What is a Florida Operating Agreement?

A Florida Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Florida. It serves as an essential blueprint for how the business will function, detailing the roles and responsibilities of the members, as well as the procedures for making important decisions. Although Florida doesn't require an LLC to have an Operating Agreement, having one is highly recommended to ensure clear guidelines and to protect the interests of all members.

Why is an Operating Agreement important?

The Operating Agreement is vital for several reasons. It helps prevent misunderstandings among members by clearly defining their rights and duties. This document can also help protect personal assets from business liabilities by reinforcing the limited liability status of the LLC. Additionally, it serves as proof of ownership and can expedite procedures for resolving disputes if they arise.

Who can draft an Operating Agreement?

Anyone, including the LLC members themselves, can draft an Operating Agreement. However, it is advisable to work with a legal professional to ensure that the document meets all legal requirements and adequately reflects the intentions of the members. A well-drafted agreement can save time and money in the long run by reducing conflicts and misunderstandings.

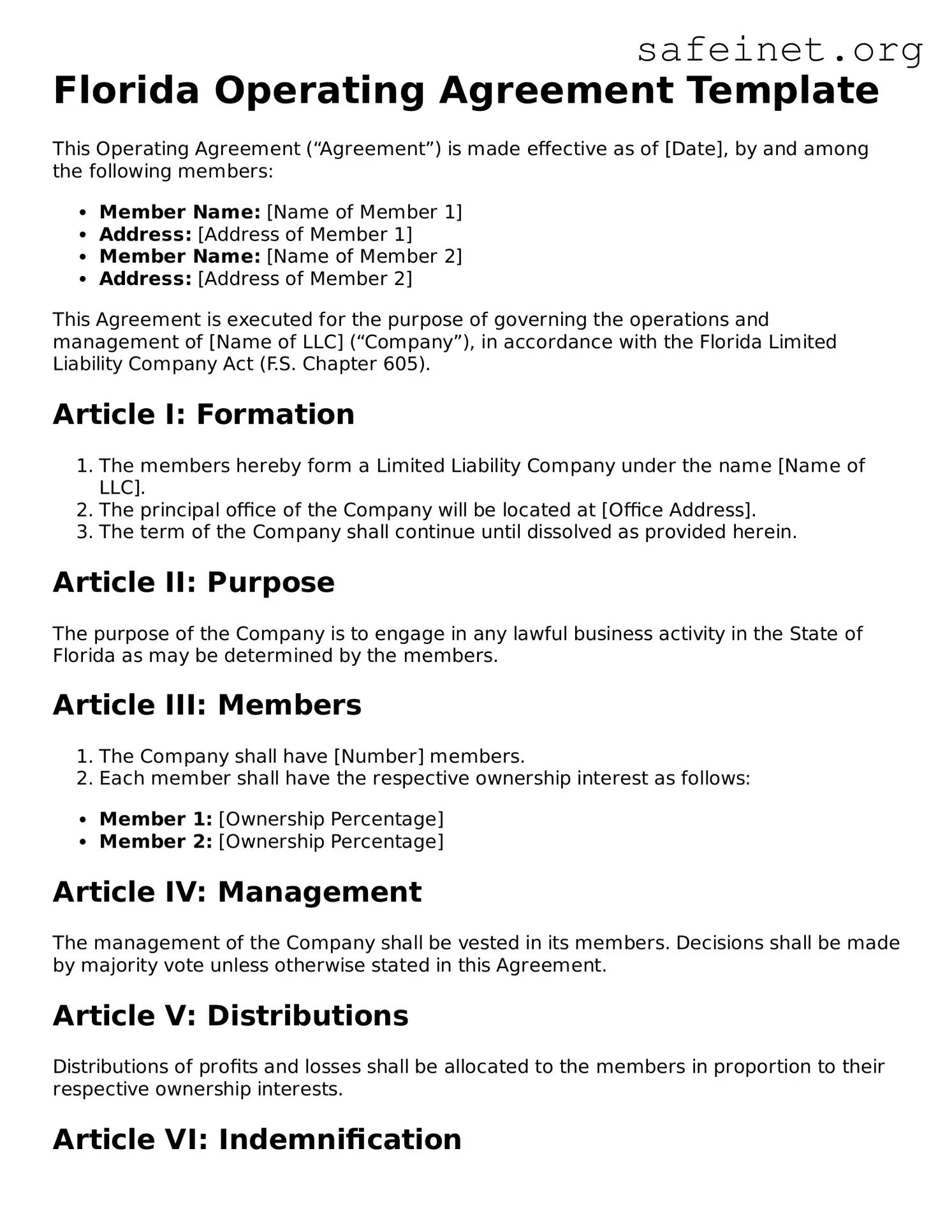

What should be included in the Operating Agreement?

An Operating Agreement should include several key components. Typical sections include the identification of members, management structure, voting rights, profit and loss allocation, and procedures for adding or removing members. Additionally, rules regarding meetings, record keeping, and dispute resolution might be included. Each section should be tailored to the specific needs of the LLC and its members.

Do all members need to sign the Operating Agreement?

Yes, all members should sign the Operating Agreement to ensure that everyone agrees with the terms outlined. This signature signifies acceptance of the rules and responsibilities detailed in the document. A signed agreement can also offer legal protection in future disputes, as it serves as evidence of the members' intentions.

Can the Operating Agreement be changed after it is signed?

Yes, the Operating Agreement can be amended after it is signed. It is common for business circumstances to change, and the Operating Agreement should be flexible enough to accommodate those changes. Typically, an amendment requires the consent of all members, as specified in the original Operating Agreement.

Is it necessary to file the Operating Agreement with the state?

No, it is not required to file the Operating Agreement with the state of Florida. Instead, the document should be kept with the LLC’s important records. Members should ensure that they all have copies for personal reference. However, certain situations, like opening a business bank account, may require a copy of the agreement.

What happens if there is no Operating Agreement?

If there is no Operating Agreement, Florida’s default laws governing LLCs will apply. This could lead to uncertainties regarding how the business operates, how profits are distributed, and how decisions are made. Without a tailored agreement, members may encounter challenges when it comes to resolving disputes or managing the company.

Where can I find a template for a Florida Operating Agreement?

Templates for Florida Operating Agreements are available through various online resources. However, it is important to choose a reputable source and to carefully review the template to ensure it aligns with the specific needs of the LLC. Customizing a template can be beneficial, and consulting a legal expert can help in this process to ensure compliance with state laws.