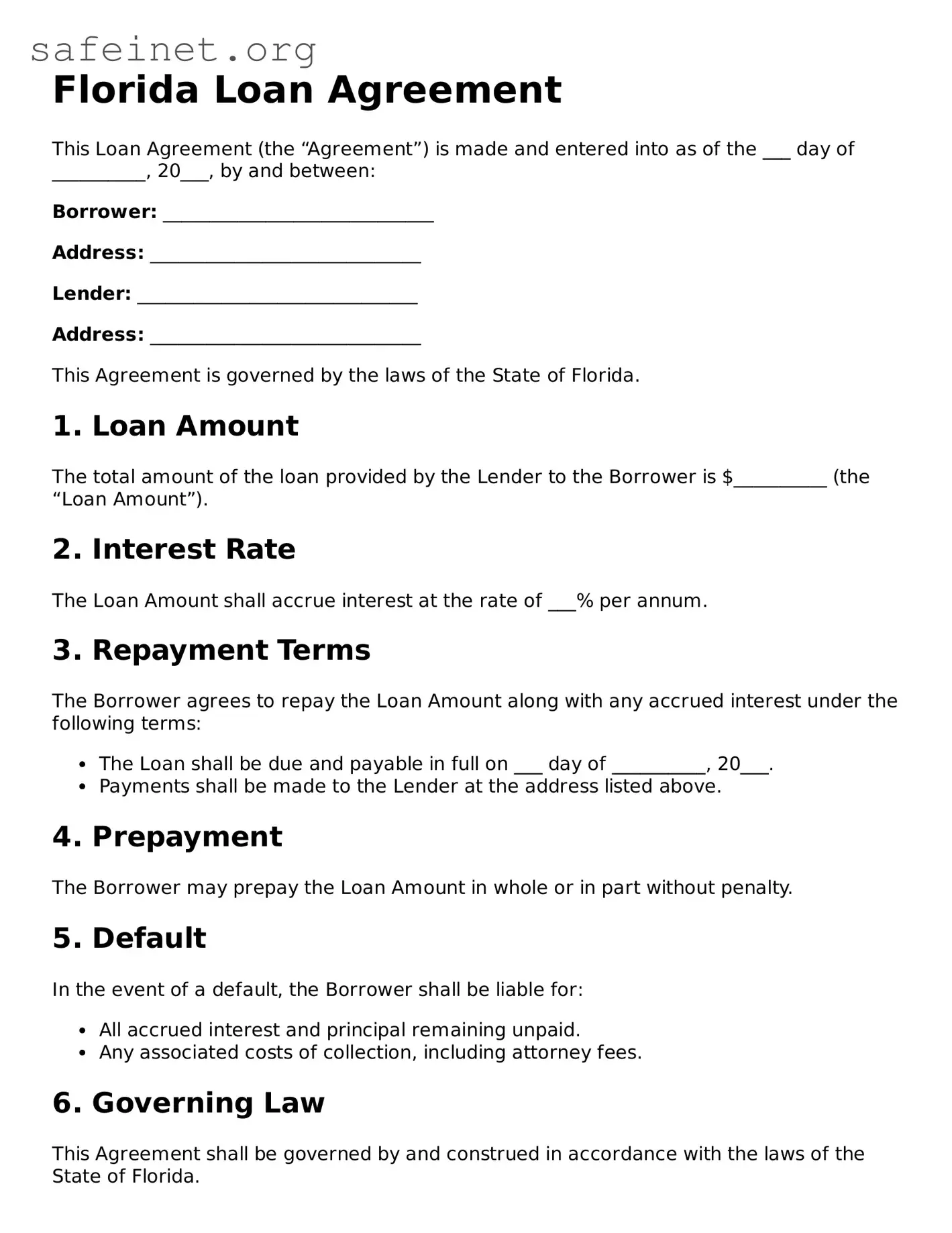

Florida Loan Agreement

This Loan Agreement (the “Agreement”) is made and entered into as of the ___ day of __________, 20___, by and between:

Borrower: _____________________________

Address: _____________________________

Lender: ______________________________

Address: _____________________________

This Agreement is governed by the laws of the State of Florida.

1. Loan Amount

The total amount of the loan provided by the Lender to the Borrower is $__________ (the “Loan Amount”).

2. Interest Rate

The Loan Amount shall accrue interest at the rate of ___% per annum.

3. Repayment Terms

The Borrower agrees to repay the Loan Amount along with any accrued interest under the following terms:

- The Loan shall be due and payable in full on ___ day of __________, 20___.

- Payments shall be made to the Lender at the address listed above.

4. Prepayment

The Borrower may prepay the Loan Amount in whole or in part without penalty.

5. Default

In the event of a default, the Borrower shall be liable for:

- All accrued interest and principal remaining unpaid.

- Any associated costs of collection, including attorney fees.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Florida.

7. Signatures

By signing below, both parties agree to adhere to the terms laid out in this Agreement.

Borrower Signature: _____________________________

Date: ______________________

Lender Signature: _____________________________

Date: ______________________