What is a General Power of Attorney?

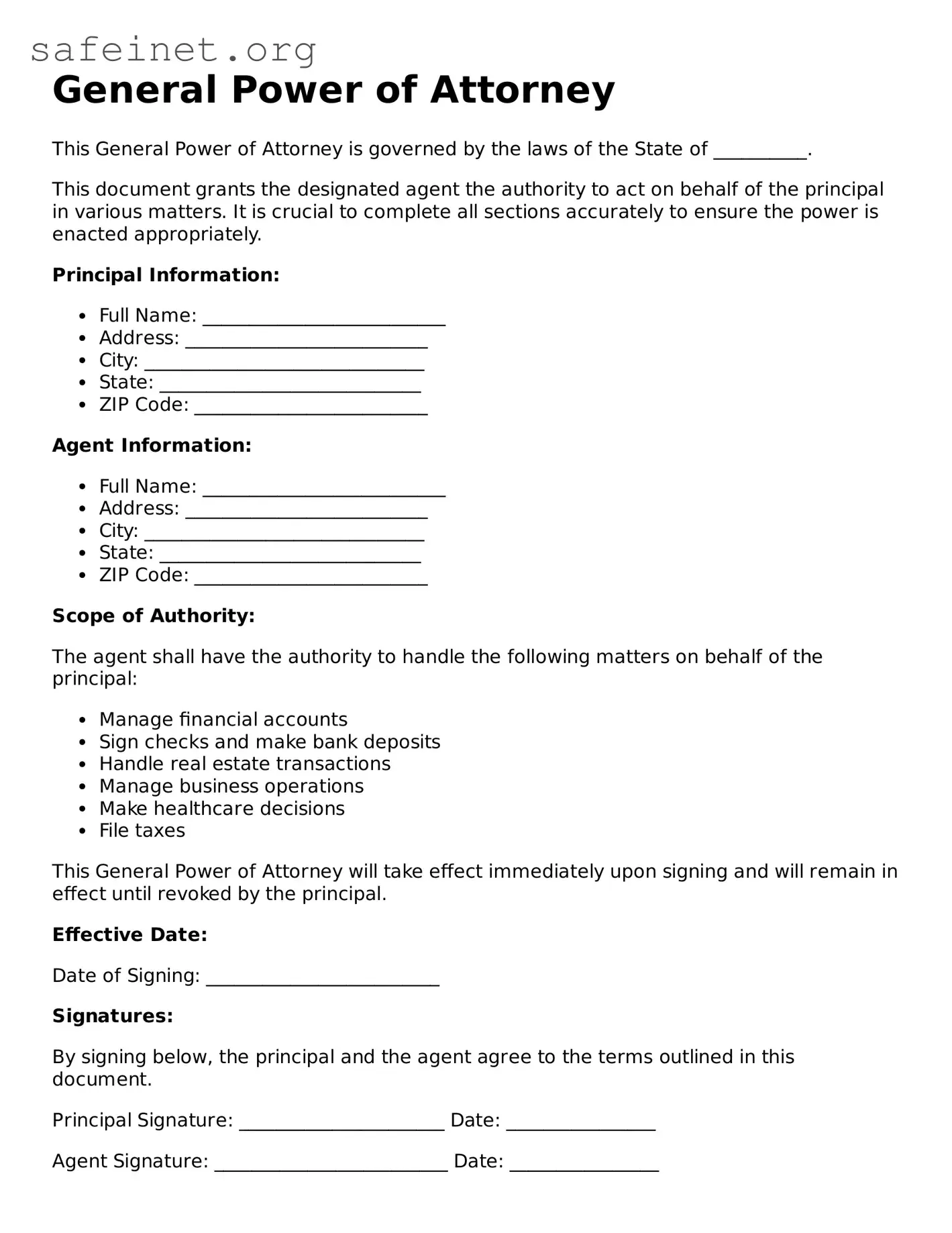

A General Power of Attorney is a legal document that allows one person, known as the principal, to authorize another person, called the agent or attorney-in-fact, to act on their behalf. This power can cover a wide range of financial, legal, and personal matters. The agent can make decisions, sign documents, and handle transactions in the principal's name, based on the authority granted in the document.

When should someone consider using a General Power of Attorney?

Consider using a General Power of Attorney if you are unable to manage your affairs due to reasons like being out of the country, undergoing medical treatment, or simply needing assistance with financial matters. It’s a useful tool for anyone who wants to ensure that their affairs are handled according to their wishes if they cannot do so themselves.

What are the limitations of a General Power of Attorney?

While a General Power of Attorney grants broad authority, there are limitations. For example, it typically cannot authorize the agent to make medical decisions without separate documentation, such as a Healthcare Power of Attorney. Additionally, the agent must act in the best interest of the principal, and they cannot use the power for personal gain without the principal's consent.

How do I revoke a General Power of Attorney?

To revoke a General Power of Attorney, the principal must notify the agent of their decision. This can be done through a written notice. It’s important to provide a copy to any financial institutions or entities that have relied on the power of attorney in the past. Additionally, the principal should consider preparing a new power of attorney if they want to appoint someone else and clearly state the revocation of the previous document.

Is a General Power of Attorney durable?

A General Power of Attorney can be established as "durable," meaning it remains effective even if the principal becomes incapacitated. To create a durable power, the document must include specific language indicating that it will continue to be effective in case of incapacity. If it is not durable, the authority granted ends when the principal can no longer make decisions.