What is a Florida Independent Contractor Agreement?

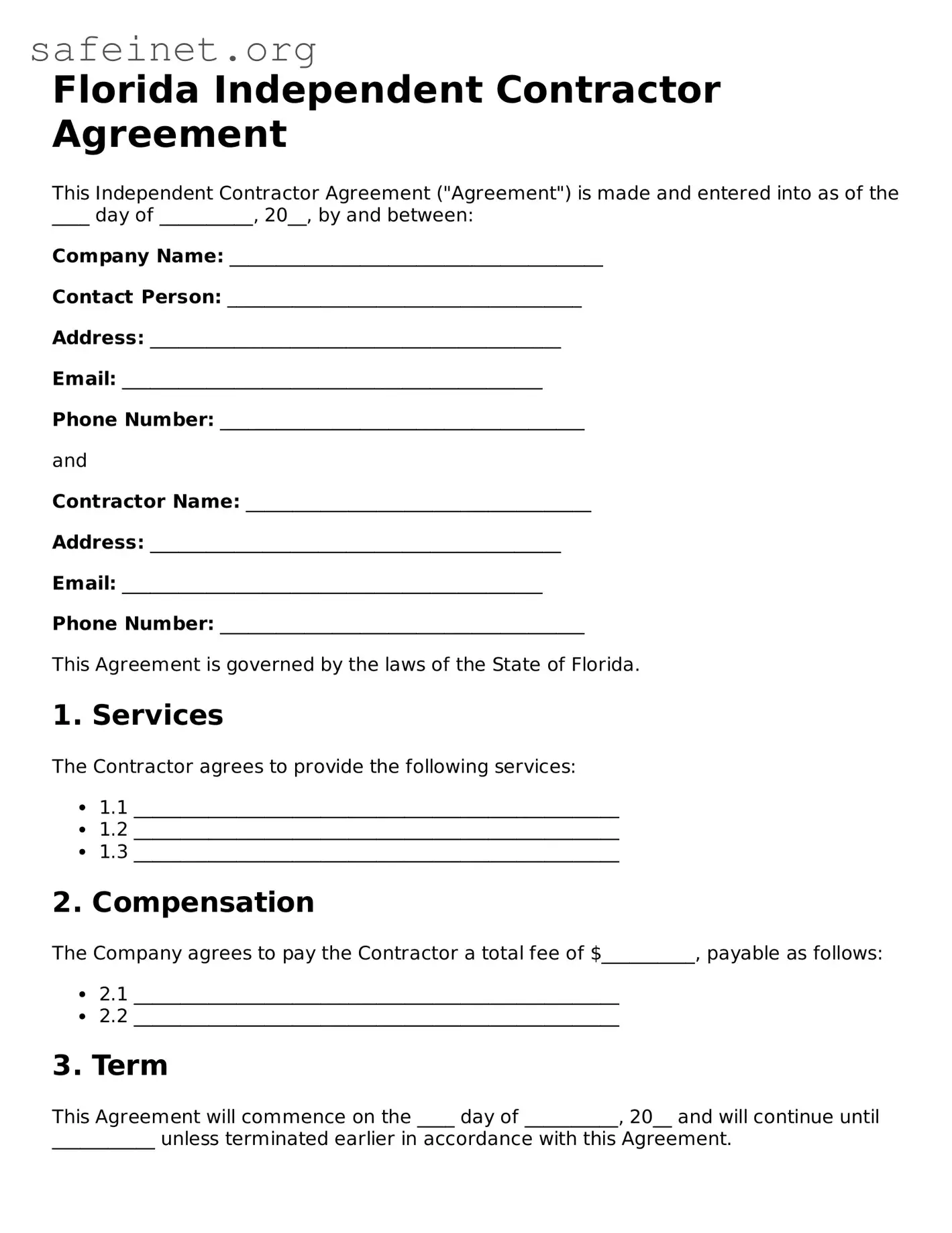

A Florida Independent Contractor Agreement is a legal document that outlines the terms and conditions of the working relationship between a client and an independent contractor. It establishes the rights and responsibilities of each party, helping to prevent misunderstandings and disputes. The agreement typically covers payment terms, project scope, timelines, and confidentiality provisions, among other relevant details.

Why is it important to have an Independent Contractor Agreement?

Having an Independent Contractor Agreement is crucial for several reasons. It clarifies expectations for both the client and the contractor, which can facilitate smooth working relationships. The agreement also provides protection in case of disputes, detailing how issues should be resolved. Additionally, it can help establish the independent contractor's status, which is important for tax purposes and compliance with labor laws.

What should be included in a Florida Independent Contractor Agreement?

A comprehensive Independent Contractor Agreement should include the following key components: the names and contact information of the parties involved, a detailed description of the services to be provided, payment details, any applicable deadlines, confidentiality clauses, termination conditions, and liability limitations. Each of these elements plays a crucial role in defining the agreement and protecting both parties' interests.

How does the payment structure work in the agreement?

The payment structure should be clearly defined in the agreement. Common arrangements include hourly wages, project-based fees, or payment upon completion of specific milestones. The agreement should specify when payments are due, acceptable payment methods, and any potential additional expenses that the contractor may incur. Clarity in payment terms can help to avoid conflicts later on.

Can an Independent Contractor Agreement be terminated early?

Yes, an Independent Contractor Agreement can be terminated early. The agreement should outline specific conditions under which termination can occur. Typically, either party can terminate the contract for reasons such as breach of contract, non-performance, or mutual agreement. It may also include stipulations regarding notice periods and any remaining payments due upon termination.

Is there a need for notarization of the Independent Contractor Agreement in Florida?

Generally, notarization is not required for an Independent Contractor Agreement in Florida. However, having the agreement notarized can add an extra layer of authenticity and may help in enforcing the document in court if disputes arise. It is advisable for both parties to sign the agreement to ensure its enforceability.

How does the agreement address confidentiality?

Confidentiality provisions in the agreement protect sensitive information from being disclosed to third parties. This may include trade secrets, client lists, and proprietary data. The agreement should specify what information is considered confidential, any obligations that both parties have to protect this information, and consequences for breaches of confidentiality.

What is the difference between an employee and an independent contractor?

The primary difference between an employee and an independent contractor lies in the level of control exerted by the employer. An employee typically works under the direction of the employer and is subject to company policies. In contrast, an independent contractor has more flexibility and autonomy in how they complete their work. This difference affects tax obligations, benefits, and legal protections for each party.

What should I do if a party breaches the Independent Contractor Agreement?

If a party breaches the Independent Contractor Agreement, the non-breaching party typically has several options. They may seek to resolve the issue through direct communication and negotiations. If this fails, the agreement may provide for alternative dispute resolution methods, such as mediation or arbitration. If necessary, legal action may be pursued in court to enforce the agreement or seek damages.

Where can I find a template for a Florida Independent Contractor Agreement?

Templates for Florida Independent Contractor Agreements can be found online through various legal document services, law firms, or state government websites. It is important to ensure that any template used is compliant with Florida law and tailored to the specific needs of the parties involved. Customizing the template to fit the particulars of the agreement is advised to create an effective document.