What is a Florida Power of Attorney form?

A Florida Power of Attorney form is a legal document that allows one person (the principal) to appoint another person (the agent) to make decisions on their behalf. This can include financial matters, healthcare decisions, or other important obligations. It is a way to ensure that someone you trust can handle your affairs if you are unable to do so yourself.

What are the different types of Power of Attorney in Florida?

There are several types of Power of Attorney forms in Florida. A General Power of Attorney gives broad powers to the agent, allowing them to act in almost any area. A Durable Power of Attorney remains effective even if the principal becomes incapacitated. A Healthcare Power of Attorney specifically pertains to medical decisions. It’s essential to choose the right type based on your needs.

How do I create a Power of Attorney in Florida?

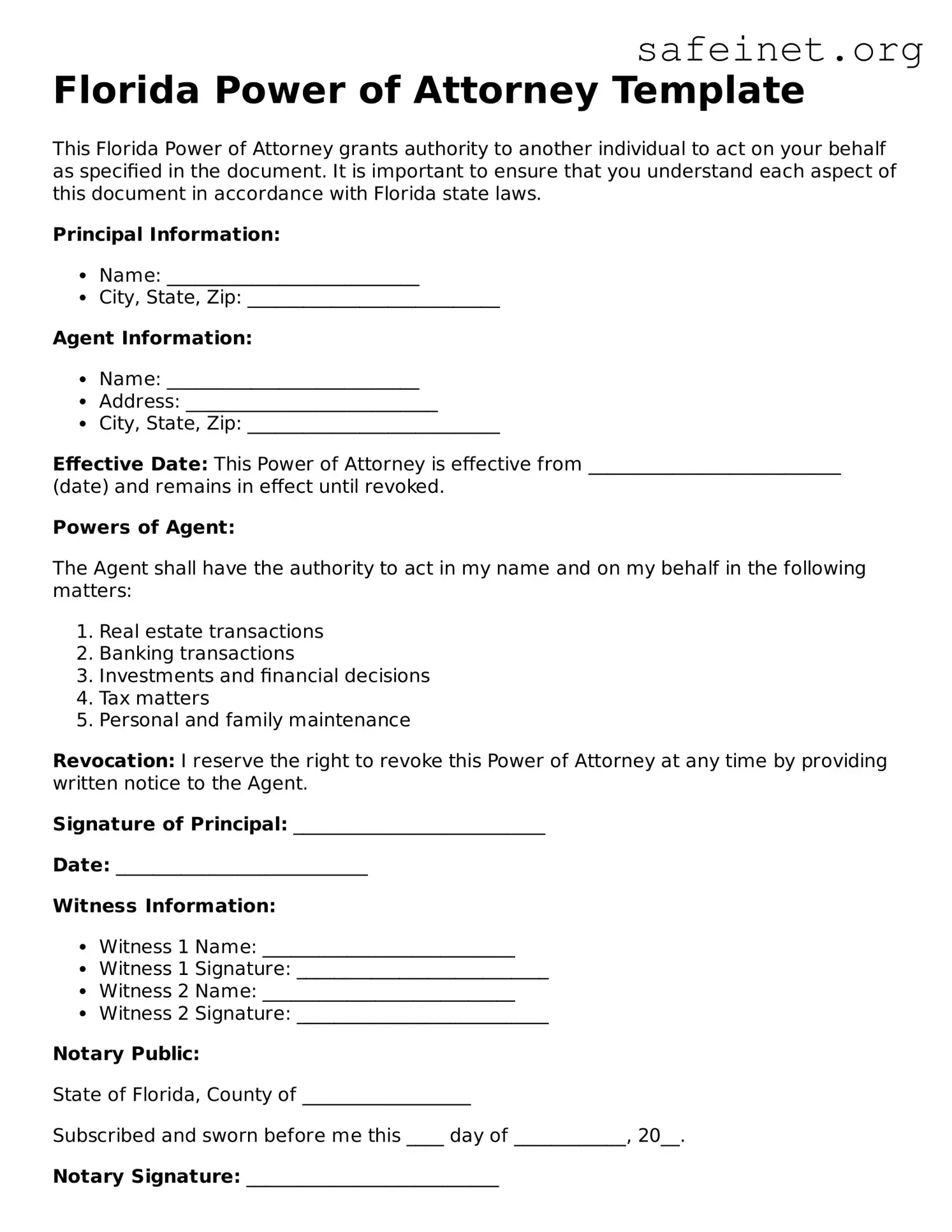

Creating a Power of Attorney in Florida is a straightforward process. You must fill out the appropriate form, which can often be found online or through legal services. The document must be signed by the principal in the presence of a notary public. Additionally, if the agent is a family member, it might be a good idea to inform them about their responsibilities before finalizing the document.

Can I revoke a Power of Attorney in Florida?

Yes, you can revoke a Power of Attorney in Florida at any time, as long as you are mentally competent. To do this, you should create a Revocation of Power of Attorney document. Make sure to notify your agent and any third parties (like banks or healthcare providers) that may have relied on the previous Power of Attorney. Clear communication is vital to prevent misunderstandings.

Are there any restrictions on who can be an agent in a Power of Attorney?

In Florida, an agent must be at least 18 years old and mentally competent. They cannot be someone who is convicted of a felony, unless their civil rights have been restored. It’s important to choose someone trustworthy, as they will have significant control over your decisions and affairs.

What happens if I do not have a Power of Attorney?

Without a Power of Attorney, if you become incapacitated, the court may need to appoint a guardian to manage your affairs. This can be a lengthy and costly process, and it may not always involve someone you would have chosen. By having a Power of Attorney in place, you can avoid this outcome and ensure that a trusted person acts on your behalf when needed.