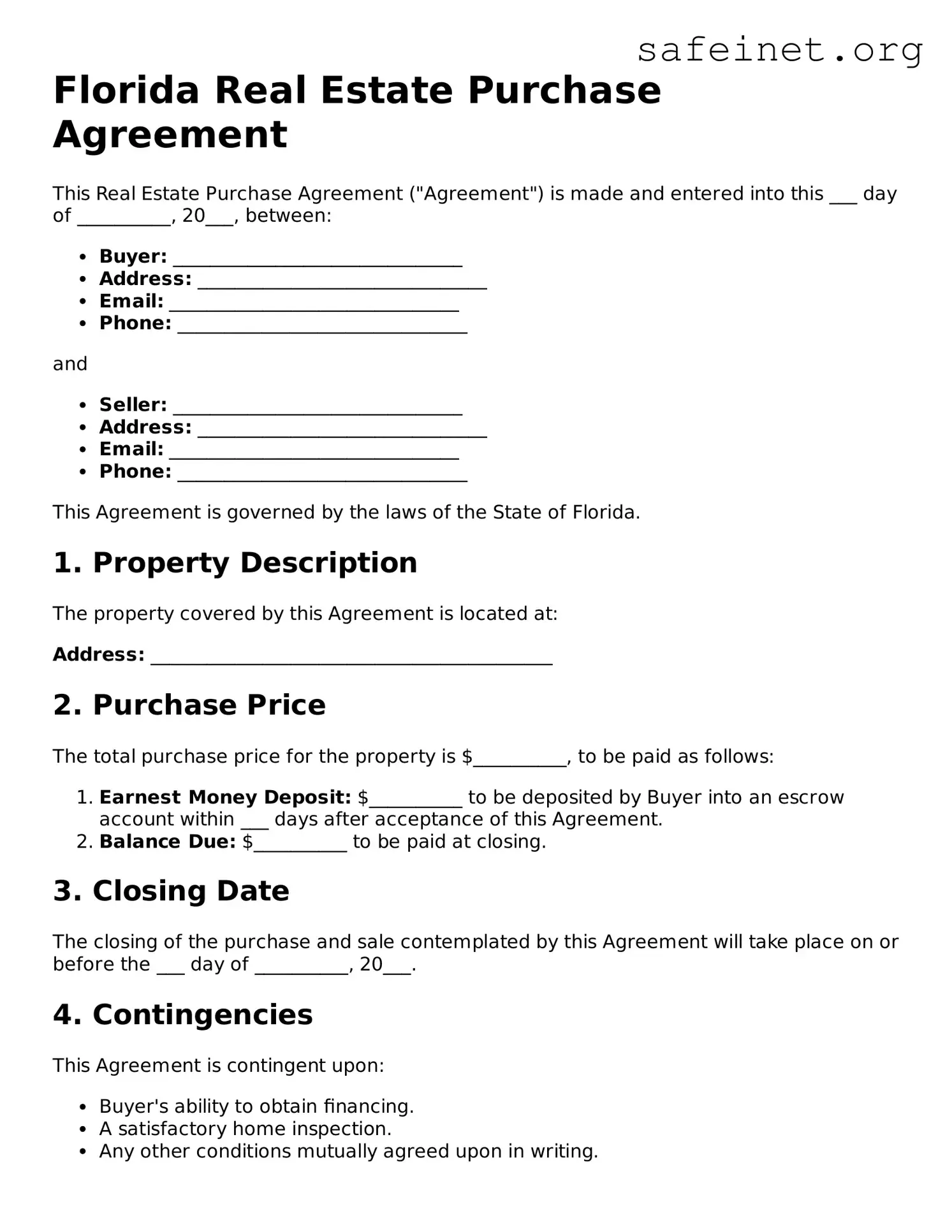

Florida Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into this ___ day of __________, 20___, between:

- Buyer: _______________________________

- Address: _______________________________

- Email: _______________________________

- Phone: _______________________________

and

- Seller: _______________________________

- Address: _______________________________

- Email: _______________________________

- Phone: _______________________________

This Agreement is governed by the laws of the State of Florida.

1. Property Description

The property covered by this Agreement is located at:

Address: ___________________________________________

2. Purchase Price

The total purchase price for the property is $__________, to be paid as follows:

- Earnest Money Deposit: $__________ to be deposited by Buyer into an escrow account within ___ days after acceptance of this Agreement.

- Balance Due: $__________ to be paid at closing.

3. Closing Date

The closing of the purchase and sale contemplated by this Agreement will take place on or before the ___ day of __________, 20___.

4. Contingencies

This Agreement is contingent upon:

- Buyer's ability to obtain financing.

- A satisfactory home inspection.

- Any other conditions mutually agreed upon in writing.

5. Title and Possession

The Seller agrees to convey clear title to the property. Possession will be given to the Buyer at closing.

6. Governing Law

This Agreement shall be construed in accordance with the laws of the State of Florida.

7. Signatures

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

_______________________________ _______________________________

Buyer (Signature) Seller (Signature)

_______________________________ _______________________________

Print Name Print Name

Date: _____________________________ Date: _____________________________