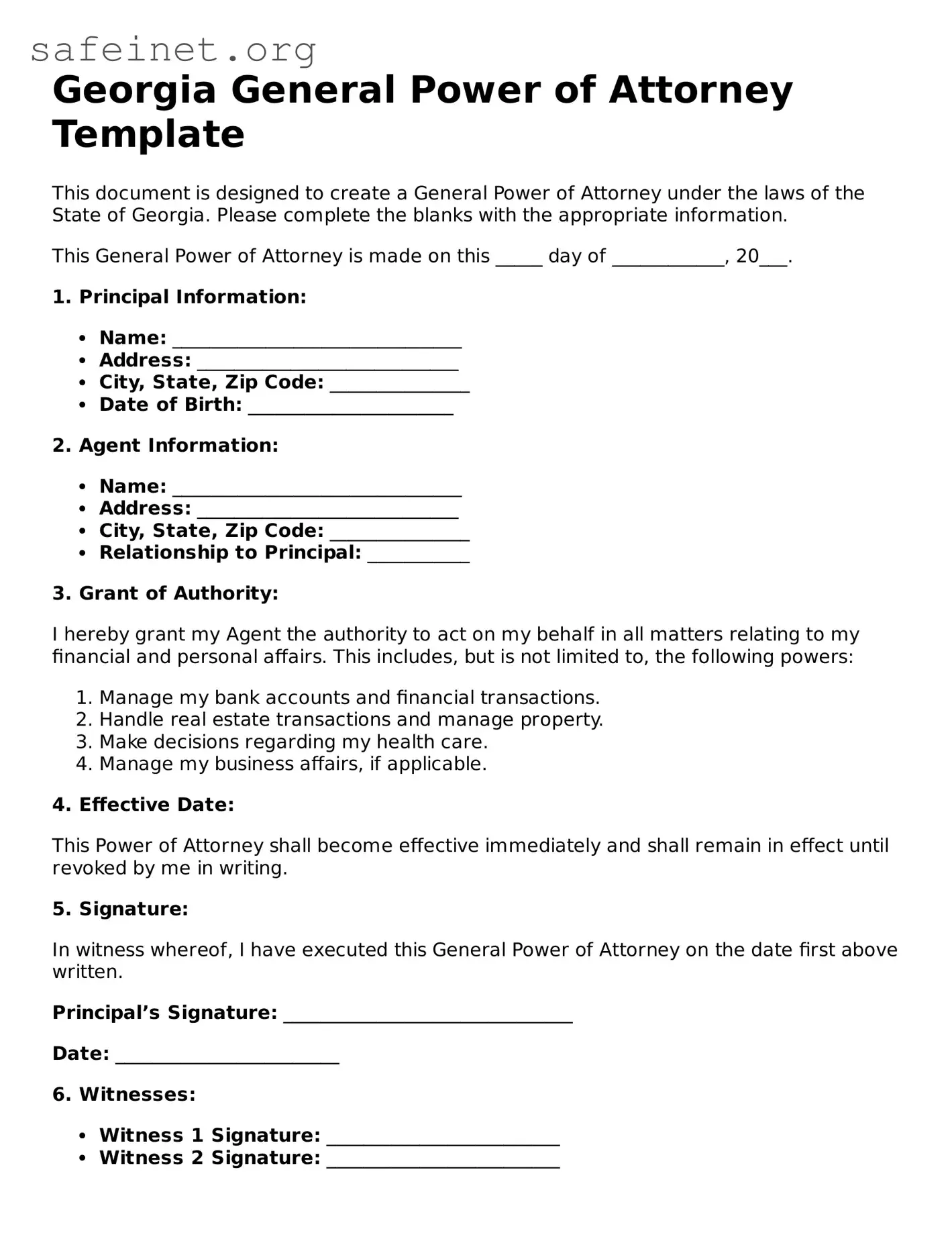

What powers does a General Power of Attorney grant?

The powers granted in a General Power of Attorney can be broad. They typically include the ability to manage bank accounts, sign checks, purchase and sell real estate, file taxes, and handle investments. It is important to articulate what powers you wish to grant clearly in the document.

Is a General Power of Attorney in Georgia revocable?

Yes, a General Power of Attorney can be revoked at any time, as long as you are mentally competent. To revoke it, you should create a written revocation document and provide a copy to your agent, any relevant financial institutions, and other parties who may rely on the Power of Attorney.

What happens if I become incapacitated?

If you become incapacitated and have a valid General Power of Attorney in place, the designated agent can step in to manage your affairs. This is one of the primary purposes of the document, ensuring that your financial needs are met even when you cannot make decisions for yourself.

Do I need a lawyer to create a General Power of Attorney in Georgia?

While it is not legally required to have a lawyer to draft a General Power of Attorney in Georgia, it is highly recommended. A legal professional can ensure that the document meets all legal requirements and adequately reflects your intentions, reducing the potential for future disputes.

How do I sign and witness a General Power of Attorney in Georgia?

In Georgia, you need to sign the General Power of Attorney in front of a notary public. While witnesses are not strictly required unless you are also revoking a previous power of attorney, having them can lend additional credibility. It’s best to follow formal procedures closely to avoid any challenges to the validity of the document later.